Biggest NFT Stories of 2023: From Bitcoin Ordinals to Blur's Surge

It was another transformative year for NFTs, both for better and for worse. We saw the emergence of the Ordinals protocol on Bitcoin, which rejuvenated creators and boosted excitement around the chain—but fomented a split between Bitcoin purists and expansionists. Meanwhile, as sales kept dropping for much of the year, collectors only got louder in expressing their frustrations, and creator royalties diminished further.

Dispite the backlash, NFTs aren’t dead—and some are still in demand. But the NFT market is in a much different place than in 2021 or 2022, and this year’s events revealed a space grappling with how to evolve and move forward now that the early outsized hype has faded. Here’s a look at the defining NFT stories and trends from 2023.

Ordinals emerge

There was no bigger NFT story in 2023 than the emergence of Ordinals, a.k.a. the native Bitcoin counterpart to NFTs. Created by Bitcoin developer Casey Rodarmor, the Ordinals protocol lets users “inscribe” media, apps, and text files to individual satoshis—the smallest unit of measurement on the original blockchain—and then collect and trade them thanks to emerging marketplaces and infrastructure.

“Laser-eyed” maximalists complained as Bitcoin users started using the chain for something other than digital money, and rising network congestion and fees ensued. But Ordinals proved to be no flash in the pan: More than 52 million have been minted to date, and the protocol also enabled the rise of BRC-20 tokens, akin to fungible tokens on other chains.

The Year in Bitcoin: ETFs, Ordinals and What Comes Next

Bitcoin couldn’t be stopped this year. Countless bearish scenarios played out that might have left a significant dent in the asset class. After the FTX scandal exploded last year, sending the crypto market into a death spiral, some asked whether Bitcoin could recover. Later on, a banking crisis ensued, with tech- and crypto-friendly banks like Silicon Valley Bank, Silvergate, Signature, and Prime Trust shutting up shop. Up until they were shut down, Silvergate and Signature had provided integral...

Now there are inscriptions and similarly created tokens flooding other chains, as well. Traditionalists are still complaining, but Ordinals are here to stay—and they’re increasingly challenging the supremacy of Ethereum as the go-to network for on-chain assets.

Blur and Tensor take over

Leading incumbent marketplaces were toppled this year on both Ethereum and Solana. No doubt, the rise of Blur was one of 2023’s defining crypto moments, as the marketplace used token incentives to quickly take over the space and crush OpenSea.

Blur’s wallet-filling token airdrops—totalling over $800 million to date at peak price—helped catapult it to the top of the pile, and now it routinely commands 80% or more of Ethereum NFT trading market share. NFT Revolution

NFT Revolution

Someone Got $8.4 Million in Blur NFT Marketplace's Latest Airdrop

As NFT marketplace Blur sets its sights on a so-called Season 3 of rewards for traders, one JPEG flipper walked away with more than $8.4 million worth of airdropped BLUR tokens from Season 2. Factoring in how active the trader was—across NFT bids, listings, and lending activity during its months-long Season 2—Blur awarded the pseudonymous Hanwe's hanwe.eth wallet with 22.85 million BLUR tokens, according to a Dune dashboard. The airdropped tokens were worth around $7.3 million when claimed late...

Granted, such incentives also fueled mass flipping of assets as traders treated NFTs more like fungible tokens. Some called it wash trading, but at the end of the day, Blur is dominating the sapce. OpenSea, meanwhile, has suffered by comparison and still hasn’t launched a token. The one-time leader, valued at $13.3 billion in early 2022, laid off half its staff in November.

A similar shift has taken place on Solana as longtime leader Magic Eden has been firmly surpassed by Tensor, an upstart that has borrowed Blur’s messaging and rewards model, albeit without an actual airdropped token as of yet. Tensor now typically owns more than 50% of Solana trading action as collections like Mad Lads and its own Tensorians see growing demand.

