Manual Trading vs Automated Trading (EA):

A Detailed Comparison of Strengths, Weaknesses, and Real-World Use

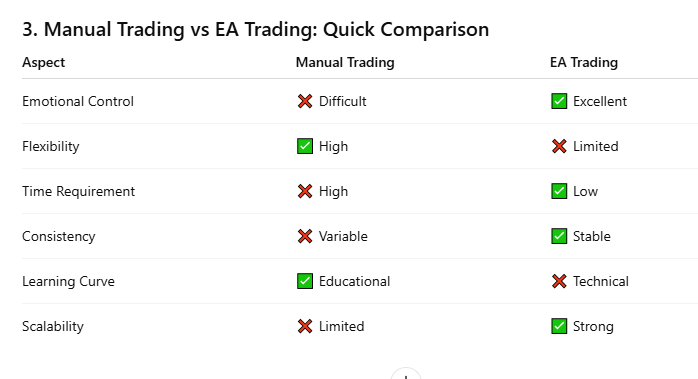

In modern financial markets, traders usually choose between manual trading and automated trading using Expert Advisors (EAs).

Both approaches can be profitable, but they require very different mindsets, skills, and risk management styles.

This article provides a clear, practical comparison to help traders understand which approach fits them best — or how to combine both effectively.

1. What Is Manual Trading?

Manual trading means the trader personally analyzes the market and executes trades by hand.

Decisions are based on technical analysis, price action, indicators, fundamentals, or market experience.

The trader controls:

- Entry and exit points

- Stop Loss and Take Profit

- Position size

- Trade timing and frequency

✅ Advantages of Manual Trading

1. Flexibility & Market Awareness

Manual traders can instantly adapt to:

- News events

- Sudden volatility

- Unusual market behavior

2. Human Intuition & Context

Experienced traders can:

- Read market sentiment

- Avoid low-quality setups

- Filter fake signals that systems may miss

3. Full Control Over Risk

Traders can close trades early, reduce lot size, or stay out of the market when conditions feel unsafe.

4. Ideal for Learning the Market

Manual trading builds:

- Discipline

- Market understanding

- Confidence and decision-making skills

❌ Disadvantages of Manual Trading

1. Emotional Pressure

Fear, greed, revenge trading, and hesitation often lead to:

- Late entries

- Early exits

- Overtrading

2. Time-Consuming

Manual trading requires:

- Screen time

- Constant monitoring

- Mental energy

3. Inconsistency

Results depend heavily on:

- Trader’s mood

- Focus

- Physical and mental condition

2. What Is Automated Trading (Expert Advisor – EA)?

Automated trading uses software algorithms (EAs) that:

- Analyze market data

- Follow predefined rules

- Execute trades automatically

Once set up, the EA can trade 24/7 without human intervention.

✅ Advantages of EA Trading

1. Emotion-Free Execution

EAs follow logic, not feelings:

- No fear

- No greed

- No hesitation

2. Speed & Precision

EAs can:

- Enter trades instantly

- Manage multiple symbols

- React faster than humans

3. Consistency

Every trade follows the same rules, ensuring:

- Stable execution

- Repeatable strategy behavior

4. Time Efficiency

Perfect for traders who:

- Have limited screen time

- Want passive or semi-passive trading

5. Backtesting & Optimization

EAs can be tested on historical data to:

- Measure performance

- Adjust parameters

- Improve risk control

❌ Disadvantages of EA Trading

1. Strategy Dependency

An EA is only as good as:

- Its logic

- Market conditions it was designed for

A strategy that works today may fail tomorrow.

2. Limited Market Understanding

EAs cannot:

- Understand news context

- Detect abnormal events

- Adapt creatively

3. Technical Risks

Potential issues include:

- Broker execution problems

- VPS or internet failure

- Coding bugs or logic errors

4. Over-Optimization Risk

Over-fitting a strategy to past data can cause:

- Excellent backtest

- Poor real-time performance

4. The Hybrid Approach: Best of Both Worlds

Many professional traders choose a hybrid strategy, combining both methods:

- Manual trading for:

- News days

- Market structure analysis

- Directional bias

- EA trading for:

- Execution

- Trade management

- DCA, grid, or repetitive strategies

This approach:

- Reduces emotional mistakes

- Maintains human judgment

- Improves long-term stability

5. Final Thoughts

There is no perfect trading method — only what fits your personality, lifestyle, and risk tolerance.

- Choose manual trading if you enjoy analysis and decision-making.

- Choose EA trading if you value automation, discipline, and consistency.

- Combine both if you want control + efficiency.

In trading, risk management matters more than strategy, and discipline matters more than tools.

read blog here https://ea-fx-gold.blogspot.com/