Solana Earns the Title of Ethereum Slayer

Solana Earns the Title of Ethereum Slayer

Solana demonstrates superior Capital Efficiency compared to Ethereum, yet despite ecosystem expansion, SOL's price remains subject to volatility. SOL has been on the market for the past few weeks and its price has increased thanks to the growing popularity of the network. One of the factors that sets SOL apart is its capital efficiency.

SOL has been on the market for the past few weeks and its price has increased thanks to the growing popularity of the network. One of the factors that sets SOL apart is its capital efficiency.

Solana takes the lead

Solana has demonstrated leadership in capital leveraging, a key factor in the Traditional Finance (TradFi) sector, demonstrating the project’s proficiency in financing and investing. In the DeFi sector, Solana also strengthens the strength and stability of the protocol, promotes maximum profitability, facilitates competitive competition, enhances liquidity, reduces risk and encourages innovation.

Research firm Reflexivity Research compared capital efficiency on Solana with Ethereum in the DeFi sector, pointing to SOL’s superiority. Data shows that Solana’s design has special features that help optimize capital efficiency in the DeFi sector. Faster transaction speeds and lower costs compared to Ethereum, minimizing transaction confirmation wait times.

Additionally, parallel processing allows for efficient DeFi operations. Solana’s architecture also separates data and code storage, helping to reduce costs and increase efficiency.

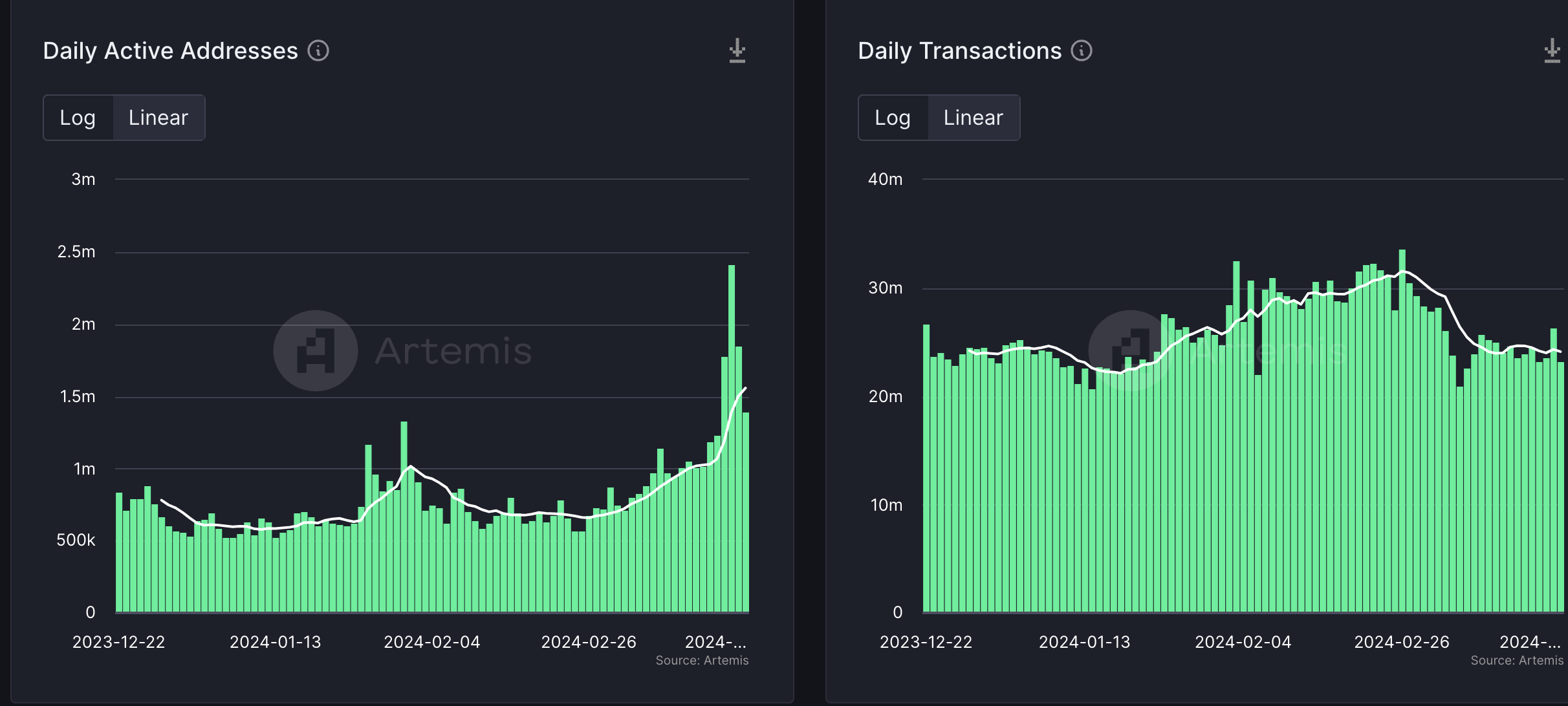

Source: Artemis

Positive capital efficiency could be the deciding factor for Solana’s game changer in the competitive DeFi scene. By attracting users through fast transactions, low fees, and the ability to leverage less locked capital, Solana can build a strong DeFi ecosystem.

