Not just the halving: Why analysts are bullish on Bitcoin in 2024

The massive overall demand for Bitcoin along with macroeconomic factors will play a far bigger role in driving the price of Bitcoin this year.

Numerous industry professionals believe that the April Bitcoin halving is just a small portion of the reasons why the cryptocurrency could see incredible increases this year.

According to financial researcher Lyn Alden, who spoke with Cointelegraph, the Bitcoin halving next month would lower daily BTC production by roughly 450 BTC from the current average daily amount of 900 BTC.

Alden said that the daily fiat inflows and outflows from Bitcoin exchange-traded funds (ETFs) and cryptocurrency exchanges dwarf the amount of supply reduction.

“In fact, inflows or outflows can easily exceed 10x of that value,” Alden said, adding that overall demand for Bitcoin is a “bigger factor than tightening supply.”

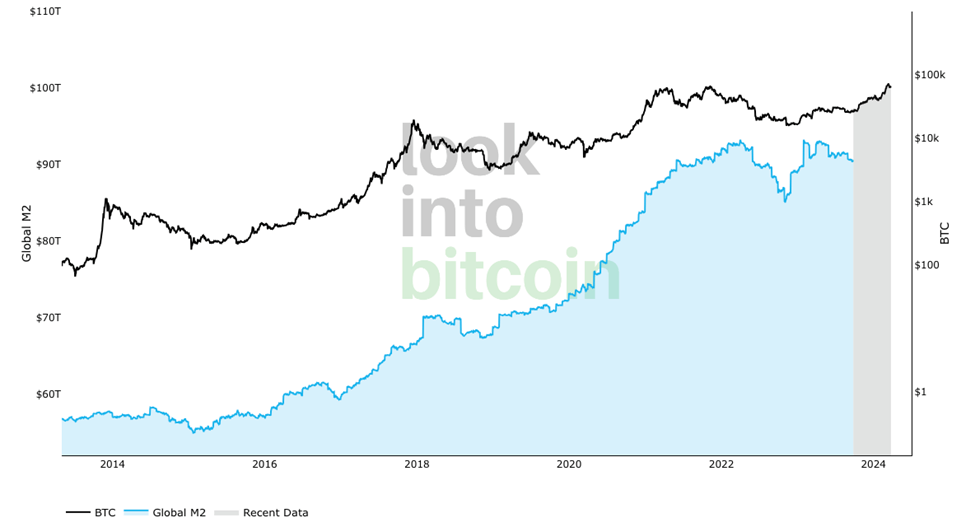

Referring to a graphic showing the price of Bitcoin vs the worldwide monetary supply (M2), Alden emphasized that historically, demand for the cryptocurrency has been more connected with indicators of global liquidity, such as the global broad money supply.

Bitcoin price vs. global liquidity (M2). Source: Look into Bitcoin

“So I think the halving is important, but it’s only one factor out of many that determines the occurrence and timing of a bull market. Various measures of global liquidity, HODL waves, and other catalysts combine to serve a larger role,” Alden said, adding:

“I am bullish for the next two years due to a combination of the halving, expectations for improved global liquidity, and the fact that so many coins have rotated to strong hands in the bear market, and so a relatively minor increase in demand can move the price quite a bit.”

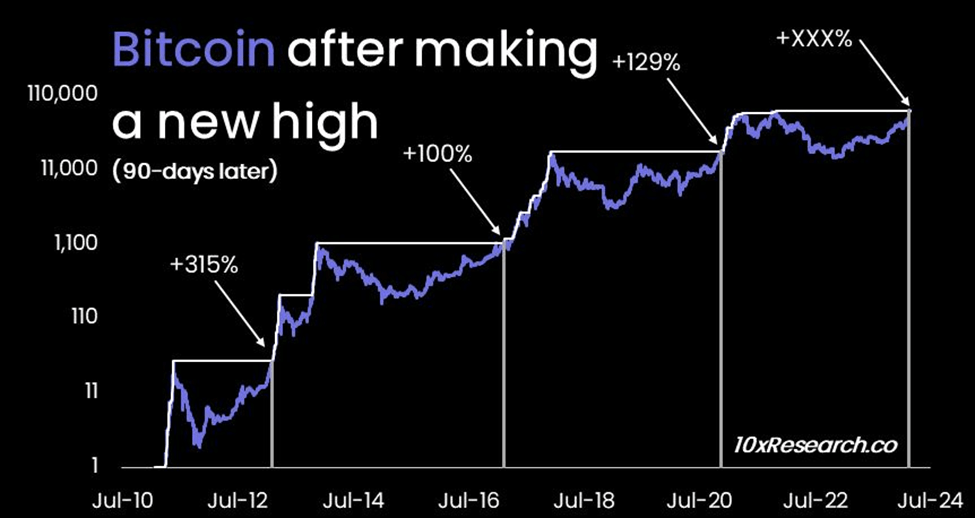

Markus Thielen, CEO of 10x Research and chief analyst, claims that the current rise is "unquestionably on par" with the bull market that began in 2020 and ended in April 2021.

Thielen has been optimistic about the price of Bitcoin since the cryptocurrency surpassed its multi-year highs on March 13, 2024, citing methods like quantitative analysis.

Tenx Research predicted that the price of bitcoin would hit $77,000 by early April and $99,000 by May 2024, based on past price fluctuations and recent highs.

In an email to Cointelegraph on March 14, Thielen stated, "We saw a wave of intraday selling when Bitcoin made a new high at $68,300, but every attempt to push down prices has been met with relentless buying."

The researcher pointed out that in February 2013, February 2017, and November 2020, when Bitcoin had fresh price breakthroughs, the price would increase by as much as 189% in 180 days. According to Thielen, it would take nine to eleven months for Bitcoin to peak after previous breakouts.

Bitcoin 90 days after making new bull market highs. Source: 10x Research

According to Thielen's forecast, Bitcoin could reach an astonishing $146,000 between December and February 2025, which would be nine to eleven months after the March 13 breakout.

The analyst stated: "Traders could use the breakout level, $68,300, as their new line in the sand, where we can argue that above this level, Bitcoin could be materially higher over the next few weeks and months, even though corrections and retracements could occur at any time."

“Despite the possibility that Bitcoin could climb to 146,000 this summer, we keep our 125,000 price target for now as we expect this bull market to continue until 2025.”

According to Simon Peters, a crypto analyst at eToro, the current Bitcoin surge is the first time the cryptocurrency has had a parabolic increase and reached a new all-time high prior to the block reward halving.

Peters claims that the introduction of spot Bitcoin exchange-traded funds (ETF) in the US on January 11, 2024, is the primary cause of this surge.

"We've never really had this in previous cycles—demand for Bitcoin is quickly outpacing the new supply," Peters said. The demand was mostly driven by retail prior to the introduction of ETFs, but the current cycle will be "more institutional," he continued.

Since August 2023, Bitcoin miners have been actively dumping BTC, making them the only natural sellers, according to Peters.

“This suggests to me that miners have already been selling into the current rally in preparation for the upcoming block reward halving,” the analyst said, adding that all selling is “well bid” because of the high demand from spot ETFs," said Peters, adding:

“If we do see a slowdown in spot ETF inflows, this could be an indication of the market topping out and running out of steam, but it’s important to note that whilst the ETFs have been a major contributor to the rally so far, they are not the only participants in the space. Other entities such as MicroStrategy and Bitcoin whales continue to accumulate too.”

Exness financial market strategist Li Xing, meanwhile, believes that this year's price of Bitcoin would be driven by macroeconomic factors.

In addition to the spot Bitcoin ETF debut, the analyst noted that other economic factors might increase the attraction of Bitcoin as a substitute store of value, such as forecasts of a softer monetary policy and lower interest rates in the US and abroad.

“Moreover, geopolitical risks and uncertainties surrounding the U.S. elections could continue to buoy demand, marking the beginning of a sustained bull run in the future,” Li added.

Bitcoin halvings are scheduled to take place once every 210,000 blocks, or roughly every four years, and are intended to keep Bitcoin's deficit in check and fight inflation.

Three halving events occurred for Bitcoin since its introduction in 2009: in 2012, 2016, and 2020. As a result, the miner reward decreased from 50 BTC to 6.5 BTC. The mining compensation will drop even further in 2024 with the impending half of Bitcoin, from 6.5 BTC to 3.125 BTC.

Bitcoin halvings in the past have been linked to post-halving rallies. For instance, following its 2016 halving, the price of Bitcoin surged by about 3,000% in just 17 months, hitting a record-breaking $20,000 in December 2017.

REFERENCES

https://cointelegraph.com/

https://www.google.com/