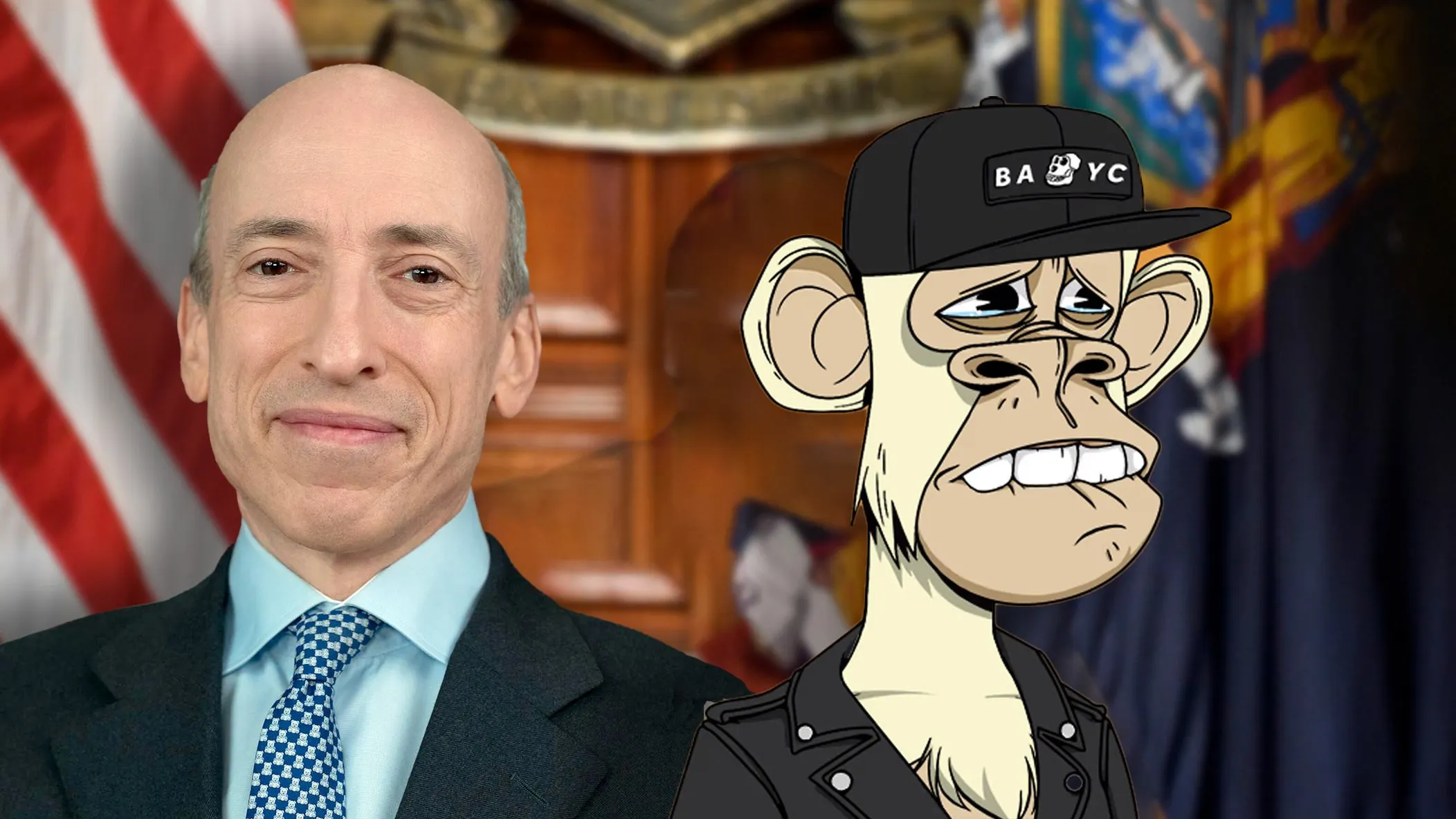

The SEC takes action

The United States Securities and Exchange Commission didn’t simply ratchet up its scrutiny on crypto exchanges this year—it also targeted NFT projects that it called unregistered securities.

First, the SEC took action against Impact Theory, an NFT startup created by entrepreneur and business influencer Tom Bilyeu, which agreed to a $6 million settlement over its “Founders Key NFTs.” Team members had promised substantial returns to investors, which was a one-way ticket to securities violations. NFT Revolution

NFT Revolution

Did the SEC Just Declare War on NFTs?

