Bitcoin Tumbles Below $60,000 as Halving Looms, Sparking Trader Liquidations

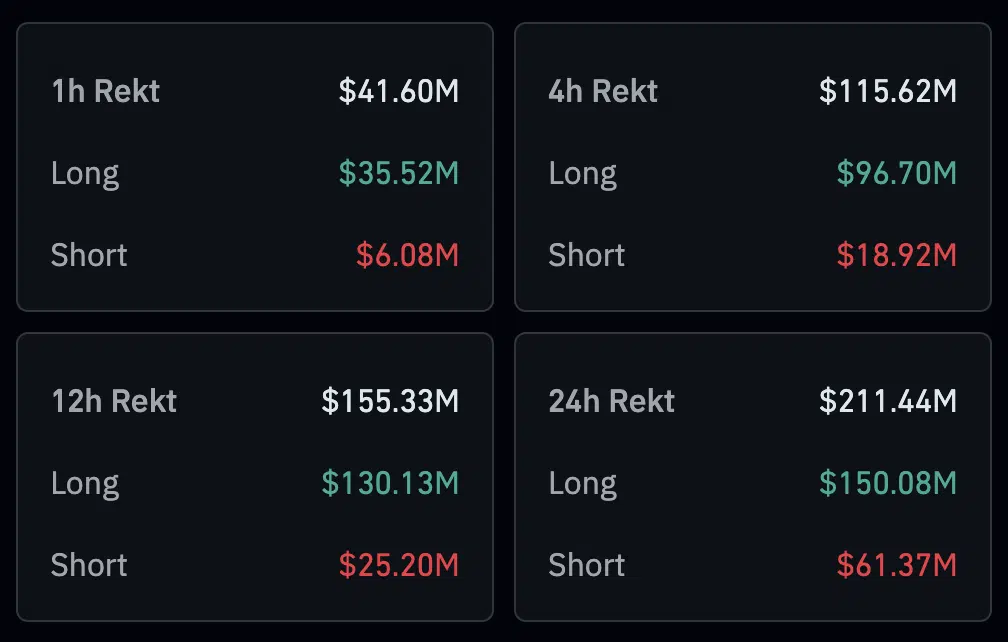

The price of Bitcoin (BTC) has dipped significantly, falling below the crucial $60,000 mark in the past 24 hours. This drop coincides with a period of heightened volatility leading up to the highly anticipated Bitcoin halving event.

The price of Bitcoin (BTC) has dipped significantly, falling below the crucial $60,000 mark in the past 24 hours. This drop coincides with a period of heightened volatility leading up to the highly anticipated Bitcoin halving event. According to CoinMarketCap data, Bitcoin has shed over 3% of its value, currently trading around $59,800. This decline is accompanied by a decrease in trading volume of nearly 12%, dropping to $40 billion. Analysts attribute this slump to a combination of factors, with the impending halving playing a major role.

According to CoinMarketCap data, Bitcoin has shed over 3% of its value, currently trading around $59,800. This decline is accompanied by a decrease in trading volume of nearly 12%, dropping to $40 billion. Analysts attribute this slump to a combination of factors, with the impending halving playing a major role.

The halving, scheduled to occur in a few days, will cut Bitcoin miner rewards in half. This fundamental shift in supply dynamics has some investors exiting their positions in anticipation of potential price fluctuations. By reducing the number of new coins entering circulation, the halving could theoretically lead to price increases due to scarcity. However, the short-term market sentiment seems to reflect a degree of uncertainty.

Volatility Beyond the Halving

Market volatility extends beyond the halving itself. Recent comments from Jerome Powell, Chairman of the U.S. Federal Reserve, have also contributed to the sell-off. Powell's statement that the central bank needs to see inflation under control before considering interest rate cuts has caused some investors to withdraw funds from popular Bitcoin ETFs (Exchange Traded Funds). This withdrawal of liquidity adds further pressure to the cryptocurrency market.

While the current market jitters and price dips may raise concerns, it's crucial to consider the longer-term narrative surrounding Bitcoin. Historically, halving events have often been followed by significant price increases. The theory behind this trend is that the reduced supply, coupled with increasing demand, eventually pushes prices upwards. For instance, after the previous halving in 2020, Bitcoin's price skyrocketed from around $9,000 to over $60,000 within a year.

However, past performance is not indicative of future results. Market conditions can change rapidly, and unforeseen events can disrupt historical patterns. Investors should avoid making investment decisions solely based on historical trends.

Miner Accumulation and Potential Price Impact

Markus Thielen, Head of Research at 10x Research, offers an interesting perspective on the recent price movements. He highlights the strategic accumulation of Bitcoin by miners since January 2024. This strategy aimed to create an imbalance between supply and demand, which in turn fueled the sharp price rise observed earlier this year, culminating in a new all-time high in March.

However, with the halving approaching, miners are expected to gradually sell off their accumulated coins. This influx of Bitcoin back into the market could put downward pressure on prices, creating a potential short-term correction.

While the current market jitters and price dips may raise concerns, it's crucial to consider the longer-term narrative surrounding Bitcoin. Historically, halving events have often been followed by significant price increases. The theory behind this trend is that the reduced supply, coupled with increasing demand, eventually pushes prices upwards.

The current volatility presents both challenges and opportunities for investors. For those with a long-term perspective, these dips might be seen as attractive entry points. However, investors with a lower risk tolerance may choose to adopt a wait-and-see approach until market conditions stabilize.

Risk Management and Portfolio Diversification

Regardless of investment strategy, sound risk management principles remain paramount. Cryptocurrencies are inherently volatile, and investors should only allocate a portion of their portfolio that they are comfortable potentially losing. Diversification across different asset classes can further mitigate risk exposure.

Regardless of investment strategy, sound risk management principles remain paramount. Cryptocurrencies are inherently volatile, and investors should only allocate a portion of their portfolio that they are comfortable potentially losing. Diversification across different asset classes can further mitigate risk exposure.

The upcoming Bitcoin halving is a significant event with the potential to shape the future of the cryptocurrency market. While the immediate consequences are uncertain, the long-term outlook for Bitcoin remains a topic of debate. Investors should closely monitor market developments, conduct their own research, and implement a risk management plan tailored to their individual circumstances.