Decentralized Exchange (DEX) Development: A Complete Guide

Introduction

The world of cryptocurrency is moving quickly, and one of the biggest shifts we’ve seen is the rise of Decentralized Exchanges (DEXs). Unlike traditional exchanges that hold your funds, a DEX allows users to trade cryptocurrencies directly from their own wallets using smart contracts.

This model is transparent, borderless, and puts full control in the hands of the users. Platforms like Uniswap and PancakeSwap are the best examples, where trades happen through automated market makers (AMMs) powered by liquidity pools rather than order books.

Let’s take a closer look at why building a DEX in 2025 is a smart business move.

What is a DEX?

Decentralized Exchange (DEX) is a peer-to-peer platform where users trade crypto assets without intermediaries. No bank. No central authority. No one is controlling your funds. Instead, trades are executed directly on the blockchain through smart contracts.

Key Advantages of DEXs

Here’s why more users prefer DEX platforms today:

- Non-Custodial Control: Users keep their private keys and full control of funds.

- Wide Token Access: Trade tokens without centralized restrictions.

- Transparent & Borderless: All trades happen on-chain, making it open to anyone, anywhere.

Revenue Streams for a DEX

The exciting part of launching a DEX is that it comes with multiple revenue models:

Trading Fees

Charge a small swap fee (0.2%–0.3%). Even with small fees, higher user volume generates significant revenue.

Token Listing Fees

New projects will pay to list their tokens on your exchange, offering a steady income stream.

Liquidity Mining & Yield Farming

Launch your governance token and reward liquidity providers (LPs). This not only brings liquidity but also keeps users engaged.

Premium APIs & Analytics

Offer pro tools like bots, analytics, and historical data on a subscription basis to businesses and advanced traders.

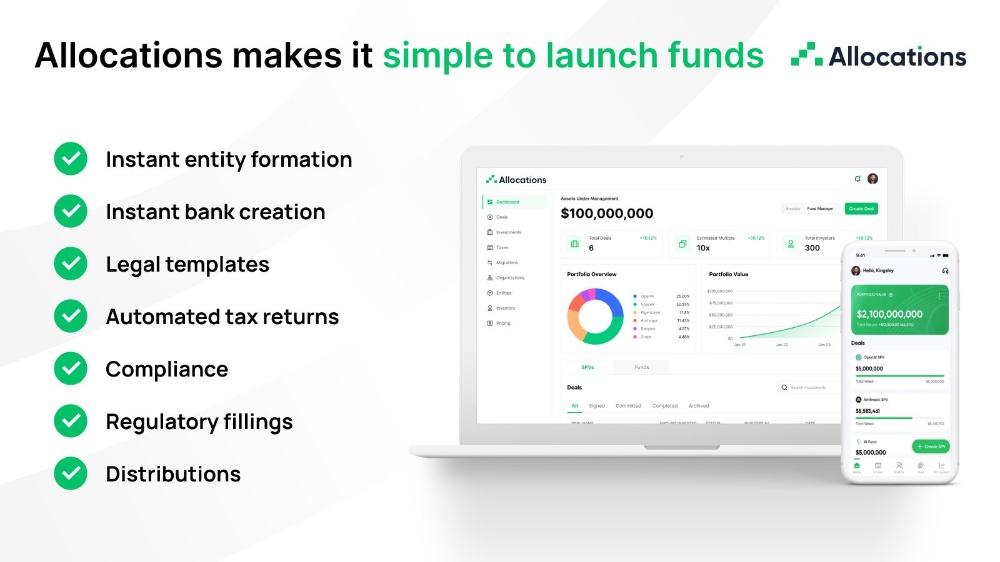

Essential Requirements to Launch a DEX

If you’re planning to build your own decentralized exchange, here are the must-have components:

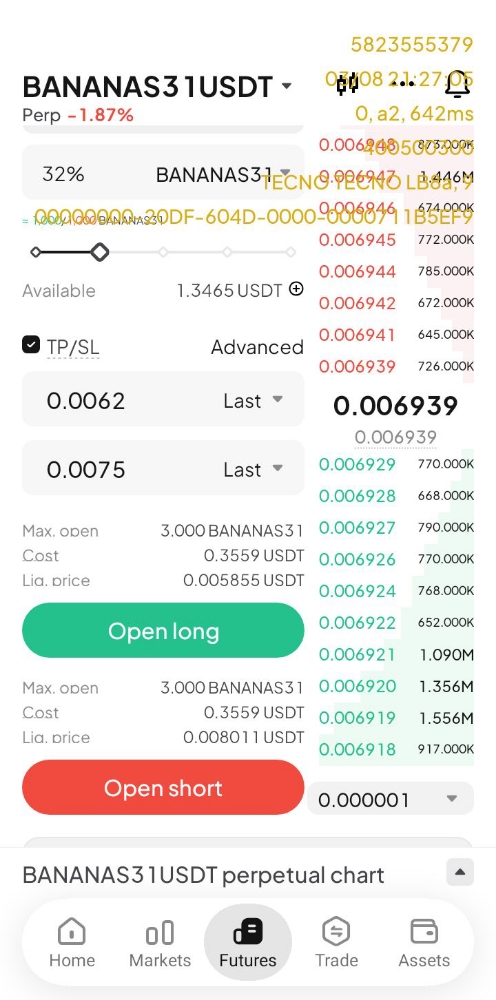

- Smart Contracts: Secure token swaps powered by AMM logic or order books.

- Liquidity Pools: Enable users to deposit funds and facilitate smooth swaps.

- Wallet Integration: Allow connections with wallets like MetaMask for safe and easy trading.

- Trading Interface: Include price charts, order history, and analytics for better decision-making.

- Admin Dashboard: Manage listings, configure fees, and analyze platform performance.

Why Build a DEX in 2025?

The timing couldn’t be better:

- Massive Adoption Potential: In early 2024, DEX monthly volume hit $268 billion, showing strong market growth.

- DeFi Expansion: Yield farming, staking, and lending services continue to bring more users into decentralized ecosystems.

- Trust Factor: Decentralization removes censorship risk and boosts user confidence.

Conclusion: Building a DEX to Succeed

Launching a Decentralized Exchange in 2025 is more than just building a platform, it’s creating a business that blends user trust, transparency, and multiple revenue streams.

By implementing smart contracts, liquidity pools, wallet integration, analytics, and governance tools, you can build a DEX that’s scalable and future-ready. With trading fees, token listings, farming rewards, and premium services, your exchange can become a long-term, profitable venture in the growing DeFi landscape.