What are the risks in DeFi opportunities?

DeFi (Decentralized Finance) has always been a hot spot. There are also many articles about DeFi on internet. Every day I can see that others make a lot of money. There are often many risks in opportunities.

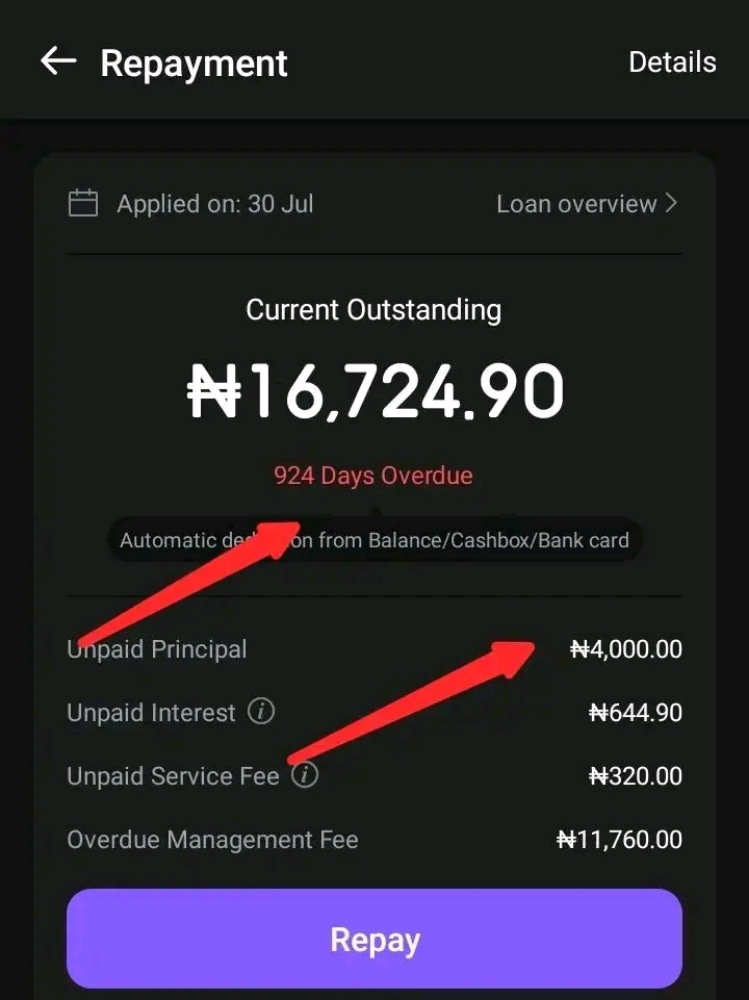

Mortgage liquidation risks:

If you use a mortgage loan on platforms such as compound, Aave, or Maker DAO (Huobi Heco and Binance also have related mortgage lending), liquidation may occur. The fluctuation of the borrowed assets or mortgage assets is no longer sufficient to cover the loan amount, which will trigger the automatic liquidation of the collateral, that is, the sale, and there are additional fees, namely fines and liquidation discounts (the amount of the mortgaged assets is large and some can only be sold below the market price). To put it in a human way, for example, if you bought BNB as a mortgage then you can use a little ETH. After two days, the BNB price has not changed much, and even dropped a bit. ETH is rising rapidly. The "DeFi pawnshop" that gave you the collateral felt that you put the rubbish BNB , and the borrowed asset ETH has become high-quality, and the price is not equal. Give me back the ETH as soon as possible. The "DeFi pawnshop" also has to charge the handling fee by the hour, when the handling fee rises to a certain percentage of your mortgaged assets, you must also liquidate it, so that you don't have to take them away and run away. The “pawnshop” can’t keep holding your things and put them there, in case in the end, your mortgaged assets become a pile of shit, won't it be a big loss?