On Monday, the United States Securities and Exchange Commission (SEC) announced its first-ever enforcement action over the sale of NFTs, fining a Los Angeles-based media company $6 million for selling illegally unregistered securities. But does the action signal an impending crackdown against a broader array of NFT projects? The facts of the case weren’t exactly ambiguous: The fined company, Impact Theory, told potential NFT buyers that “if you’re paying 1.5 [ETH], you’re going to get some massi...

Soon after, the SEC targeted a very high-profile project: “Stoner Cats,” the 2021 animated series funded with and accessed via NFT passes. The Mila Kunis-backed project agreed to a $1 million settlement and effectively shut down; major marketplaces then blocked the NFTs.

An NFT scammer faced justice by U.S. authorities this year, too: Aurelien Michel, the 25-year-old founder of the Mutant Ape Planet NFT collection, pled guilty in November to wire fraud charges. The Department of Justice said that he had “rugpulled” NFT buyers—that is, made promises attached to the asset sales and then not followed through once the money was made.

Trump torpedoes his NFTs

Launched in December 2022, former U.S. President Donald Trump’s initial NFT collection was a hit. Although widely mocked online and in the mainstream media, the collectibles sold out in 24 hours and then generated millions of dollars’ worth of secondary market sales. And prices actually went up in the early months of this year.

Trump Dumps Millions in Ethereum After Disastrous NFT Redux

Donald Trump is dumping his bags. Weeks after attempting—with little success—to breathe life into his NFT trading card business for a third time, the former president appears to be divesting his considerable crypto holdings. According to an analysis by blockchain intelligence firm Arkham, Trump began sending ETH he had accumulated as NFT royalties to Coinbase earlier this month. In the last three weeks, he’s sold off 1,075 ETH, for a total haul of $2.4 million. Arkham says that still leaves T...

But in April, Trump’s team released another, very similar second set of NFTs, which caused the value of the first set to collapse almost immediately. And a third set launched earlier this month, which is larger than the first two sets combined, isn’t even half sold out yet. A trading lock will lift on December 31, at which point we’ll see whether they sink below the $99 mint price.

“The Goose” fetches $6.2 million

The NFT market may be down substantially, but demand for some “blue chip” assets remains strong. Case in point: An Art Blocks NFT in Dmitri Cherniak’s “Ringers” generative art collection, affectionately called “The Goose” for its resemblance to the creature, sold for a massive $6.2 million at a live Sotheby’s auction in June. It’s the top NFT sale of 2023. NFT Revolution

NFT Revolution

NFT Artwork Owned by Three Arrows Capital Sells for $6.2 Million at Sotheby's

Ringers #879, a generative piece of blockchain artwork by Dmitri Cherniak that's commonly known as “The Goose” among NFT enthusiasts, sold at a Sotheby’s auction today for just over $6.2 million including auction house fees. The piece has quite a history. In 2021, it was purchased by now-defunct cryptocurrency hedge fund Three Arrows Capital for a whopping $5.66 million worth of ETH. “The Goose” has since been connected to Three Arrows’ Starry Night Capital fund, which sought to assemble “the wo...

Beyond the amusing nickname and resemblance, this digital art has another distinctive quality to it: The piece was previously owned by Three Arrows Capital, the now-shuttered crypto hedge fund that apparently lost billions as the market collapsed in 2022. Pseudonymous collector Punk6529 was the buyer through their 6529 NFT Fund, Sotheby’s said.

Royalties are dead… or are they?

Creator royalties—small fees automatically paid to artists and companies when their NFTs are resold on the secondary market—started evaporating in late 2022 as upstart marketplaces shunned them to claim market share from stalwart platforms. However, OpenSea and some other marketplaces ultimately opted to keep them last year following backlash from creators and collectors alike.

