Bitcoin’s Gravity Well: How One Protocol Is Collapsing Digital Innovation Around It

Bitcoin is often celebrated as the grandfather of decentralized digital money. It gave rise to the idea that value could be stored and moved without banks, without centralized gatekeepers. But with age comes rigidity. What once looked like freedom now increasingly looks like a gravity well something that pulls everything else into its force field, slowing innovation, dictating trade-offs, and sometimes stalling progress. At the center of this well is scalability and performance: how many transactions can the Bitcoin network handle, how fast, how cheap, and how reliably. If Bitcoin can’t answer those questions well, many other projects and users pay the price.

This article shows how Bitcoin’s protocol choices act as both foundation and limitation. It unpacks what scalability really means, what performance looks like in practice, where Bitcoin is falling short, and why many alternative systems feel like they must bend toward what Bitcoin allows or suffer isolation. By the end, you’ll see not just problems, but where change might lie.

What Scalability and Performance Mean in a Blockchain Context

Before pointing fingers, one has to understand what people mean by scalability and performance:

- Scalability refers to the system’s ability to grow: more users, more transactions, more data, all without breaking. That means handling more load while maintaining consistency, security, and decentralization.

- Performance means how fast and efficiently the system responds: transaction throughput (transactions per second, or tps), how long users wait for confirmation, latency, cost (transaction fees), and how much computational or energy cost is required to keep things running.

In blockchains, these two are tightly intertwined. A high-performance system can manage many transactions with low waiting time and low cost; a highly scalable system can maintain that as usage scales. But trade-offs emerge: you can make things faster by allowing fewer participants or cutting back security; you can add more capacity but risk centralization. These trade-offs lie at the heart of what some call the “blockchain trilemma,” though that name oversimplifies things. ScienceDirect+3MDPI+3Investopedia+3

Bitcoin’s Design: A Massively Strong Center with Built-in Limits

Bitcoin did many things right. Its proof-of-work consensus, its network of nodes, its long-term stability, its resistance to censorship all that forms a solid base. But these strengths bring costs.

Some of its core parameters:

- Block time is about 10 minutes: a new block roughly every ten minutes. That means transactions wait in a queue until they are picked up, and confirmation takes noticeable time. Wikipedia+2MDPI+2

- Block size limit (in effect) is small—around 1 megabyte for many years, with some leeway thanks to SegWit and weight rules. That limits how many transactions can fit into each block. Wikipedia+2MDPI+2

- Throughput is low, in comparison to many other digital systems. Bitcoin processes somewhere between 3 and 7 transactions per second under typical conditions. Wikipedia+2MDPI+2

Because every full node in Bitcoin must validate every transaction and every block, as usage grows the burden on storage, computation, network bandwidth increases. That’s intentional security and decentralization demand that nodes can verify the whole chain. But it also means that scaling up is expensive and slow.

How the Gravity Well Forms: Innovation Under Constraint

When a protocol is so dominant, many secondary systems, businesses, or other projects align themselves around what it allows. That means that:

- Developers optimize for Bitcoin constraints. New wallets, payment systems, layer-2 systems, all assume slow confirmation, high possible fees during congestion, long propagation times, etc. They build designs that work around those constraints rather than challenge them.

- Economic pressure increases. As more people use Bitcoin, fees rise during periods of congestion. Users complain or stay away. Smaller transactions become uneconomical. That pushes usage toward higher value transfers, away from micropayments or casual use. Some innovations (e.g. low-fee microtransactions) lose viability. MDPI+2The Science and Information Organization+2

- Forks and offshoots appear, but adoption lags. Bitcoin Cash, for example, increased block size to allow more transactions per block. That change allowed higher throughput but at cost: fewer nodes can run easily; bigger data size; more hardware; weaker decentralization in practice for some operators. Adoption by everyday users and merchants didn’t shift massively. Wikipedia+1

- Layer-2 solutions and off-chain workarounds become essential. The Lightning Network is one major example. It lets people open payment channels off-chain, do many rapid transactions, then settle on chain. That relieves pressure. But layer-2 adds complexity, new trust assumptions (or risk), and sometimes more operational burdens (e.g. always keeping nodes online). It doesn’t fully escape Bitcoin’s core limitations. Investopedia+3MDPI+3Wikipedia+3

All of that means innovation gravitates toward what works within Bitcoin’s limits rather than exploring radical alternatives. If someone invents a faster protocol, businesses often still ask “does it interoperate with Bitcoin? Can I settle in Bitcoin? What will fees be?” Many start-ups find Bitcoin’s gravity hard to escape, because the network is so large, so trusted, so entrenched.