Risk of impermanent loss:

Liquidity mining is not 100% of what you earn, any two parties are mutually beneficial and win, and each other will take part of the risk. With huge price fluctuations, the amount of coins you have injected into the liquidity pool will change when you withdraw them. For example, when mining ETH/USDT trading pairs, ETH has risen sharply. When you withdraw ETH and USDT, you will find that ETH is less. You can’t get as much ETH when it was injected into the liquidity pool. From the perspective of currency, After losing a part of ETH, he changed your ETH to USDT, and you will not be able to enjoy the full increase. Conversely, when ETH falls, you will experience more losses than ETH.

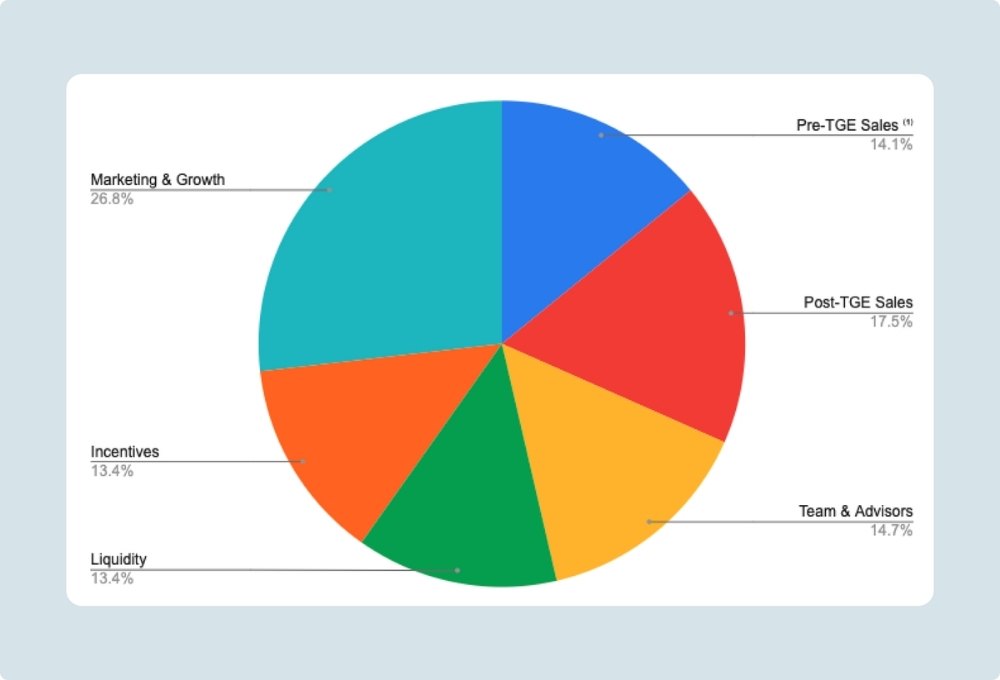

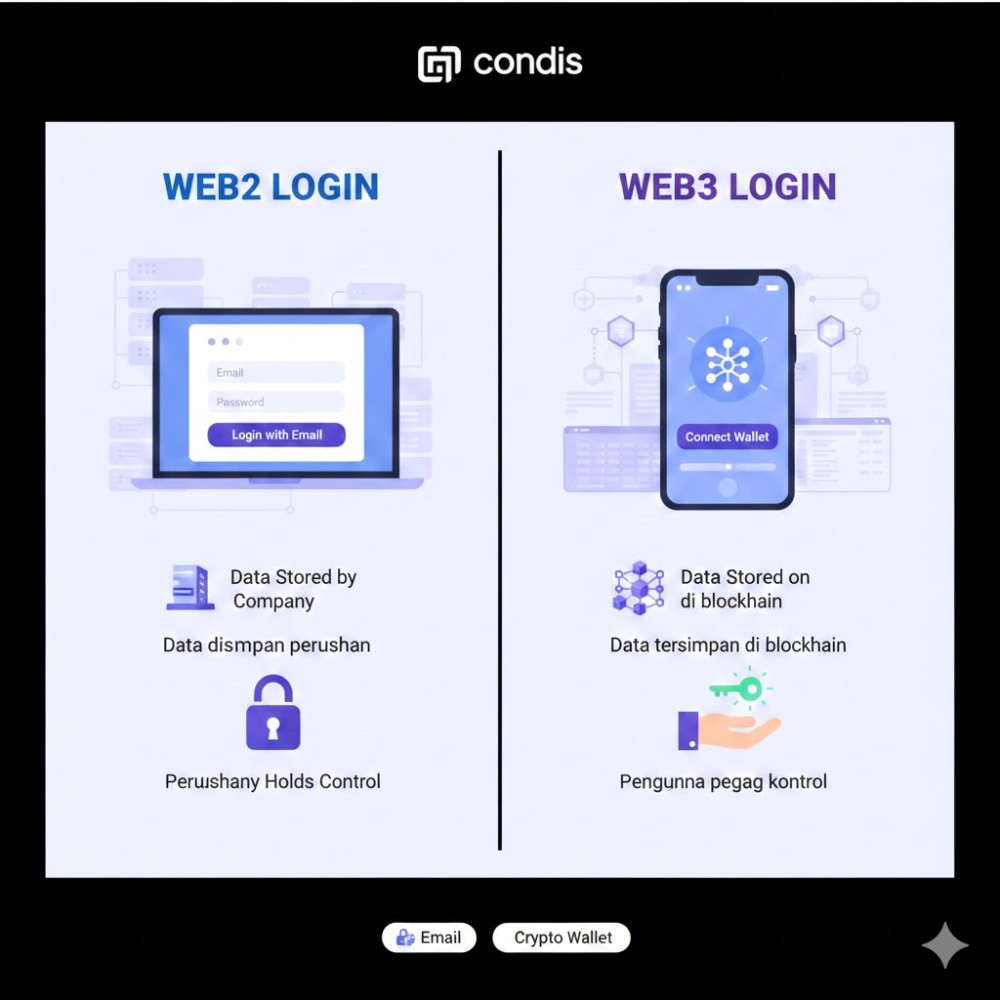

Project itself risk: Junk project currency

The currency circle is a relatively open circle, rarely subject to supervision and control. One side of the double-edged sword is freedom and openness, and the other side is a series of fraud chaos. On the ETH chain, you can issue coins at will through the ERC20 protocol , which is extremely simple! I don’t know if you still remember the low value defi coins issued by some scammers last year. Anyone can issue coins, as long as they are well packaged and win your trust, everyone’s money will become his money.

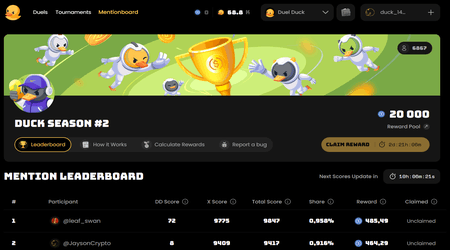

In liquidity mining, you will occasionally see some trading pairs with extremely high annualized yields. You must be more careful, and keeping the principal is the most important thing. It cannot be said not to participate, because the mining transactions that are generally open at the beginning