Why Most Beginners Lose Money in Crypto (And How to Avoid It)

Introduction

The crypto market attracts millions of newcomers every year with promises of fast profits, life-changing gains, and financial freedom.

Yet the reality is harsh: most beginners lose money, often very quickly.

This doesn’t mean crypto is a scam.

It means most people enter the market without the right mindset, knowledge, and risk control.

Let’s break down why beginners fail — and more importantly, how you can avoid the same traps.

1. Entering Crypto With the Wrong Expectations

Many beginners come to crypto believing:

- “I can double my account in a week”

- “This coin will go to the moon”

- “I don’t need risk management if the trend is strong”

These expectations are usually shaped by social media hype, screenshots of big profits, and influencers selling dreams.

Reality check:

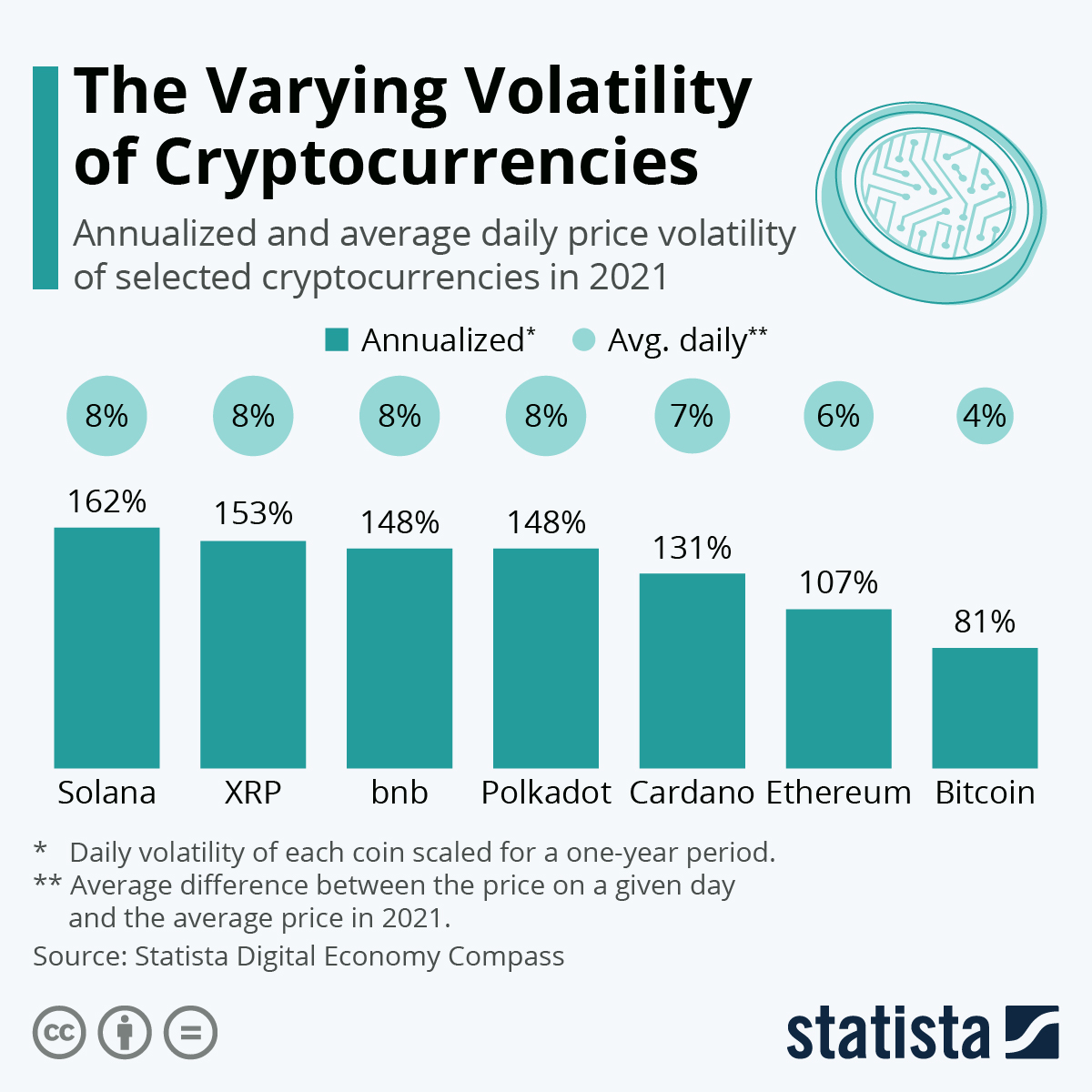

Crypto is not a shortcut to wealth. It’s a high-volatility market where emotional decisions are punished fast.