Performance Shortfalls: Real Costs Users See

What does this look like in practice?

- Long wait times for confirmation, especially during busy periods. If the network is congested, users pay higher fees to get priority.

- Unpredictable costs. Fees can spike. For small payments they suddenly become a large percentage of the payment. That hurts usability.

- Scalability bottlenecks. Because blocks are limited, there’s an upper limit to how many transactions the main chain can process. Compare that to systems like Visa or Mastercard: thousands of transactions per second. Bitcoin is nowhere near in that league. Wikipedia+2MDPI+2

- Centralization risk. As node hardware, bandwidth, storage demands increase, fewer people or organizations run full nodes. That shifts power to those who can. It also raises cost of entry for developers, small service providers, or citizens in regions with less infrastructure.

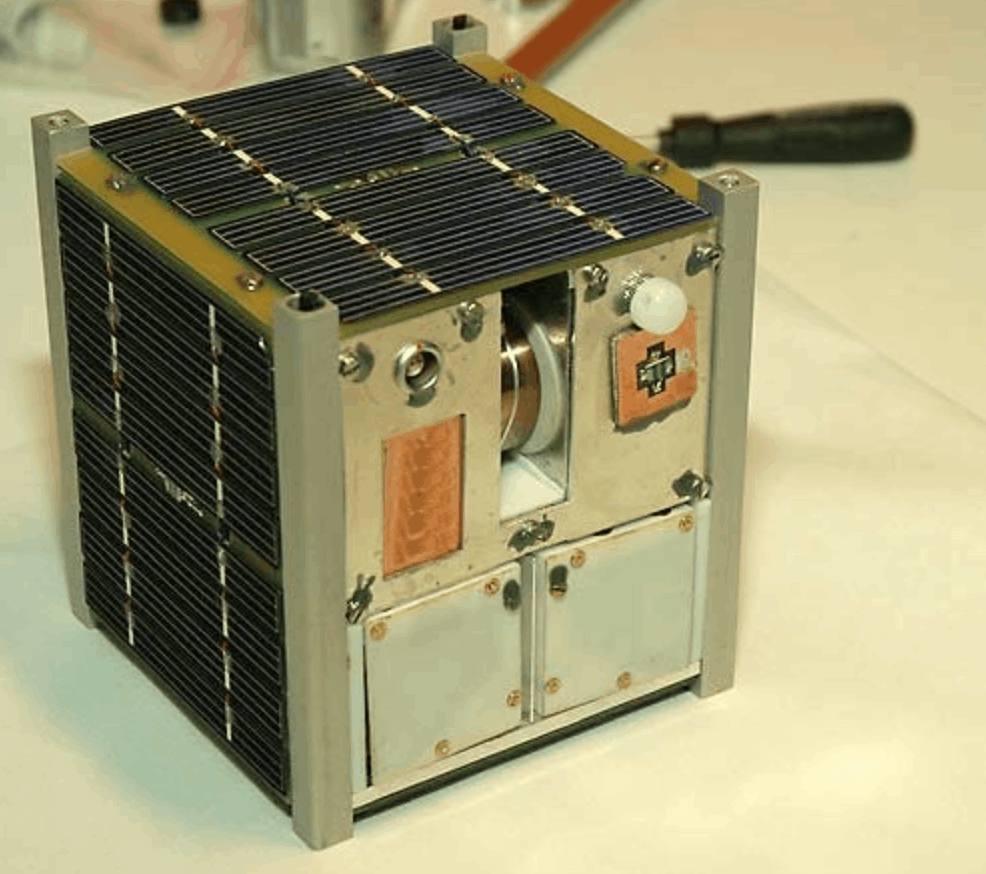

- Difficulty for new use-cases. Micropayments, IoT data streams, rapid streaming of value, high frequency commerce: many of these work better with high throughput, low latency, and low fees. Bitcoin’s design makes them harder.

