Solana’s DeFi landscape matures with significant growth in liquidity and lending sectors

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Solana's vibrant ecosystem now has a staggering $4.666 billion in total value locked (TVL) and analysis reveals a dynamic landscape of blockchain innovation. As you peel back the layers of Solana’s financial network, you'll discover how each protocol, from the leading staking solution Marinade to the user-friendly DEX Orca, plays a critical role in shaping the user experience and preferences. The distribution of these vast sums across various platforms tells a story of evolving needs and emerging trends within the community. But it’s not just about liquidity and trading – a deeper analysis hints at a robust demand for sophisticated DeFi solutions. Yet, amid this bustling activity, how does the surge in memecoins fit into the broader narrative of Solana's ecosystem? The answer may surprise you, challenging preconceived notions and setting the stage for an unexpected revelation about the impact of these fleeting tokens on the network’s stability and growth.

To read the rest of this article, connect your Solana wallet or learn more about CryptoSlate Alpha.

Unlock this story with CryptoSlate Alpha

This story is only available for CryptoSlate Alpha members. CryptoSlate Alpha is a web3 membership built to empower you with cutting-edge insights and knowledge, built in partnership with Access Protocol.

👋 Hey, connecting to CryptoSlate Alpha requires authentication using Access Protocol. CryptoSlate is a launch partner of Access Protocol and we are also invested in the project through a grant we received. For more information, see our terms page.

To access CryptoSlate Alpha, you will need

1. Solana Wallet

Connect a Solana self-custody wallet (Phantom, Solflare or Torus).

2. Stake ACS

Stake 20k ACS (native token of Access Protocol) to the CryptoSlate pool.

Included in your membership

Exclusive Research & Analysis

Crypto, Macro & DeFi Insights

Already holding ACS? Connect & stake now → Get Alpha

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

GT Protocol

GT Protocol

GT-Protocol.io

Most Hyped AI token of 2024

Buy GTAI

Ad CryptoSlate on Substack

CryptoSlate on Substack

cryptoslate.substack.com

Must-read crypto news & insights. Delivered daily.

Join 75,000+ subscribers

Ad

Latest Alpha

Solana’s DeFi landscape matures with significant growth in liquidity and lending sectors

Bitcoin’s latest rally upends traditional market expectations with shallower drawdowns

In this article

Solana

Solana

SOL (24h)

$191.697

+0.93%

VOL: $3.51B

MCAP: $85.17B

Solana is a high-performance blockchain platform that utilizes a unique consensus algorithm called “Proof of History” to achieve fast transaction speeds and low fees.

More about Solana

Featured Story

The future of Bitcoin mining post-halving, according to GoMining

Exploring GoMining's innovative strategies for overcoming the challenges Bitcoin miners face post-halving. CryptoSlate on Substack

CryptoSlate on Substack

cryptoslate.substack.com

Daily digest of top crypto stories and market insights. Never miss out.

Join 75,000+ subscribers

Ad

News ▸ Coinbase ▸ Arbitrum · Avalanche · Ethereum · Optimism · Polygon · USDC ▸ Crypto

Coinbase to store more of its $220 million USDC holdings on Base

As of press time, the exchange only holds 17% of its USDC on Base. Mike Dalton

Mike Dalton

Mar. 26, 2024 at 11:59 pm UTC

2 min read

Updated: Mar. 26, 2024 at 11:59 pm UTC

X

Telegram

LinkedIn

Email Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content. Ad

Ad

ADVERTISE HERE

Coinbase said that it will store a greater amount of USDC on its Base network on March 26.

Max Branzburg, Vice President of Product, announced the change on X. He wrote:

“Going forward, Coinbase is going to be storing more corporate and customer USDC balances on Base.“

Branzburg said the change will allow Coinbase to manage and secure customer funds with lower fees and faster settlement. He added that the change will not impact user experience.

Branzburg also urged other companies to follow Coinbase’s lead as it moves its business on-chain.

Coinbase’s USDC breakdown

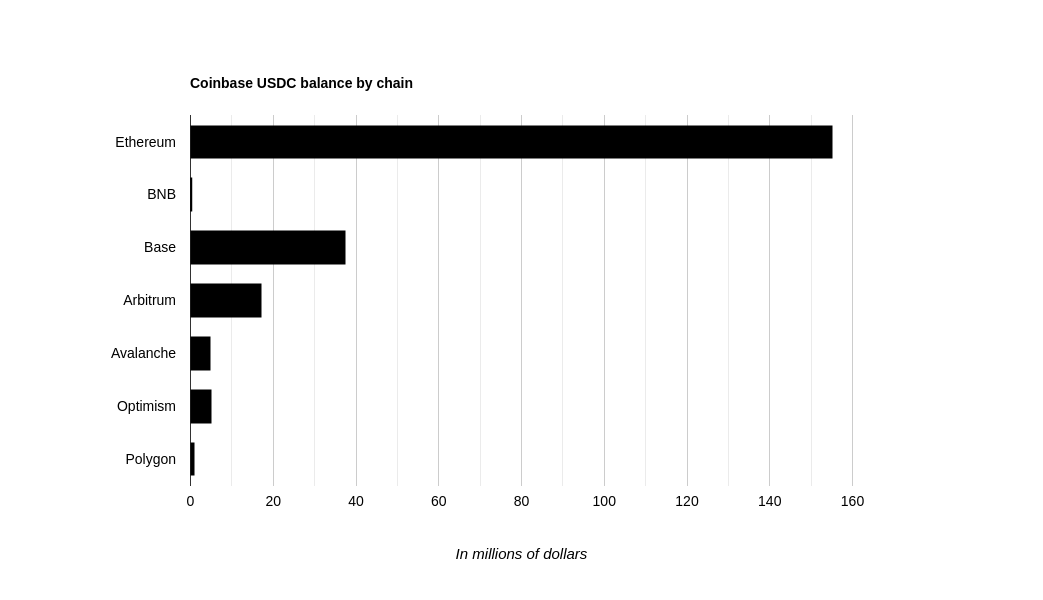

Data from Arkham Intelligence indicates that Coinbase currently holds $220.7 million of USDC in total and stores only 17% of it on Base — equating to $37.4 million.

Most of its USDC holdings — 155.1 million USDC, amounting to roughly 70% of the total — are currently held on Ethereum.

Coinbase stores the remaining 13% of its USDC on various other chains, including $17.2 million on Arbitrum (7.8% of the total), $4.9 million on Avalanche (2.2%), $5.1 million on Optimism (2.3%), $1.0 million on Polygon (0.5%), and $38,557 on BNB Chain (0.02%). Coinbase USDC balance across networks (via. Arkham Intelligence)

Coinbase USDC balance across networks (via. Arkham Intelligence)

Shifting the balance

As of March 26, there was $735.2 million in USDC natively on Base, plus $73.5 million of USDC bridged from Ethereum to Base.

Coinbase moving hundreds of millions of dollars in the stablecoin to the network could noticeably shift the chain’s overall USDC balance.

However, Coinbase’s USDC holdings are just a small fraction of USDC’s total $32.3 billion market cap, of which $27.2 billion exists on Ethereum. As such, shifts involving Coinbase’s USDC balance will not impact USDC’s broader Ethereum distribution in a significant way.

Coinbase previously had a key role in governing USDC through the CENTRE consortium. However, in August 2023, CENTRE was dissolved, passing governance to Circle.

Coinbase now holds a stake in Circle, and the two firms maintain a commercial relationship.