But that changed in 2023, first as Blur took over the majority of NFT trading (without honoring full royalty settings) and then as OpenSea effectively admitted defeat on the topic, saying in August that it would stop enforcing required royalties. Backlash returned, but many creators had already accepted the reality that ongoing royalties would no longer be reliable. NFT Revolution

NFT Revolution

Bored Ape Creator Yuga Labs and Magic Eden Launching Ethereum NFT Marketplace That Enforces Royalties

Multi-chain NFT marketplace Magic Eden announced Saturday that it will launch a new Ethereum platform by the end of the year in collaboration with Bored Ape Yacht Club creator Yuga Labs—with a firm commitment to honor creator royalties on NFT sales. The companies said in a statement that Magic Eden will have a “contractual obligation” to pay Yuga Labs its share of secondary market sales of its future NFT collections. “We’re very much happy to put our money where our mouth is,” Magic Eden co-foun...

However, there’s potentially hope. On Solana, which arguably led the charge away from required royalties in 2022, a new token standard has led to firmer enforcement of creator fees. And there’s movement in that direction on Ethereum too, including with the introduction of the ERC721-C standard from game developer Limit Break.

DeGods leave Solana; it’s not going well

One of the biggest stories in the NFT space at the tail end of 2022 and into early this year was the planned departure of top projects DeGods and y00ts from Solana, following substantial turmoil in the ecosystem and the cratering price of SOL late last year. The collections did indeed depart Solana, but it arguably hasn’t worked out well over the long term.

DeGods migrated to Ethereum in March and y00ts followed suit to Ethereum scaling network Polygon (before migrating again to ETH mainnet). However, sentiment has shifted since. DeGods NFTs have fallen sharply in value, plunging from a USD floor price of $16,000 in August to about $7,300 today as the project has faced criticism for under-delivering and failing to maintain the hype. NFT Revolution

NFT Revolution

Solana's Top NFT Project Just Pumped 122% in a Week

Solana (SOL) has seen a wild pump lately, more than doubling over the past month and hitting an 18-month high earlier this week. But it’s not just SOL that’s on the way up—the network’s top NFT project has also seen a rapid rise in value of late, registering a price climb of more than 100% in just the last seven days alone. Mad Lads, a Solana profile picture (PFP) project launched earlier this year, has surged in price to become the top collection on the network by floor price—the price of the c...

Making matters worse for DeGods is the fact that the Solana ecosystem has seen a dramatic bounceback in recent months. In fact, Solana’s new top NFT project Mad Lads has a starting price of $14,400 worth of SOL, about double that of DeGods on ETH.

DeGods and y00ts founder Rohun “Frank” Vora, who recently tweeted that “2023 has been the worst year of my life,” has played into speculation over whether the projects might offer a bridge back to Solana and allow owners to have their NFTs on whichever chain they please. It’s still unclear, however, whether DeLabs will actually follow through on that chatter.

Pudgy Penguins puts NFTs in Walmarts

Decrypt’s 2023 NFT project of the year award went to Pudgy Penguins, a collection that thrived amid the Crypto Winter and emerged even stronger—and now is making a mainstream play. NFT Revolution

NFT Revolution

Decrypt's 2023 NFT Project of the Year: Pudgy Penguins

A brutal Crypto Winter nearly starved the NFT market—most projects couldn’t stand the cold. But there’s one that was seemingly built for the climate. It’s only fitting that it’d be Pudgy Penguins—Decrypt’s NFT project of the year. Buzz around NFTs froze in mid-2022, and the once-lively space became very chilly indeed. Prices fell, sales collapsed, and the all-important vibes around the NFT world increasingly became frigid as collectors griped and projects saw revenue largely evaporate. That was...

The Ethereum project teamed with mega-retailer Walmart to put plush toys into thousands of stores, and each toy comes with a scannable QR code that unlocks free NFTs that can be used within the upcoming Pudgy World online game. Pudgy Penguins owner and CEO Luca Netz told Decrypt that about 20% of buyers are claiming the NFTs so far, but they aim to boost that figure with improved messaging and via the impending game launch.

