🔮 Crypto Regulation: A Necessary Evil or the End of Freedom?

Cryptocurrency was born from rebellion.

A reaction to financial crises, failing banks, inflated currencies, and systems that favored institutions over individuals.

Bitcoin’s first block contained a message criticizing the bailout of banks — a clear sign that crypto was meant to be different.

But now, more than a decade later, crypto is no longer a niche experiment. It has become a global financial movement. With this growth comes pressure: from governments, central banks, regulators, and traditional institutions that want clarity — or control.

This leads to a powerful question:

Is crypto regulation a necessary step toward maturity…

or the slow death of the freedom crypto promised?

Let’s explore the debate.

🏛️ 1. Why Governments Want to Regulate Crypto

From a government perspective, the argument for regulation is simple:

Money must be controlled, monitored, and traceable.

Without regulation, officials fear:

- tax evasion

- money laundering

- terrorist financing

- market manipulation

- consumer fraud

- catastrophic collapses (FTX, Terra, Celsius…)

In their narrative, regulation is not an attack on crypto — it is “consumer protection.”

To some extent, they aren’t wrong.

Millions lost money due to scams, rug pulls, or reckless platforms. And every major crisis strengthened the government’s case:

“Crypto is dangerous without oversight.”

Regulation, they argue, brings safety and legitimacy.

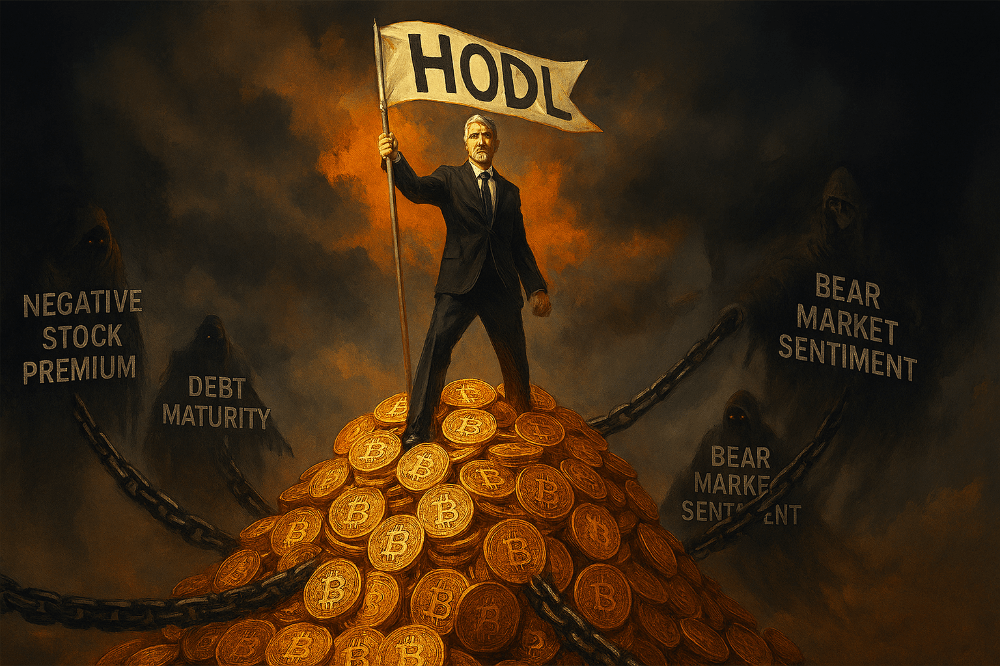

🔐 2. Why Crypto Purists Fear Regulation

For many early adopters, regulation feels like a betrayal.

Crypto wasn’t created to fit inside the old system.

It was created to replace it.

The spirit of crypto is built on:

- decentralization

- censorship resistance

- individual sovereignty

- financial freedom

- borderless transactions

Regulation threatens these principles.

When governments regulate crypto, purists fear:

- surveillance

- transaction monitoring

- KYC on everything

- limits on self-custody

- control over blockchain networks

- censorship of “unapproved” transactions

To them, regulation is not protection — it is civilization reclaiming control over a technology it cannot stop.

⚖️ 3. Regulation Isn’t One Thing — It’s a Spectrum

Not all regulation is equal.

There are different levels:

1. Light Regulation

Frameworks that promote innovation and protect consumers while keeping crypto’s core freedoms intact.

2. Heavy Regulation

Strict licensing, full surveillance, capital controls, and limitations on self-custody.

3. Total Ban

Countries like China chose prohibition, forcing all crypto activity underground.

The reality is that “regulation” could mean progress — or repression.

It depends entirely on how it is implemented.

🧩 4. Can Crypto Grow Without Regulation?

This is one of the hardest questions.

Innovation thrives in open environments. But mass adoption requires trust.

Most people will not use:

- unregulated exchanges

- anonymous platforms

- risky DeFi protocols

- wallets with no customer support

They want safety.

Regulation may be necessary to create:

- clear tax rules

- registered exchanges

- secure custody services

- accountable platforms

Without these, institutions and governments won’t participate — and global adoption stalls.

In this sense:

Crypto may need regulation to evolve from rebellion to infrastructure.

🔥 5. The Dark Side of Regulation: Control and Surveillance

But regulation has risks.

Real risks.

Not hypothetical.

Not exaggerated.

Some governments propose:

- forcing people to register personal wallets

- banning privacy coins

- blocking unapproved addresses

- limiting stablecoin use

- monitoring every blockchain transaction

- freezing assets directly on-chain

This is not consumer protection — it is financial control.

If regulation turns into surveillance, crypto loses its purpose.

Crypto without freedom is just another digital banking system.

🌍 6. Global Differences: A Fragmented Future

Crypto regulation varies wildly across regions:

✔ The U.S.

Confused, divided, and hostile in many cases.

✔ Europe

Creating structured laws like MiCA, aiming for clarity and balance.

✔ Africa & Latin America

Seeing crypto as a way to escape currency instability — and often regulating lightly.

✔ Asia

A mix of strict (China) and innovative (Singapore, UAE) approaches.

This fragmentation means the future of crypto may not be global —

it might split into regulated and unregulated zones.

🔮 7. The Future: Two Possible Paths

➡️ Path 1: Regulation Enables Mass Adoption

Crypto becomes mainstream.

Banks integrate blockchains.

Stablecoins become digital cash.

Governments embrace Web3 innovation.

In this future, regulation creates trust — and trust brings billions into crypto.

➡️ Path 2: Regulation Destroys Freedom

Governments overreach.

Self-custody is restricted.

Privacy tools are banned.

Decentralization becomes illegal.

In this future, crypto survives — but as a shadow of its potential.

The real battle is not about technology.

It’s about philosophy.

💭 Final Thought

Crypto was born from a desire for freedom — not permission.

Regulation can help protect users, but only if it respects the core values that made crypto worth fighting for in the first place.

So the real question is not:

“Should crypto be regulated?”

It’s:

“Can we create rules that protect people…

without giving governments absolute control?”

The answer will decide the fate of Web3 —

and the future of financial freedom itself.