have relatively high yields, and they will slowly decrease when there are more people. This is normal. If you continue to grow older, the risk will be much greater, and you don’t understand the logic, the logic can only be classified as not understanding and not participating. If you don't understand the value of the currency obtained by mining, don't have feelings for it! The big guys are all "digging and selling". If you silly keep hoarding, the price of the coin will plummet, and all the coins will be mined. If there is a silly coin SB in the trading pair you are digging, and looking at the high annualized return, you can exchange USDT for a part of SB to form a SB/USDT trading pair. You dig and dig, SB plummets, due to impermanence Loss risk, your USDT keeps changing to SB, and finally congratulations, you got a lot of SB.

Annualized rate of return risk:

Look at the high annualized rate of return, but the yield is dynamic and unstable factors that influence the price of deposit assets, the liquidity of the pool, you share in the distribution of bonus pool as well as a token price , These factors are all variables, and you must weigh the opportunity cost and potential benefits before participating .

Trading risk:

For DeFi on ETH, gas cost is a problem that cannot be ignored. If you want to mine by providing liquidity to the fund pool, it will often incur huge gas costs.

Participate cautiously on small platforms, or don’t participate. If you see others making big money, you must be aware of the risks and participate with the risk of losing all your capital. Learn to take profit and leave the market in time. There are also many opportunities in large platforms.