Layer2 Blockchains

Investment themes in crypto have been continuously evolving with time. Back in 2017 when I started investing in crypto, privacy-based coins, ICOs, and Ethereum killers were proven to be profitable investing themes. In the last bull market of 2021, Gaming, NFTs, and Alternative L1s emerged as profitable investing themes.

Some crypto projects have also evolved over the past two bull cycles from ideas to products. I believe we will see many crypto projects gaining traction and experiencing on-chain growth.

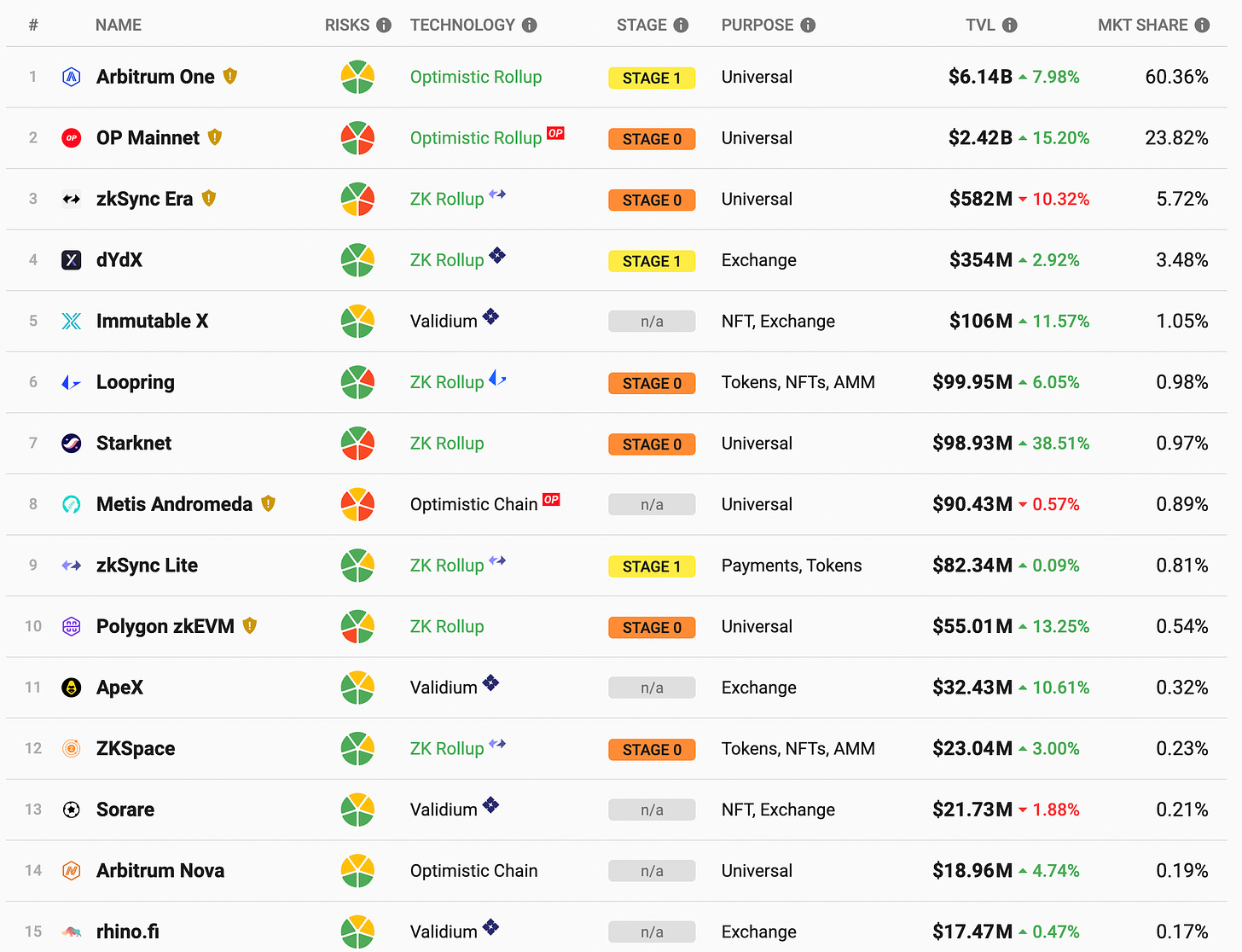

The Rise of Layer2 Blockchains

Picture Credit: L2Beat.com

In the past few years, discussions around Ethereum scalability have been ongoing. Projects like Polygon and OMG Network explored various approaches to offload transactions from the Ethereum network to scale the base layer. Early attempts like Plasma failed, but Polygon's commit chain emerged as a winner, although it didn't borrow security from Ethereum. The industry is looking for scaling solutions that can be more secure by borrowing security from leading chains like Bitcoin or Ethereum.

