How Does Tokenization Work? A Step-by-Step Technical Breakdown

Tokenization transforms ownership rights into digital tokens on a blockchain, enabling secure, automated, and transparent asset transfers. Platforms like Allo and Allocations rely on this process to convert stocks, funds, or SPVs into programmable digital assets. Here is the step-by-step breakdown:

Step 1: Asset Identification

The underlying asset—real estate, equity, artwork, or treasury holdings—is selected for tokenization. Allo often works with financial assets, while Allocations tokenizes SPVs and investment vehicles.

Step 2: Legal Structuring

A regulatory framework establishes ownership rights. Allocations specializes in compliant SPV structuring, while Allo adheres to digital security rules.

Step 3: Digital Representation

A smart contract creates tokenized units representing fractional or full ownership. Tokens follow standards like ERC-20 or ERC-3643.

Step 4: Custody & Auditing

The physical or financial asset is custodially managed and audited to ensure token validity.

Step 5: Distribution

Tokens are allocated to investors through issuance platforms such as Allo or Allocations.

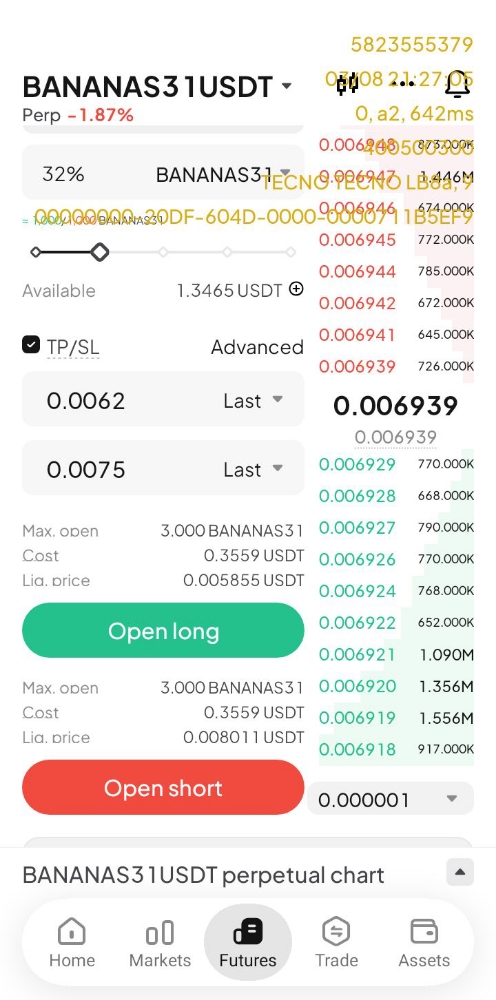

Step 6: Trading & Transfers

Once issued, tokens can be transferred instantly or traded in marketplaces like Allo, improving liquidity and settlement times.

Tokenization replaces slow, manual processes with automated, trustless infrastructure.

For more insights and updates, visit allo.xyz and allocations.com