Building Your Digital Asset Treasury Strategy

Becoming a Digital Asset Treasury Company involves more than a simple purchase; it requires a comprehensive Bitcoin treasury strategy and a framework for managing a digital asset balance sheet. For DATCOs, this includes secure onchain treasury management and potentially generating treasury yield from staking on Ethereum corporate holdings.

This evolution towards tokenized corporate treasuries is a key part of modern blockchain corporate finance. As more public companies holding Bitcoin emerge, the playbook for managing corporate crypto treasuries is being written by these first movers, creating new opportunities for institutional crypto exposure.

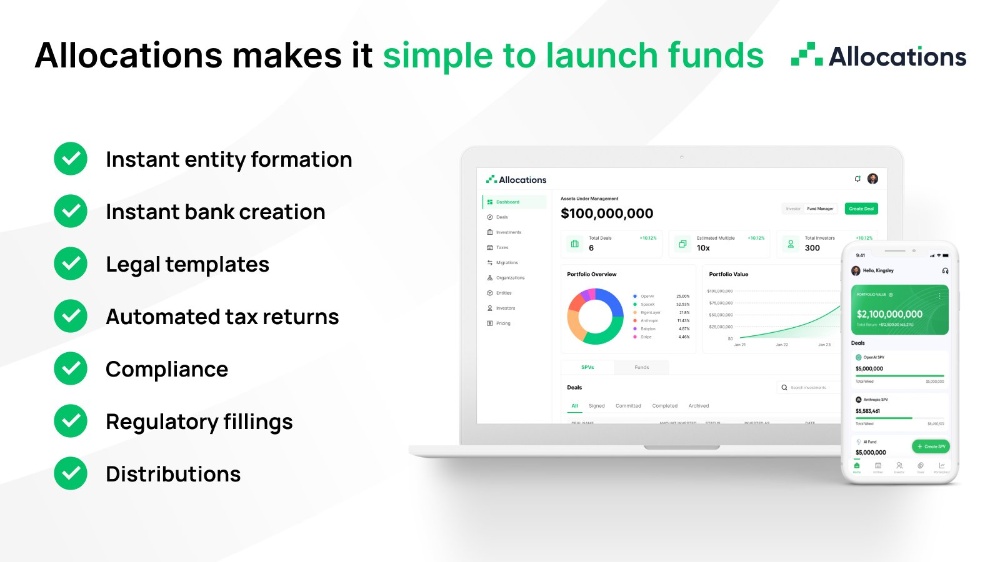

Executing this vision demands specialized expertise. The team at Allocations is equipped to support this journey. Explore our straightforward fees and learn how a startup SPV can be your first step. For more complex assets, a crypto SPV or a custom SPV provides the tailored structure a serious Digital Asset Treasury Company needs.