After Ethereum's transition from a PoW chain to a PoS chain, validators started joining by putting their ETH at stake, and the ETH staking ratio reached over 20%, providing $42B of economic security to the Ethereum network.

When launching a new blockchain network or blockchain services, the first concern is the validator sets and the security of the network. By launching a Layer 2 (L2) solution on Ethereum, security is taken care of, and L2s can settle transactions on their own chain. If they need to scale further, they can use a separate data availability (DA) layer to store Call data and make it available to all nodes.

With an easy deployment process available, blockchain development teams can deploy an L2, customize it according to their needs, and launch it in the market. Hence, hundreds of new L2s are expected to launch in the market by the next bull market, many of them designed for specific use cases. L2s will likely emerge as the biggest investing theme for the next bull market.

Rollups and Validiums are two types of L2 scaling solutions that have been explored by teams so far. In rollups, Optimistic rollups are ahead in terms of development and market maturity and are seen as a promising solution for projects to choose in the foreseeable future. However, in the long term, ZK Rollups are expected to emerge as a winner.

Tokenomics Designs for L2s

Even if an L2 chain manages to attract demand from DApps and users, without a good tokenomics design, they can't capture value for investors in the long term. There are various tokenomics design approaches available for L2s, but most of these L2s are launching a token to decentralize governance. OP and ARB are two popular governance-based L2 tokens. Apart from governance, decentralization of the sequencer and prover could present more value capture for validators and provide an additional token utility as reward incentives. Polygon, in its new token proposal, is planning to use their token as a reward token for validators.

https://twitter.com/hmalviya9/status/1677751727595065344?s=20

Growth Narratives for L2 Coins

Investing themes need narratives to be played out. EIP4844 (Proto Dank Sharding) is expected to be the biggest narrative for L2 coins in the next 6 months. Ethereum core developers have confirmed the implementation of EIP4844 by the year-end. After the implementation, Ethereum will introduce a separate DA layer for L2s to store call data, which will eventually reduce the L2 rollup calldata cost and help them scale further. A 90% reduction in gas fees on L2s is anticipated after this upgrade.

Learn more about EIP4844 :

https://twitter.com/hmalviya9/status/1646758013766889472?s=20

Top 3 L2 Coins

Polygon(MATIC/POL)

Overview

- Polygon has launched a ZkEVM Rollup and is now planning to upgrade Polygon PoS into a Polygon ZkEVM Validium.

- Polygon also provides a tech stack for projects to launch App-specific L2s using supernets and ZK Stack.

- Recently, Polygon has put forth a proposal to rebrand MATIC into POL, along with proposing new token utilities for governance, staking, and validator rewards.

Tokenomics

- Token Utility: Staking, Validator Rewards, Gas token(Supernets)

- Demand Drivers: ZK Tech Stack, Polygon SuperNets

- Value Capture: Multiple Incentives Opportunities for Validators, Staking/Restaking for Stakers

- Business Model: Revenues collected by Sequencer will be distributed with Participating Validators

- Supply Distribution: Inital Supply of POL : 10B

- Supply Inflation: Fixed Annual emission of 2% every year for next 10 years

Arbitrum(ARB)

Overview

- Arbitrum has launched an Optimistic Rollup-based L2 chain.

- Arbitrum is currently the most popular L2 chain with a TVL over $1.5B.

- Arbitrum launched a tech stack to launch L3s called Orbit. Orbit chains will use Arbitrum Nitro architecture and settle transactions on Arbitrum L2.

- Arbitrum has managed to build a robust ecosystem of new-age DeFi apps, which are bringing new innovations to the space. GMX and other derivatives are among the most demanded dApps on the Arbitrum network.

- Arbitrum is planning to launch their own VM, Stylus, which will allow developers to code dApps in any language of their preference, and they can deploy their contracts seamlessly on their VM, which would be compatible with EVM.

Tokenomics

- Token Utility: Governance, Gas token(Orbit L3s)

- Demand Drivers: Arbitrum Orbit Tech Stack, Orbit Chains

- Value Capture: Participation in Governance

- Business Model: No Distribution of Sequcencer revenue

- Supply Distribution: Max Supply 10B, Circulating Supply: 1.275B

- Supply Inflation: Average annual emisison for next 4 years: +16.77%, Max 2% Inflation after 10B reached

Optimism(OP)

Overview

- Optimism launched an Optimistic Rollup-based L2 blockchain.

- Optimism is currently the 3rd most valuable chain in terms of TVL.

- Optimism also launched a tech stack called OP Stack, which provides easy-to-use tools and libraries to launch modular L2s.

- The OP Stack is currently the most popular L2 tech stack, and major upcoming L2s like Mantle, OpBNB, and Base have used OP Stack to develop their L2s.

Tokenomics

- Token Utility: Governance

- Demand Drivers: OP Stack, OP Chains

- Value Capture: Participation in Governance

- Business Model: No Distribution of Sequencer revenue

- Supply Distribution: Max Supply 4.29B, Circulating Supply:644M

- Supply Inflation: Average annual emission for next 4 years: +28.6%, Max 2% inflation after 4.29B reached

Learn More about OP Fundamentals here:

https://twitter.com/hmalviya9/status/1680197540074094592?s=20

Upcoming L2 coins to watch out for

Base by Coinbase

- Base is an Optimistic Rollup-based L2 chain built using OP Stack, specifically designed to support tooling from Coinbase.

- Base will enable the account abstraction feature for developers to use, and we can expect the launch of smart wallets and other DeFi-specific tools on the Base blockchain.

- Base is expected to be a governance token, but more details on tokenomics are yet to be released to the public.

Frax L2

- Frax has recently announced the launch of an L2 blockchain.

- Frax Finance is considered one of the most innovative DeFi teams in the space right now. Their Liquid staking derivatives, Frax Ether, is one of the top ETH LSD tokens in the market currently.

- FXS is publicly live for trading and will be used as a token in Frax L2. Details regarding token usage in the proposed L2 network are yet to be released to the public.

Celo

- Carbon Negative, a mobile-first public L1 blockchain, Celo, has announced a transition from L1 to Ethereum L2 using OP Stack and EigenDA Layer.

- The Celo Blockchain has successfully built a robust ecosystem of Regenerative finance applications.

- Celo is publicly live for trading and will be used as a Gas and Governance token in the network.

Linea by Consensys

- Linea is a ZkEVM Rollup-based L2 being developed by ConsenSys.

- Consensys is planning to launch a $150M fund in collaboration with VC funds to onboard DApps on Linea.

- Linea is expected to be a governance token, but more details on tokenomics are yet to be released to the public.

Mantle Network by Mantle(BitDAO)

- Mantle is building an Optimistic Rollup-based L2 using OP Stack.

- Mantle L2 is being supported by BitDAO and Bybit. They have a large treasury size that could attract more projects to build on Mantle in the near future.

- Mantle is using the EigenDA Layer, which could make it the cheapest L2 for transactions.

- The MNT Token will be launched soon, and it will be used as an ecosystem token for L2, LSD, and other future products from Mantle DAO.

opBNB by BNB Chain

- opBNB is building an Optimistic Rollup-based L2 using OP Stack.

- opBNB is specially designed to support gaming and social media use cases.

- opBNB will use BNBChain as a settlement layer, and BNB Chain Validators will form a DAC to provide data availability to L2 transactions.

- opBNB is expected to be a governance token, but more details on tokenomics are yet to be released to the public.

ZkSync

- ZkSync launched a ZkEVM Rollup-based L2.

- ZkSync is one of the most funded L2 projects, and its mainnet has attracted over 100+ DApps so far.

- ZkSync is expected to be a governance and validator reward token, but more details on tokenomics are yet to be released to the public.

STRK by Starknet

- Starknet launched a Zk Rollup-based L2.

- Starknet has managed to achieve the highest TPS among all L2 chains.

- Starknet is using ZKStark tech for proof generation, which is considered to be the best in the long term.

- STRK is expected to be a Gas, Governance, and Validator reward token, but more details on tokenomics are awaited.

Scroll

- Scroll is building a Type 2 ZKEVM rollup based L2.

- Scroll ZkEVM will go live on the mainnet in the coming weeks.

- Scroll is expected to be a governance token, but more details on tokenomics are awaited.

Plan of Action

As an investor, you should start tracking the on-chain growth of these L2 blockchains. Stay updated about their new releases, updates, and ecosystem-related announcements. More new L2 launches are expected to be announced in the near future, so keep a close track of that. For L2 coins, value capture should be high for investors. Governance is the most common value capture model used by these L2s, which is considered a weak model. However, if the DAO manages to establish active governance and engage people in the governance process, it could prove to be a good value capture strategy in the long term.

Optimism DAO has successfully implemented governance, involving people in funding more projects that could eventually become part of the OP ecosystem. I personally believe that more value capture for validators in the form of sequencer revenue distribution will motivate them to provide more economic security to the network. That's why I think POL will offer more token utilities than other L2 networks currently exist. Nevertheless, you should also look forward to new L2 launches, as some of these upcoming projects may come up with better tokenomics for long-term value capture for investors.

Here are some very insightful threads on L2 Blockchains that you should check out:

A Detailed Thread on L2s

https://twitter.com/0xFinish/status/1678465519417163777?s=20

A Detailed Thread on ZKEVMs

https://twitter.com/expctchaos/status/1679128596546297856?s=20

A Detailed Thread on Modular Blockchains

https://twitter.com/stacy_muur/status/1678733113718112257?s=20

Disclaimer: I am not offering any kind of financial advice here, and it is recommended to use the information provided in this letter for educational purposes only.