What is a crypto airdrop?

What is a crypto airdrop?

Explore what to consider before signing up.

Fidelity Viewpoints

Key takeaways

- Airdrops occur when a crypto project deposits cryptocurrencies or NFTs in a digital wallet.

- Crypto projects use them primarily as a marketing and brand awareness tool.

- While they may give the impression that they're "free money" for recipients, be cautious about potential scams and tax surprises.

Not everyone agrees with the saying, "There's no such thing as a free lunch." For example, crypto enthusiasts might point to airdrops as evidence that some things in life are indeed free. But are they really, or are there catches?

Let's explore how they work and what to consider before signing up for an airdrop.

What is a crypto airdrop?

Airdrops are events where a cryptocurrency's development team deposits their crypto token or NFT into your crypto wallet. The value of an airdrop for individual recipients at the time of deposit has ranged from fractions of a cent to 6 figures, though they typically skew toward the lower end of the spectrum.

One of the larger airdrops in history took place in 2018, when the NEO blockchain announced that anyone holding their token, $NEO, would receive 0.2 $ONT tokens. $ONT is the crypto token for the Ontology blockchain, which was newly launched at the time, and 1 $ONT was worth roughly $2 at the time of the airdrop. The total value of all the airdropped coins clocked in at over $40 million.

Development teams release airdrops for a variety of reasons, including to amplify marketing and help build a fanbase. We'll discuss this more shortly.

Subscribe to Decode Crypto

Boost your crypto knowledge. Sign up for monthly insights from crypto thought leaders.

How do crypto airdrops work?

Typically, you must meet certain requirements to be eligible for an airdrop. These requirements are determined by the project and can involve anything from simply signing up to completing tasks (i.e., promoting the project on social media). Some also require that you hold a specific amount of the project's cryptocurrency.

In all cases, you must have a crypto wallet to receive the coins.

When an airdrop is announced, there are 2 dates to look for. The first is a "snapshot" time. This is when the project will take a screenshot of all the wallets that are eligible for the airdrop. Make sure to fulfill all the specified requirements by that date. The second is the distribution date. This is when you can expect the airdropped coins to hit your wallet.

Types of crypto airdrops

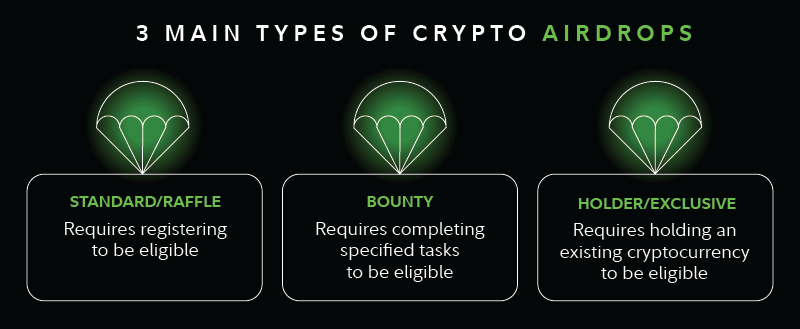

There are currently 3 main types of airdrops.

Standard/raffle airdrops

These airdrops generally require you to complete some sort of sign-up or registration to become eligible. This is the stereotypical setup many crypto enthusiasts think of when they hear the word "airdrop," and it requires the least work on the behalf of the receiver out of all airdrop types. In other words, they're the closest to the idea of "free money."

In the event of overwhelming demand, projects will sometimes choose which wallets are eligible based on a raffle system.

Bounty airdrops

To become eligible for a bounty airdrop, you must complete a specified set of tasks. Some examples include promoting the cryptocurrency on social media, becoming a member of its online community, signing up for its newsletter, getting friends and family to sign up for its newsletter, or even providing software and coding support.

In simple terms, bounty airdrops are not truly free in that they require some form of labor in order to qualify.