This positive cycle attracts users and developers, drives innovation, and solidifies the network’s position as a leading DeFi platform. Ultimately, positive capital efficiency helps Solana not only compete with, but also surpass, established DeFi competitors like Ethereum.

Related: Ethereum Fund Under Government and SEC Scrutiny

Analysis of data from Artemis shows that the number of daily active addresses on the Solana network has increased from 870,000 to 1.56 million. The number of transactions on the Solana network also did not change significantly.

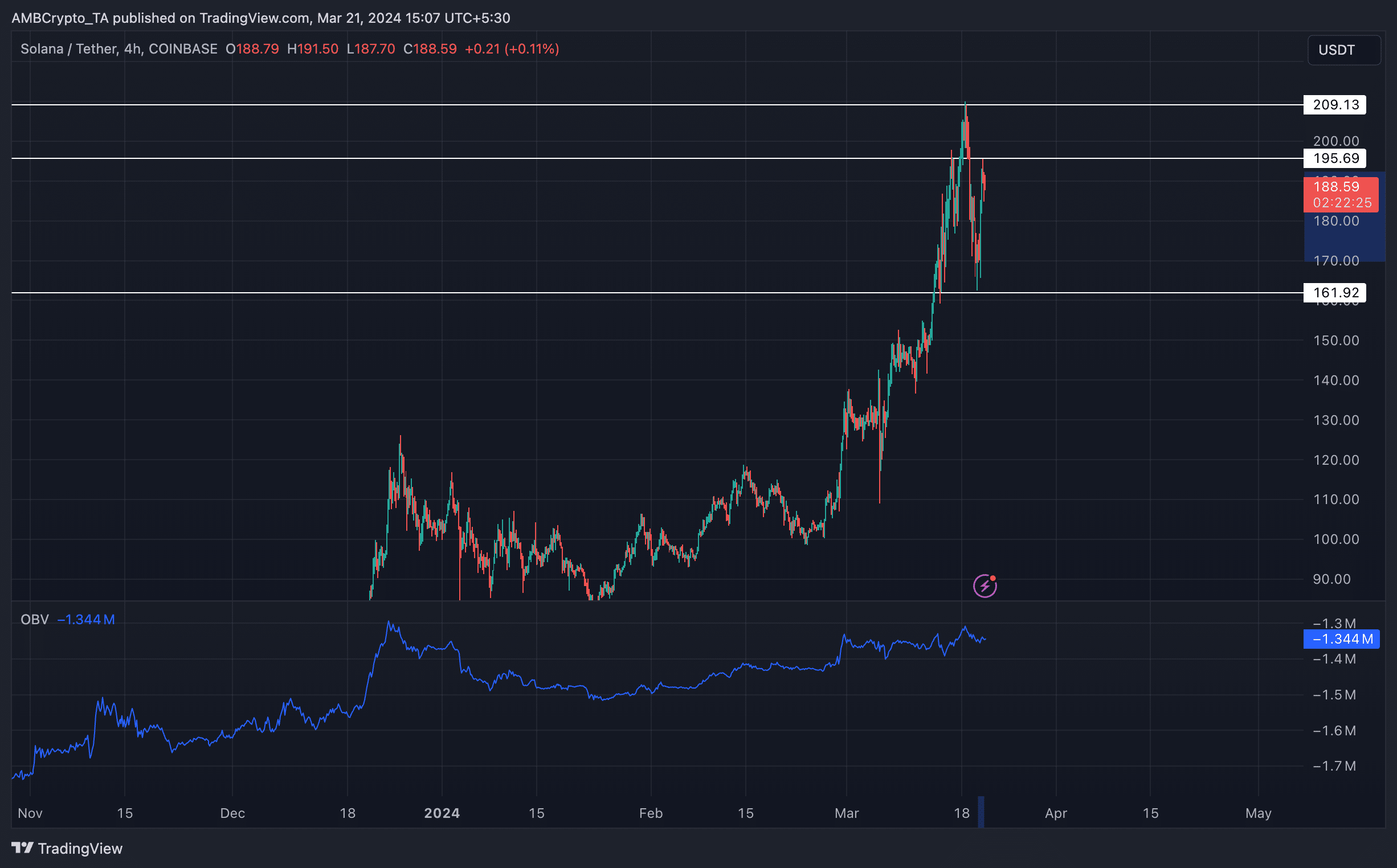

Source: Trading View

Despite the positive performance of the network, SOL price has encountered some volatility. Over the past few days, SOL price has dropped 20% after reaching $209.

After that, SOL price recovered and increased 13.42% to $195.69. However, SOL’s OBV has decreased.

OBV fell despite rising SOL prices, suggesting weaker buying pressure, which could lead to a bullish trend reversal or limit future upside.