Yuga Labs wins court battle

The legal battle between Bored Ape Yacht Club creator Yuga Labs and artist Ryder Ripps (and associate Jeremy Cahen) was closely watched by the industry over matters like NFT intellectual property and the legality of copycat projects described as “parody.” Ultimately, Yuga Labs was victorious, with a U.S. district judge awarding the startup over $1.5 million in damages. NFT Revolution

NFT Revolution

Ryder Ripps Must Pay Yuga Labs $1.5 Million for Bored Ape Trademark Infringement

A U.S. District Judge in California issued a judgment on Wednesday in favor of Yuga Labs, creators of the popular Bored Ape Yacht Club, against Ryder Ripps (“Ripps”) and Jeremy Cahen (“Cahen”) and awarded Yuga Labs over $1.5 million in damage, the amount the court said Ripps and Cahen made in profits from the sale of Ryder Ripps Bored Ape Yacht Club which the court said infringed on Yuga Labs’ trademark. According to court documents shared with Decrypt by a Yuga Labs spokesperson, the defendants...

Ripps and associates launched the “Ryder Ripps Bored Ape Yacht Club” NFT collection, which consisted of flipped versions of the original artwork, after accusing Yuga of using racist imagery. The NFTs sold out and Yuga filed suit over trademark violations, ultimately winning a summary judgment and damages. Ripps and Cahen were also ordered to transfer the project’s smart contract to Yuga and destroy any related digital assets.

Nouns owners bail

One of the most unique NFT projects saw its community fracture in September, as owners of more than half of all Nouns NFTs voted to “fork” away from the rest and take $27 million worth of ETH in the treasury with them. Such a move was enabled by the creation of the “ragequit” protocol, which allowed holders to form groups and leave with a “refund” of sorts.

Nouns was designed as a decentralized, open-source intellectual property, with the community of holders spending millions upon millions of dollars to fund projects—like comic books, toys, an esports team, and even a parade float. But some in the community saw frivolous spending and unclear returns, and opted to bail and take their share of the treasury. The remaining Nouns owners are still building up the IP and funding projects.

Azuki backlash

One of the biggest NFT drops of the year quickly became a big mess. In June, Chiru Labs—creator of Azuki, one of the most valuable Ethereum NFT projects—revealed an “Elementals” set to expand its collector base, generating $38 million in sales in about 15 minutes. But once the artwork was revealed after the mint, buyers revolted.

The Elementals artwork was largely similar to that of the original NFTs, not only creating confusion but sinking the value of the earlier Azuki NFTs in the process (much like Trump’s NFTs). Some owners even formed a DAO to demand refunds via a lawsuit, though they ultimately dropped the suit and moved on. NFT Revolution

NFT Revolution

Azuki NFT Floor Plummets as Collectors Blast 'Identical' Elementals Art

Today’s Azuki Elementals launch was one of the hottest NFT drops in quite some time, with 10,000 Ethereum profile pictures (PFPs) selling out in around 15 minutes and generating some $38 million worth of ETH for Chiru Labs. But the vibe appears to be souring, as some holders are selling Elementals well under the mint price amid uproar over the artwork. Azuki Elementals NFTs sold for 2 ETH (about $3,800) apiece in the initial mint today, with another 10,000 of the NFTs airdropped free to holders...

As of this writing, Azuki Elementals NFTs start at about $1,200 worth of ETH after minting at about $3,800 worth, per data from NFT Price Floor. The original Azuki NFT prices are down to about half the USD value as just before the Elementals mint.