👉 How to avoid this mistake

- Treat crypto as a skill, not a lottery

- Focus on capital preservation first, profit second

- Set realistic goals: consistency > big wins

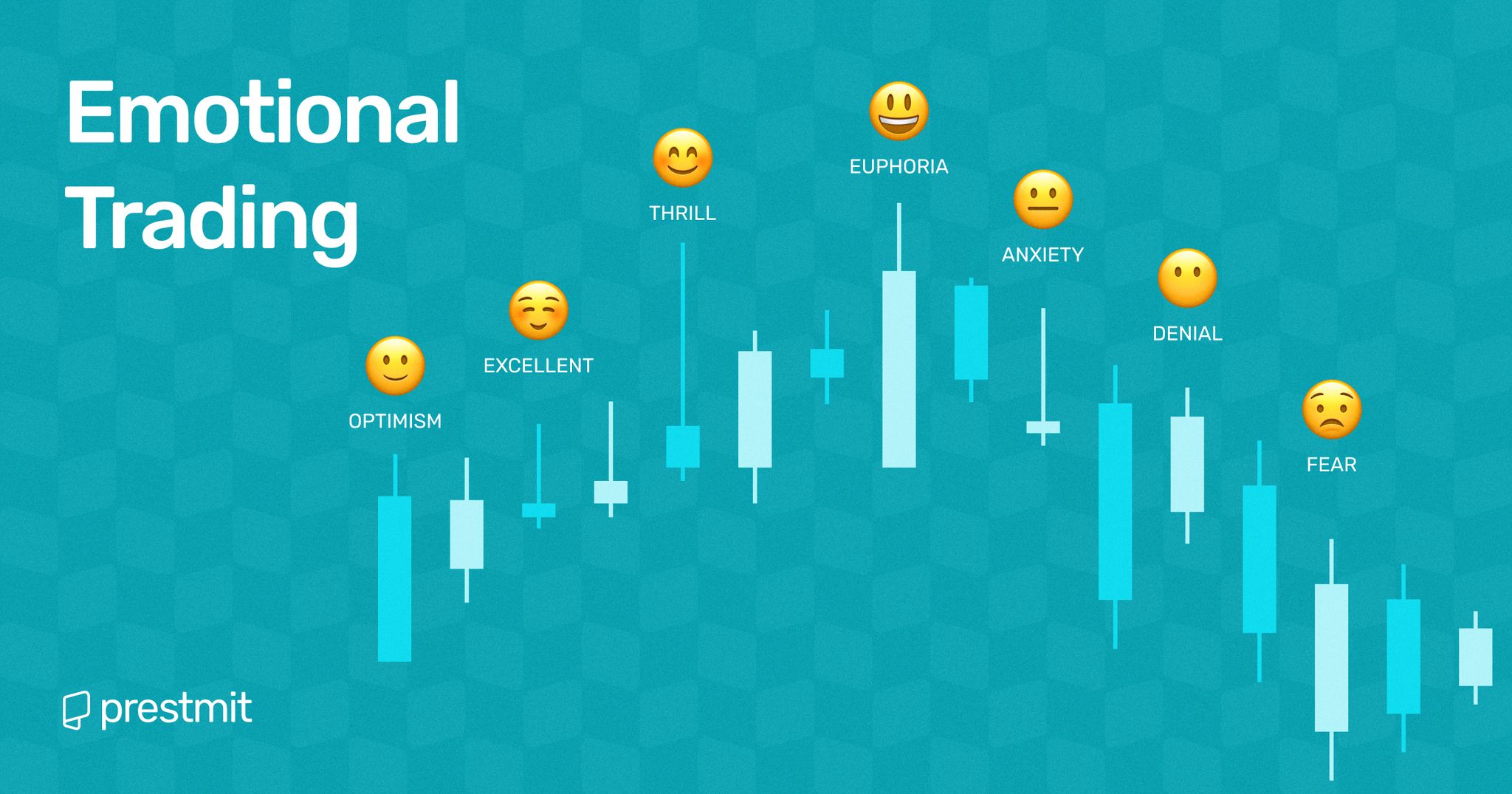

2. Trading With Emotions Instead of a Plan

Fear and greed are the two biggest enemies in crypto trading.

Common emotional mistakes:

- FOMO buying after a big pump

- Panic selling during a normal pullback

- Revenge trading after a loss

- Overtrading just to “feel active”

Most beginners don’t lose because their strategy is bad —

they lose because they don’t follow any strategy at all.

👉 How to avoid this mistake

- Always trade with a clear plan: entry, stop loss, target

- Risk a fixed % per trade (not emotions)

- Accept losses as part of the game

3. Ignoring Risk Management

This is the #1 reason accounts blow up.

Typical beginner behavior:

- Using too much leverage

- No stop loss

- “All-in” on one coin

- Adding more money to losing positions blindly

In crypto, one bad trade without risk control can erase months of gains.

👉 How to avoid this mistake

- Risk only what you can afford to lose

- Use stop losses — always

- Keep position size small, especially as a beginner

- Survival is more important than profit

4. Overcomplicating Everything

Many beginners think:

“More indicators = better trading”

So they stack:

- RSI

- MACD

- Bollinger Bands

- Fibonacci

- Volume indicators

- Custom signals

The result? Confusion and hesitation.

Professional traders often use simple systems:

- Price structure

- Trend direction

- One or two confirmations

- Clear risk-reward rules

👉 How to avoid this mistake

- Keep your strategy simple

- Master one setup instead of chasing many

- Clarity beats complexity

5. No Long-Term Perspective

Beginners often judge themselves by:

- Daily profit

- One winning or losing trade

- Short-term outcomes

But crypto success is built over months and years, not days.

👉 How to avoid this mistake

- Track performance over many trades

- Focus on process, not single results

- Learn continuously and adapt

Final Thoughts

Most beginners lose money in crypto not because crypto is impossible,

but because they approach it with the wrong mindset.

If you:

- Control risk

- Manage emotions

- Keep your strategy simple

- Stay patient and disciplined

You already place yourself ahead of the majority.

⚠️ Risk Disclaimer

This article is for educational purposes only and does not constitute financial advice.

Cryptocurrency trading involves significant risk, and you should only trade with money you can afford to lose. Always do your own research and understand the risks before participating in the market.