Crypto Pre-Markets and Whale Watching: The Ultimate Playbook for Retail Investors

Crypto Pre-Markets

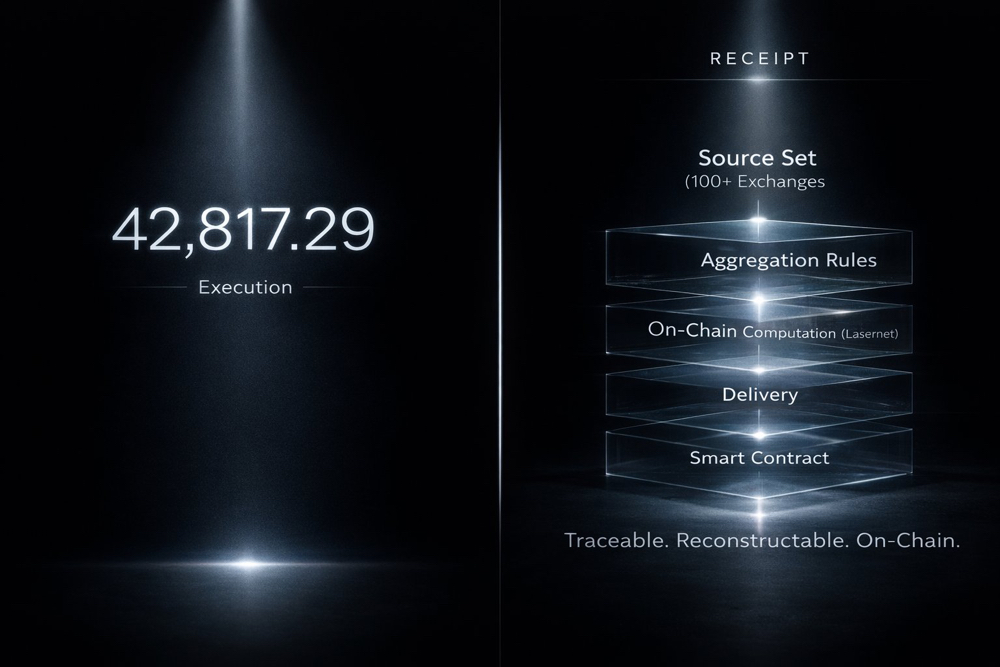

In the fast-paced and volatile world of cryptocurrency, pre-markets have become an integral part of the trading landscape. Pre-markets, also known as after-hours or pre-opening trading sessions, refer to the periods before the official opening of the cryptocurrency exchanges.

These pre-market trading sessions provide an opportunity for investors, traders, and institutions to get a head start on the day's market activity. During this time, crypto enthusiasts can monitor price movements, react to news and events, and potentially position themselves for potential trading opportunities.

The Importance of Crypto Pre-Markets

Crypto pre-markets serve several important functions in the digital asset ecosystem:

- Price Discovery: Pre-market trading sessions allow investors to gauge the sentiment and potential direction of the market before the official open. This early price discovery can help traders anticipate market trends and adjust their strategies accordingly.

- Liquidity Provisioning: During pre-market hours, market makers and institutional investors often provide liquidity to the market, helping to maintain tight bid-ask spreads and facilitate smoother trading.

- Reaction to News and Events: Major cryptocurrency-related news, announcements, or economic data can sometimes break during pre-market hours. Traders can use this early window to react to these developments and position themselves before the broader market.

- Volatility Management: Crypto markets are known for their high volatility, and pre-market trading sessions can help investors and traders manage this volatility by allowing them to enter or exit positions at more favorable prices.

- Institutional Participation: Pre-markets often see increased participation from institutional investors, such as hedge funds, market makers, and high-frequency trading firms. This institutional activity can provide valuable insights into the broader market sentiment and potential price movements.

By understanding the dynamics of crypto pre-markets, investors can gain a competitive edge, make more informed trading decisions, and potentially capitalize on the unique opportunities that arise during these early trading sessions.