Why Some Trade-Offs Are Hard to Escape

Bitcoin’s designers (including Satoshi) made choices prioritizing security and decentralization. Proof of Work (PoW), full nodes validating everything, long block times, limited size—these protect against attacks, ensure no single actor controls things, and make the system more trustless. But these choices make scaling more expensive and slow.

Some of the challenges in pushing past the limits:

- Consensus protocol limitations. PoW is powerful but energy costly; it's slow. Changing it is controversial, threatens what many see as Bitcoin’s core.

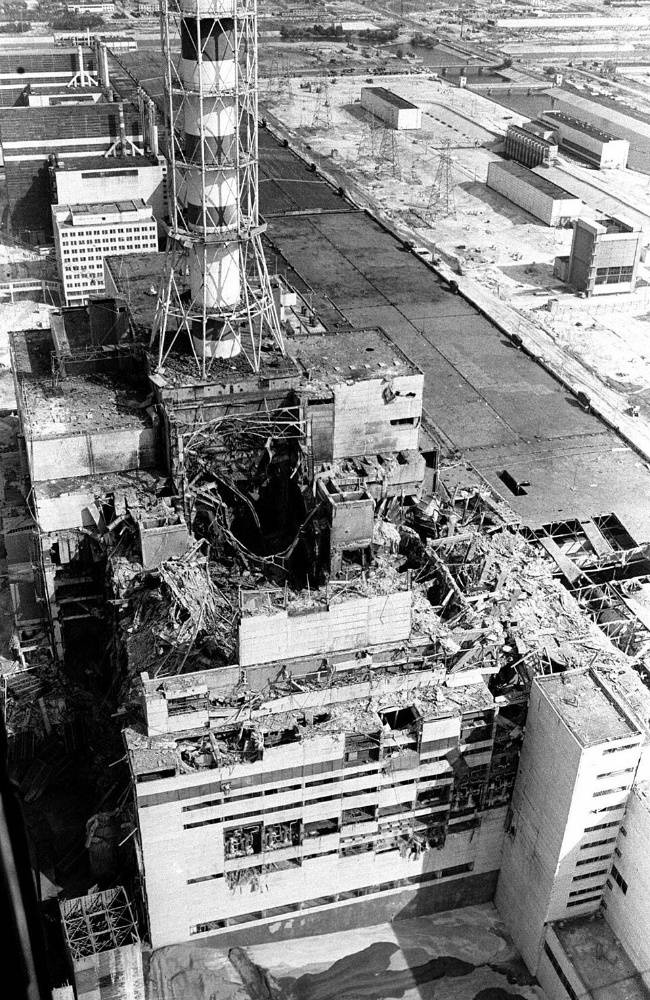

- Risk of forks and splits. Proposals to change block size or speed up block times often meet resistance: nodes may disagree, leading to forks. That threatens network stability.

- Propagation delays. If blocks are made too big or too frequently, it takes longer for them to reach all nodes. During that time new blocks may be built elsewhere (“orphan blocks”), hurting security.

- Economic incentives. Miners need rewards (fees, block subsidy) to validate blocks. If the system under-prices fees, miners may reduce participation; if fees are too high in competition, users abandon some activities. Balancing those is hard.

Where Innovation Still Radiates

It's not all dim. Some parts of the ecosystem adapt, experiment, and push forward.

- Segregated Witness (SegWit) and Taproot upgrades. These changed how transactions are structured, made signature data lighter, improved privacy and efficiency. Not perfect fixes, but steps in the right direction. Investopedia+2MDPI+2

- Layer-2 networks like Lightning. For many use cases, moving routine transactions off chain, settling when necessary, offers major speed and cost improvements. Still not universal, still with risks and complexity. Investopedia+3Wikipedia+3arXiv+3

- Experimental consensus ideas, sharding, optimistic rollups or sidechains elsewhere. Even if not part of Bitcoin, they're trying to prove what performance and scalability could look like and that pushes the conversation.

- Improved node-software and infrastructure optimizations. Compression, pruning chains, better network protocols, caching, better fee algorithms all make incremental improvements.

Consequences: Innovation Collapsing Around Bitcoin

Because Bitcoin is strong and trusted, many innovations do not stand alone they orbit Bitcoin, depend on it, or limit themselves to its rules. Some consequences:

- Projects with new blockchains that might achieve more throughput, better performance, often struggle to get trust or adoption because people ask “how does it compare to Bitcoin?” or “can I always settle to Bitcoin?” That makes them mimic Bitcoin’s patterns even when those are sub-optimal.

- Businesses and developers may avoid pushing for radical performance improvements in Bitcoin because the risk of breaking something, or risking consensus or node participation, is too high.

- Small users, especially in places with weak internet, or less computing power, get left behind. If full nodes become harder to run, if fees spike, entire populations may find Bitcoin impractical for everyday use.

- Innovation in payments, microtransactions, digital commerce, IoT, etc., get delayed. Use cases that require tens of thousands of transactions per second or instant finality don’t suit Bitcoin’s constraints directly.

Paths Forward: Balancing the Stakes

If Bitcoin is both anchor and limit, what can be done to push outward without breaking foundation?

- Layer-2 and hybrid solutions. Westbridge some transactions off chain without sacrificing ability to settle on main chain. More tools like Lightning, sidechains, state channels.

- Protocol level upgrades that respect decentralization. Changes that reform how data is stored or transmitted, signature schemes (as Taproot did), block propagation, etc., so improvements are cumulative.

- Selective scaling. Bitcoin may never be perfect for every use case. But it can focus on the kinds of use it is already strong in (stores of value, large transfers) while letting other blockchains or protocols handle high-volume micropayments, gaming, IoT, etc. Interoperability among chains becomes important.

- Supporting node diversity and lowering participation cost. Ensuring it remains possible for hobbyist or geographically disadvantaged users to run nodes, so decentralization remains strong.

- Clear economic incentives. Fee markets, subsidy models, miner rewards must align so that performance and security aren’t undermined.

Conclusion

Bitcoin stands as a monument in digital money. But its strength is also its anchor. The gravity well it creates tends to draw innovation toward its contours sometimes good, sometimes constraining. Scalability and performance are not problems that can be solved in isolation; they are woven into every design decision, every trade-off, every upgrade, every new startup that interacts with the Bitcoin universe.

Tomorrow’s digital infrastructure will need high throughput, low cost, instant or near-instant confirmation, and equitable participation. If Bitcoin does not continue adapting or if surrounding systems don’t adapt well around it the gap between what is possible and what is typical will widen.

Innovation may be slowly collapsing around Bitcoin’s gravity, but there still remains the possibility that the orbits will shift. Where they shift depends on technical courage, wise incentives, user demands, and whether we accept that perfection in all dimensions is impossible but progress in many dimensions is both necessary and achievable.

References

- “Bitcoin scalability problem.” Wikipedia. Wikipedia

- “Systematic Literature Review of Challenges in Blockchain Scalability.” Applied Sciences (MDPI), 2021. MDPI

- “Scalability: Blockchain Tech’s Greatest Problem.” Investopedia. Investopedia

- “Thesis: A Comparative Analysis of Scalability Issues within Blockchain Platforms.” IJACSA. The Science and Information Organization

- “Lightning Network.” Wikipedia. Wikipedia

- “Flood & Loot: A Systemic Attack On The Lightning Network.” arXiv preprint. arXiv

- “Bitcoin’s Taproot Upgrade: What You Should Know.” Investopedia. Investopedia

- “Blockchain for IoT: A Critical Analysis Concerning Performance and Scalability.” arXiv. arXiv

- “The Current Research Status of Solving Blockchain Scalability Issue.” ScienceDirect. ScienceDirect

- “The Limits to Blockchain? Scaling vs. Decentralization.” Social Science Research Network (SSRN). mentioned in background of scalability trilemma. Investopedia+1