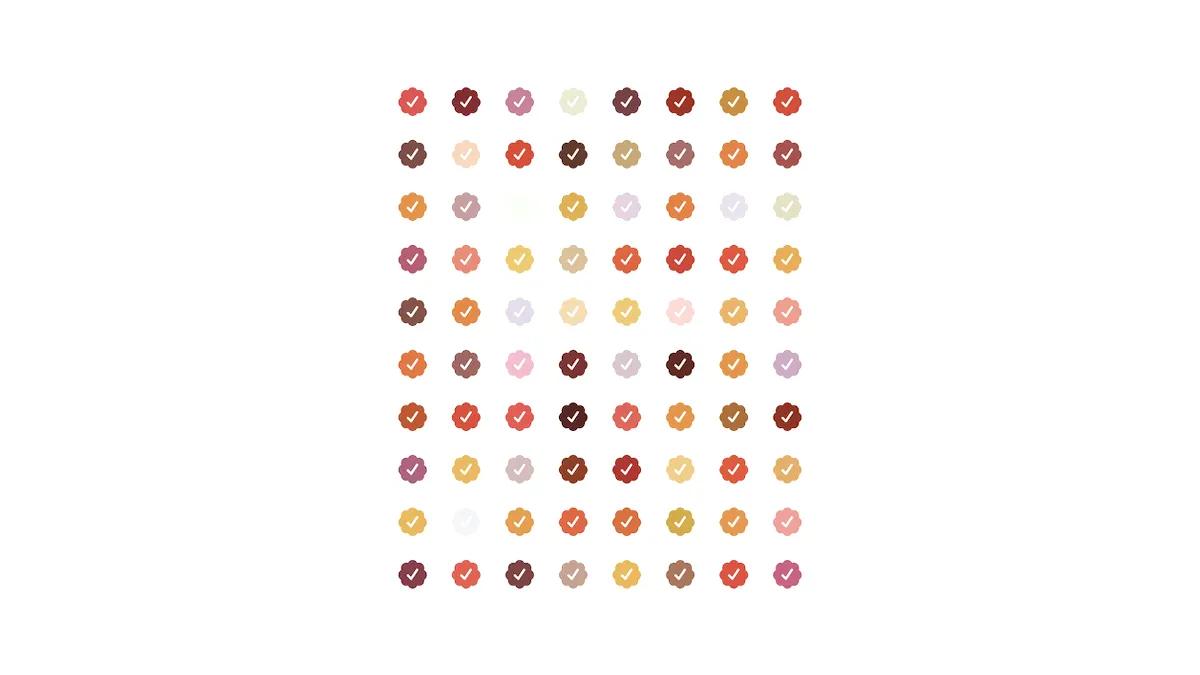

Open Edition meta

Amid falling NFT prices early this year, a new type of NFT release model took hold. Open edition mints were affordably priced and offered either identical or lightly differentiated artwork, designed as an accessible way for buyers to collect—but also an opportunity to create gamified models and reward collectors for buying and trading up with several editions. NFT Revolution

NFT Revolution

From $8 Mint to $4K Flip: Open Edition NFTs Are Reenergizing the Market

The NFT market showed sparks of life in January with a sharp uptick in trading volume and total NFTs sold, but it’s not just high-value Bored Ape Yacht Club sales driving the renewed buzz. Lately, it’s also open edition mints in which artwork is selling for tiny sums, yet fueling hype thanks to gamification techniques and FOMO over potential future rewards. At its core, an open edition NFT mint simply means a drop in which there’s no cap on how many of the identical artwork pieces can be purchas...

“Checks,” a project by artist Jack Butcher riffing on Twitter’s verification check design, was the most successful of these drops. Some 16,000 editions were minted for just $8 apiece, and within weeks, they were flipping for thousands of dollars apiece as collectors attempted to trade up to rarer renditions. The open edition buzz cooled, but it provided another way for artists and creators to engage with collectors and incentivize trading.

“The Simpsons” weighs in

For 35 years, “The Simpsons” has skewered culture—and NFTs finally got a spotlight in November as part of its annual “Treehouse of Horror” Halloween special. The episode segment referenced various creators and projects, from Beeple to Bored Apes, while poking fun at NFT hype and some of the inanity that accompanied it. NFT Revolution

NFT Revolution

The Best NFT Gags and References From the Viral 'Simpsons' Episode

On Sunday, the long-running animated series “The Simpsons,” known for skewering many aspects of American life, finally put the beleaguered NFT market in its crosshairs. During one segment of the show’s 34th annual Halloween-themed “Treehouse of Horror” anthology series, Homer accidentally mints Bart onto “the blockchain” as an NFT, triggering a daring rescue mission featuring multiple eerily recognizable designs and characters from the NFT ecosystem. Here are a few key highlights from the episo...

Broadly, NFT collectors and creators responded well to the episode, seeing it as a defining moment for the culture. Meanwhile, some launched unofficial Simpsons-themed NFT projects, generating millions of dollars in trading volume. Maybe that’ll be part of the next roast, should “The Simpsons” ever loop back on the NFT craze again.