Ensuring Compliance and Transparency with a Professional SPV Account

A professionally managed SPV account is the linchpin for regulatory compliance and investor transparency. It provides the clear audit trail required to demonstrate that the SPV vehicle is being operated as a truly independent entity. This is especially vital for more complex structures like an offshore company or a special purchase vehicle used in cross-border transactions, where regulatory scrutiny can be high.

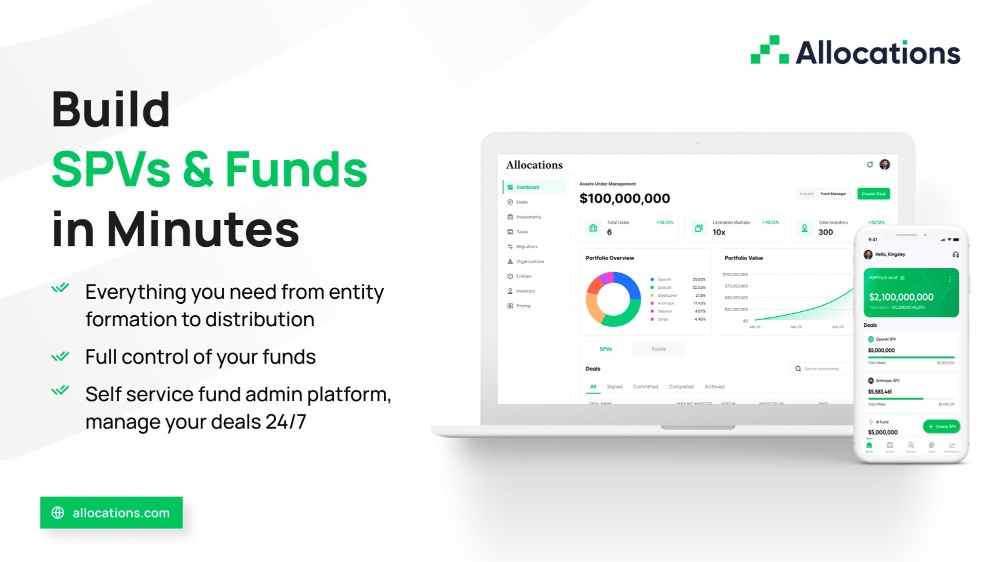

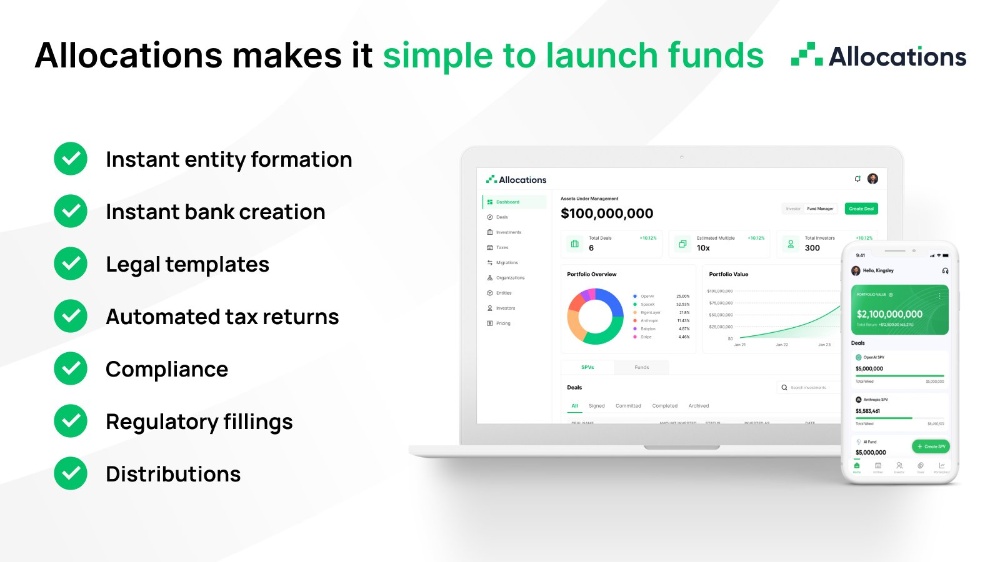

Maintaining this compliance manually is error-prone. A comprehensive SPV management platform automates these safeguards. Allocations builds compliance into the operational workflow. The platform ensures that the SPV account is used exclusively for its intended purpose, transactions are properly categorized, and all activity is visible to authorized investors through a secure portal.

This built-in governance offered by Allocations not only mitigates risk for the sponsor but also provides investors with the confidence that comes from transparent, professional-grade financial administration for their SPV investment.

This service from Allocations not only saves significant time but also ensures compliance with the stringent "separateness" covenants required for a true bankruptcy remote SPV, which is essential for any serious financial SPV.