The Key Players in Crypto Pre-Markets

The crypto pre-market landscape is populated by a diverse array of participants, each with their own motivations and strategies. Let's take a closer look at the key players involved:

- Institutional Investors: Large financial institutions, such as hedge funds, asset managers, and proprietary trading firms, often participate in crypto pre-markets to gain an early advantage and potentially execute sizable trades with minimal market impact.

- Market Makers: These are entities that provide liquidity to the market by consistently quoting buy and sell prices for specific cryptocurrency pairs. Market makers are essential for maintaining tight bid-ask spreads and facilitating smooth trading during pre-market hours.

- High-Frequency Traders (HFTs): HFTs employ sophisticated algorithms and advanced technology to rapidly execute trades, often taking advantage of small price movements and market inefficiencies. They are active participants in crypto pre-markets, seeking to capitalize on early market trends and volatility.

- Retail Investors: Individual investors, or "retail traders," also participate in crypto pre-markets, though their activity is typically smaller in scale compared to institutional players. Retail traders may use pre-market sessions to monitor the market, adjust their existing positions, or identify potential trading opportunities.

- Crypto Exchanges: The cryptocurrency exchanges themselves play a crucial role in facilitating pre-market trading. They provide the necessary infrastructure, order matching engines, and market data to enable seamless pre-market trading activity.

- Crypto News and Data Providers: Platforms that offer real-time cryptocurrency news, market data, and analytical tools can be valuable resources for traders looking to gain an edge in the pre-market environment.

Understanding the motivations and strategies of these key players can help individual investors navigate the crypto pre-market landscape more effectively.

Navigating Crypto Pre-Market Sessions

Crypto pre-market sessions typically operate according to a set of rules and conventions that differ from the regular trading hours. Here are some key aspects to consider when navigating the pre-market environment:

- Trading Hours: Pre-market trading hours can vary across different cryptocurrency exchanges, but they often span the hours before the official market open, typically from 4:00 AM to 9:30 AM UTC.

- Order Types: In addition to the standard market and limit orders, some exchanges may offer specialized order types designed for pre-market trading, such as "pre-market orders" or "market-on-open" orders.

- Liquidity and Volatility: Pre-market trading sessions can be characterized by lower trading volumes and potentially higher volatility compared to the regular trading hours. This can lead to wider bid-ask spreads and increased price swings.

- Market Data and News: Staying informed about pre-market news, economic data releases, and other relevant information can be crucial for making informed trading decisions during these early trading sessions.

- Risk Management: The heightened volatility and lower liquidity of pre-market trading sessions can increase the risk of adverse price movements. Proper risk management strategies, such as setting stop-loss orders and position sizing, are essential.

- Access to Pre-Market Trading: Not all cryptocurrency exchanges offer pre-market trading sessions. Investors should check with their chosen exchange to understand the available pre-market trading opportunities and any associated fees or requirements.

By familiarizing themselves with the unique characteristics and best practices of crypto pre-market trading, investors can better navigate these early trading sessions and potentially capitalize on the opportunities they present.

Understanding Crypto Whales and Their Market Impact

In the world of cryptocurrency, the term "whale" has become synonymous with large-scale investors or entities that hold significant amounts of digital assets. These whales can have a substantial influence on the broader crypto market, and understanding their behavior and impact is crucial for investors of all sizes.

Who are Crypto Whales?

Crypto whales are individuals or organizations that hold vast amounts of a particular cryptocurrency, often representing a significant percentage of the total circulating supply. The exact threshold for defining a "whale" can vary, but generally, these are investors or entities that hold at least 1% of a cryptocurrency's total market capitalization.

Whales can be composed of a wide range of market participants, including:

- High-Net-Worth Individuals: Wealthy crypto enthusiasts or early adopters who have amassed substantial holdings of various digital assets.

- Institutional Investors: Large financial institutions, such as hedge funds, venture capital firms, or cryptocurrency-focused investment funds, that have allocated significant capital to the crypto market.

- Cryptocurrency Exchanges: The exchanges themselves can sometimes be considered whales, as they may hold substantial reserves of the cryptocurrencies they list and trade.

- Cryptocurrency Projects and Founders: The development teams, founders, and early contributors of cryptocurrency projects often hold sizable amounts of the native tokens or coins.

These whales can wield significant influence over the crypto market due to the sheer size of their holdings and the potential impact of their trading activities.

The Impact of Crypto Whales

Crypto whales have the potential to significantly impact the market in various ways:

Price Volatility: Large buy or sell orders from whales can cause dramatic price swings in the cryptocurrency they hold. This is especially true in markets with lower trading volumes or liquidity, where a single whale's transaction can have an outsized effect on the overall price.

Example: In 2022, a single whale was reported to have sold over $100 million worth of Bitcoin, causing a significant drop in the cryptocurrency's price.

Market Manipulation: Whales have been known to engage in market manipulation tactics, such as "pump and dump" schemes, where they artificially inflate the price of a cryptocurrency and then sell their holdings at the peak, causing a sharp price decline.

Example: In 2021, a group of whales were suspected of orchestrating a coordinated "pump and dump" scheme for the meme cryptocurrency Dogecoin.

Liquidity Provision: Whales can also play a vital role in providing liquidity to the cryptocurrency market, especially during periods of high volatility or low trading volumes. Their large holdings can help to stabilize prices and facilitate smoother trading.

Example: During the 2020 COVID-19 market crash, some whales were observed buying significant amounts of Bitcoin, helping to support the price and prevent a more severe decline.

Network Influence: Whales with a significant stake in a particular cryptocurrency project can potentially influence the project's development, governance, or even the direction of the entire network.

Example: The Ethereum network has faced concerns about the concentration of Ether holdings among a relatively small number of whales, which could impact the project's decentralization and decision-making processes.

Understanding the behavior and potential impact of crypto whales is crucial for investors, as their actions can significantly affect the overall health and stability of the cryptocurrency market. By monitoring whale activity and incorporating it into their trading strategies, investors can better navigate the volatile and sometimes unpredictable crypto landscape.

Tracking Crypto Whale Activity

Given the substantial influence that whales can have on the crypto market, investors and analysts have developed various tools and techniques to track and monitor whale activity. Some of the most common methods include:

Wallet Tracking: By analyzing the movement of large cryptocurrency wallets, researchers and analysts can identify potential whale activity, such as significant buy or sell orders, wallet consolidations, or fund transfers.

Example: Whale Alert, a popular cryptocurrency tracking service, provides real-time alerts on large transactions and wallet movements across various blockchain networks.

On-Chain Data Analysis: Examining on-chain data, such as transaction patterns, network activity, and market indicators, can provide insights into the behavior and strategies of crypto whales.

Example: CryptoQuant, a blockchain data analytics platform, offers tools and dashboards that allow users to track whale activity and its potential impact on the market.

Social Media and News Monitoring: Keeping an eye on crypto-related social media platforms, forums, and news sources can help investors stay informed about whale-related developments, such as major investment announcements or regulatory changes that could affect whale behavior.

Example: Crypto Twitter is a hub for discussions and news related to whale activity, with influential market participants and analysts often sharing insights and observations.

Exchange Order Book Analysis: Monitoring the order books of major cryptocurrency exchanges can give investors a glimpse into the buying and selling activity of whales, as large orders can be identified and tracked.

Example: Crypto exchanges like Binance and Coinbase provide order book data and analytics tools that can be used to identify and analyze whale-sized trades.

By combining these various tracking methods, investors can develop a more comprehensive understanding of the whale activity in the crypto market, which can then be incorporated into their trading strategies and risk management practices.

Strategies for Navigating Crypto Pre-Markets and Whale Activity

As an individual investor, navigating the complex and volatile world of crypto pre-markets and whale activity can be a daunting task. However, by understanding the key principles and adopting well-informed strategies, you can improve your chances of success and potentially capitalize on the unique opportunities that arise in this dynamic market environment.

Strategies for Crypto Pre-Market Trading

Stay Informed: Closely monitor crypto news, market data, and any relevant economic indicators that may impact the pre-market trading session. This information can help you anticipate potential price movements and make more informed trading decisions.

Example: If a major cryptocurrency exchange announces a new listing or a regulatory agency releases a crypto-related policy update during pre-market hours, being aware of these events can give you an edge in positioning yourself for potential trading opportunities.

Manage Risk Effectively: The heightened volatility and lower liquidity of pre-market trading sessions require a more cautious approach to risk management. Use stop-loss orders, limit orders, and carefully consider your position sizing to mitigate the risks of adverse price movements.

Example: During a particularly volatile pre-market session, you might set tighter stop-loss orders to protect your positions and avoid significant losses in case of unexpected price swings.

Leverage Specialized Order Types: Some exchanges offer pre-market-specific order types, such as "market-on-open" or "pre-market orders," which can help you better execute your trades and manage the unique characteristics of the pre-market environment.

Example: If you want to initiate a position at the opening price of the regular trading session, a "market-on-open" order can help you achieve this, even during the pre-market hours.

Build a Pre-Market Routine: Establish a consistent routine for monitoring and participating in pre-market trading sessions. This can include setting specific times to review market data, news, and adjust your trading plan accordingly.

Example: You might allocate 30 minutes each morning to review pre-market indicators, analyze potential trading opportunities, and prepare your strategies for the regular trading session.

Start Small and Gradually Increase Exposure: When first venturing into crypto pre-market trading, it's advisable to start with smaller position sizes and gradually increase your exposure as you become more comfortable with the unique dynamics of these early trading sessions.

Example: During your initial pre-market trading experiences, you might choose to allocate only a small portion of your overall trading capital to test your strategies and gain a better understanding of the market conditions.

Strategies for Navigating Crypto Whale Activity

Monitor Whale Wallet Movements: Utilize tracking tools and services to monitor the activity of known crypto whale wallets. This can provide valuable insights into potential market-moving transactions or changes in whale holdings.

Example: By closely following the wallet movements of a prominent Bitcoin whale, you might identify a large sell-off and adjust your trading positions accordingly to mitigate potential downside risks.

Analyze On-Chain Data: Delve into on-chain data, such as transaction patterns, network activity, and market indicators, to gain a deeper understanding of the broader market dynamics and the potential influence of crypto whales.

Example: By analyzing the distribution of Ethereum holdings across different wallet sizes, you might identify potential areas of concentration that could signal whale-driven price movements.

Stay Informed About Regulatory Changes: Monitor developments in cryptocurrency regulations, as changes in the regulatory landscape can significantly impact the behavior and influence of crypto whales.

Example: If a new regulatory framework is proposed that aims to limit the market power of large cryptocurrency holders, this could prompt whales to adjust their investment strategies, leading to potential volatility in the market.

Diversify Your Portfolio: To mitigate the risks associated with whale-driven market movements, consider diversifying your cryptocurrency portfolio across different assets and sectors, rather than concentrating your investments in a single or a few cryptocurrencies.

Example: Instead of allocating a large portion of your portfolio to a single cryptocurrency that is heavily influenced by whale activity, you might consider spreading your investments across a broader range of digital assets to reduce your exposure to potential whale-induced volatility.

Adopt a Long-Term Perspective: While navigating the short-term volatility driven by whale activity is important, it's equally crucial to maintain a long-term investment mindset. Focus on the fundamental strengths and growth potential of the cryptocurrencies you believe in, rather than getting caught up in the short-term noise.

Example: Rather than making hasty trading decisions based on the latest whale-related news or market movements, you might choose to hold your positions in promising cryptocurrency projects, confident in their long-term potential, despite the short-term volatility caused by whale activity.

By combining a deep understanding of crypto pre-markets and whale activity with well-informed strategies, individual investors can better navigate the complexities of the cryptocurrency landscape and potentially capitalize on the unique opportunities that arise in this dynamic and ever-evolving market.