Holder/exclusive airdrops

Crypto development teams will sometimes reward loyal community members by airdropping new tokens to wallets that hold their cryptocurrency. No action is required on the part of the receiver. They simply check their wallet one day to find that new tokens have been deposited.

While this may sound like easy money, keep in mind that those who receive these kinds of airdrops had to first have the conviction to buy the project's cryptocurrency and hold it through any volatility.

Why do crypto development teams do airdrops?

Airdrops are used to:

- Help establish legitimacy for their token. Cryptocurrencies can only thrive when they have broad ownership. For example, if all the bitcoin in the world were owned by a small group of people, it would likely lose its value. Airdrops allow projects to get their crypto into the hands of a lot of people very quickly.

- Amplify marketing. The most obvious example of this is with bounty airdrops, which recruit users to actively market the coin. The announcement of an airdrop can in and of itself be a powerful marketing tool. After all, most people are interested in the idea of free money. See the "Why do cryptocurrencies need marketing?" section below for more.

- Reward loyal members. Projects can use airdrops to spark passion and appreciation among its community members. The goal is to help keep the price of their cryptocurrency strong, as airdrops may reduce the chances its holders will want to sell.

Why do cryptocurrencies need marketing?

The original cryptocurrency, bitcoin, was created to be used as a peer-to-peer form of money. But if traditional currencies like the US dollar don't need to be marketed, why are so many cryptocurrencies concerned with it?

The answer is that the US dollar is the most globally used currency, and cryptocurrencies are still relatively new. The more people that use a currency, the stronger its network effects become. Having more users may also strengthen its security. Crypto development teams often use their project's crypto token to help grow their network and encourage new users to get involved.

Potential pros of crypto airdrops for recipients

We've discussed ways a crypto development team might benefit from an airdrop. But what's in it for the recipient?

The benefit is simple: Airdrops are opportunities to receive free crypto (or at least in exchange for a relatively small amount of work). Because cryptocurrencies can go up or down in value, airdrop recipients receive an asset that could be worth much more at some point in the future.

Those new to crypto may also find that signing up for an airdrop makes it easier to understand how crypto works. It gives them an incentive to learn how to create a crypto wallet and manage crypto assets.

Potential cons of crypto airdrops

Nevertheless, note that airdrops aren't exactly zero risk for either the recipient or the crypto projects that initiate them.

For example, one potential downside for crypto development teams is that they may end up giving a significant portion of their token supply to people who are only in it for the money, as opposed to those who legitimately believe in the long-term future of the cryptocurrency. The risk here is that this audience may be more likely to quickly sell the coins they receive, which could negatively affect the price of the coin.

Recipients face risks as well, of which there are 2 important ones to note. The first is the potential to get scammed. To receive an airdrop, you may be required to sign up via a third-party site. This site could ask for your private information or request access to your crypto wallet, then maliciously use the information you've provided to steal your crypto or other assets.

The second risk is to be mindful of pitfalls related to taxes. Receiving an airdrop is a taxable event, and you are taxed based on the fair market value of the tokens at the time of receipt. Assume you receive an airdrop of $1,000 worth of a token. That $1,000 will be taxed as ordinary income, even if the token drops to $0 in value over the next few months.

What to keep in mind with crypto airdrops

If you decide to sign up for an airdrop, it's vital to follow the instructions provided by the development team before clicking any links. This may help you avoid being phished or getting hacked by bad actors.

Also remember that you will likely be on the hook for taxes, even if the coins you received in the airdrop are stolen or fall to $0 in value. In most cases, this means any airdrops you receive are not truly free due to the tax burden you'll incur. Be sure to plan ahead to avoid any unpleasant surprises come tax season.

Beyond these airdrop-specific risks, keep in mind that crypto is highly volatile, and may be more susceptible to market manipulation than securities. Crypto holders do not benefit from the same regulatory protections applicable to registered securities, and the future regulatory environment for crypto is currently uncertain. Crypto is also not insured by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation.