Chauffeur Knowledge in Cryptocurrency Trading: A Comprehensive Analysis.

In the dynamic and often volatile world of cryptocurrency trading, trading psychology plays a crucial role. One of the most misleading and dangerous psychological phenomena in this area is "chauffeur knowledge". This expression refers to people who appear to have deep knowledge and confidence in a subject, but lack genuine experience, similar to a parrot that repeats memorized phrases without understanding their meaning. This article explores how chauffeur knowledge manifests itself in cryptocurrency trading and the potential consequences for investors.

Chauffeur Knowledge Background

The term "chauffeur knowledge" originated to describe those individuals who, although they appear knowledgeable, are only repeating superficial information without deep understanding. In the context of cryptocurrencies, this can be particularly damaging due to the complex and rapidly evolving nature of the market.

Manifestations in Cryptocurrency Trading

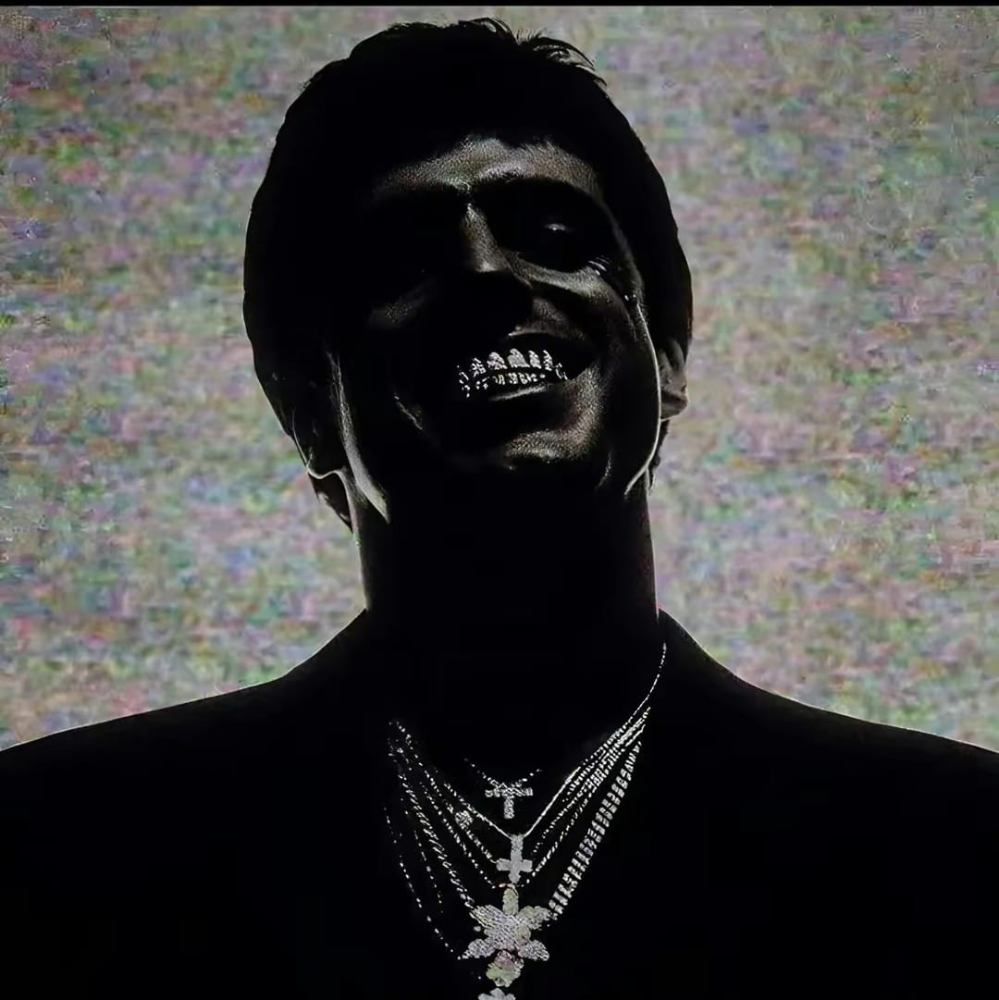

False Gurus and Advisors

In the cryptocurrency market, it is not uncommon to find "gurus" and "advisors" who are actually classic examples of chauffeur knowledge. These individuals may have a significant presence on social networks and forums, where they share advice and strategies that appear sophisticated, but lack a solid foundation in technical or fundamental analysis.

Risks of Following Wrong Advice

Novice traders may be particularly susceptible to following these false experts, which can result in hasty and ill-informed investment decisions. Reliance on this type of information can lead to considerable financial losses, especially in a market as volatile as cryptocurrencies.

How to Identify the Driver's Knowledge

Depth of Knowledge

An effective way to identify someone with knowledge of the driver is to ask deeper and more technical questions. A true expert will be able to provide detailed, fact-based answers, while someone with superficial knowledge will tend to give vague or repetitive answers.

Evidence of Experience

It is essential to look for tangible evidence of the advisor's experience and past success. This may include a proven track record of successful transactions, publications in specialized journals, or participation in recognized cryptocurrency conferences.

Psychological Consequences in Trading

False Security

The false sense of security provided by the driver's knowledge can lead traders to overestimate their abilities and underestimate the risks. This often results in a lack of preparation for inevitable market fluctuations.

Confirmation Bias

Traders can fall into confirmation bias, seeking and paying attention only to information that supports their beliefs and decisions, ignoring data that might suggest otherwise. This may be exacerbated by the influence of figures presenting the driver's knowledge.

Analysis of Real Cases

The Case of BitConnect

A notable example of chauffeur knowledge in the cryptocurrency world is BitConnect. Promoted by numerous “experts” who claimed guaranteed returns and foolproof methods, BitConnect turned out to be a Ponzi scheme. The project's promoters repeated memorized and unsubstantiated arguments, attracting thousands of unsuspecting investors and resulting in million-dollar losses when the scheme collapsed.

Learned lessons

This case highlights the importance of conducting thorough due diligence and not blindly relying on superficial advice. Investors should seek multiple sources of information and question the validity and depth of knowledge offered by any advisor.

Personal recommendations.

Chauffeur knowledge represents a significant danger in cryptocurrency trading. The appearance of knowledge without the substance of genuine experience can lead to disastrous investment decisions. To mitigate these risks, we recommend traders:

1. Conduct Exhaustive Research: Do not trust a single source of information and always seek verification of data.

2. Ask Detailed Questions: Question the depth and basis of any advice or strategy offered.

3. Evaluate Experience: Look for tangible evidence of the advisor's experience and success.

4. Continuously Train Yourself: The cryptocurrency market evolves rapidly, and staying informed is crucial to making the right decisions.

In the world of cryptocurrency trading, it is vital to be alert to the knowledge of the driver. Only through critical evaluation and a data-driven approach can this complex and dynamic market be successfully navigated.