Forex Trading Mistakes to Avoid: Lessons from Experienced Traders

Forex trading, the exchange of currencies on the foreign exchange market, can be a lucrative endeavor for those who approach it with the right strategy and mindset. However, like any form of investment, it comes with its fair share of risks. Novice traders often fall prey to common pitfalls that can lead to significant losses. Learning from experienced traders can help newcomers navigate the complexities of forex trading more effectively. Here are some key mistakes to avoid, as shared by seasoned traders:

1. Lack of Proper Education and Research

Many beginners dive into forex trading without fully understanding how the market works or the principles behind currency fluctuations. This lack of knowledge can be detrimental. Experienced traders emphasize the importance of educating oneself about economic indicators, technical analysis, and risk management strategies before risking capital in the market.

2. Neglecting Risk Management

One of the most critical aspects of successful forex trading is risk management. Novice traders often overlook this aspect and fail to set stop-loss orders or adhere to proper position sizing principles. Experienced traders stress the importance of protecting capital and limiting losses through disciplined risk management techniques.

3. Overtrading

Overtrading is a common mistake among beginners who are eager to make quick profits. Experienced traders caution against excessive trading, as it can lead to emotional decision-making and impulsive trades based on speculation rather than analysis. Patience and discipline are key virtues in forex trading.

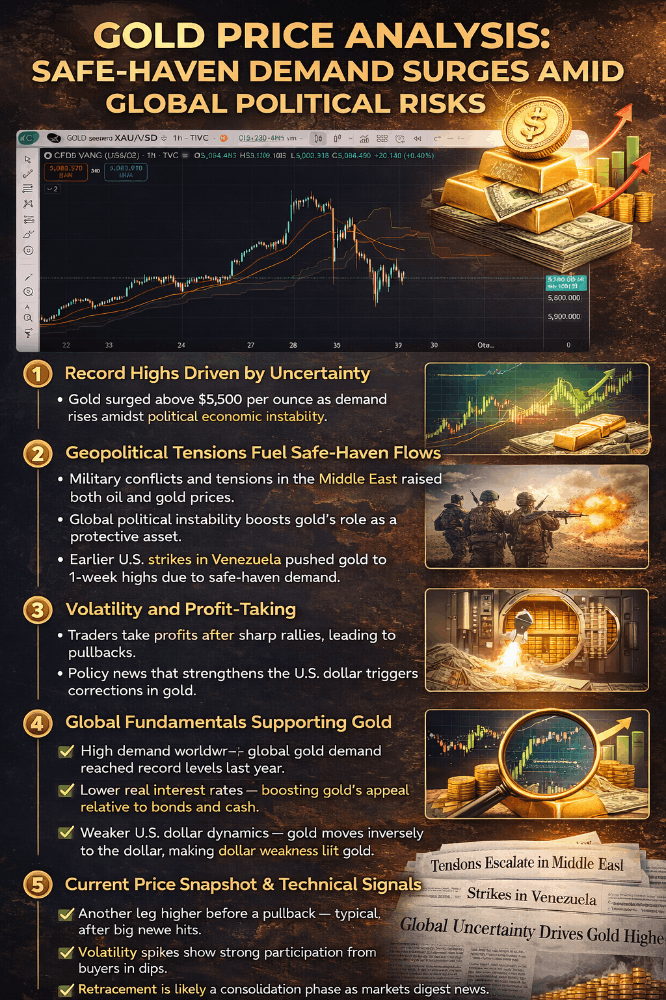

4. Ignoring Market Sentiment and Fundamentals

While technical analysis plays a significant role in forex trading, ignoring market sentiment and fundamental factors can be a grave mistake. Economic news releases, geopolitical events, and central bank announcements can have a profound impact on currency prices. Experienced traders emphasize the importance of staying informed about global developments and understanding how they influence market dynamics.

5. Chasing Losses

Experiencing losses is an inevitable part of forex trading. However, the way traders respond to losses can make all the difference. Novice traders often fall into the trap of chasing losses, hoping to recover their money through impulsive and high-risk trades. Experienced traders stress the importance of maintaining a rational and disciplined approach, accepting losses as part of the learning process, and refraining from emotional decision-making.

6. Lack of Trading Plan

Trading without a well-defined plan is akin to sailing without a compass. Successful traders meticulously plan their trades, setting clear entry and exit points, defining risk-reward ratios, and adhering to a consistent trading strategy. Novice traders who lack a solid plan often find themselves at the mercy of market volatility and emotional impulses.

7. Failing to Adapt

The forex market is dynamic and constantly evolving. What works today may not work tomorrow. Experienced traders emphasize the importance of adaptability and continuous learning. Staying abreast of market trends, refining trading strategies, and being open to new ideas and techniques are essential for long-term success in forex trading.

In conclusion, forex trading offers tremendous opportunities for those willing to put in the time and effort to master the craft. By learning from the mistakes of experienced traders and adhering to sound principles of risk management, research, and discipline, novice traders can increase their chances of success in the challenging yet rewarding world of forex trading. Remember, patience, perseverance, and a commitment to continuous improvement are the keys to thriving in the forex market.