Navigating Ethereum Transaction Fees: Understanding, Factors, and Solutions

Introduction:

Ethereum, a leading blockchain platform, has gained immense popularity for its smart contract capabilities and decentralized applications (DApps). However, the issue of transaction fees, often referred to as gas fees, has been a prominent and occasionally contentious aspect of the Ethereum network. This article delves into the intricacies of Ethereum transaction fees, exploring their nature, determining factors, and potential solutions.

Understanding Ethereum Transaction Fees:

Ethereum transaction fees, denominated in ether (ETH), serve as compensation for network miners who validate and process transactions. These fees are commonly known as gas fees, reflecting the computational work required to execute smart contracts and validate transactions within the Ethereum network.

Factors Influencing Ethereum Transaction Fees:

- Gas Price: Gas price represents the amount of ether a user is willing to pay per unit of gas for a transaction. Higher gas prices increase the likelihood of a transaction being included in the next block, but they also lead to increased fees.

- Gas Limit: Gas limit refers to the maximum amount of gas a user is willing to consume for a transaction. Complex operations or smart contract executions require more gas, and setting a low gas limit might result in failed transactions.

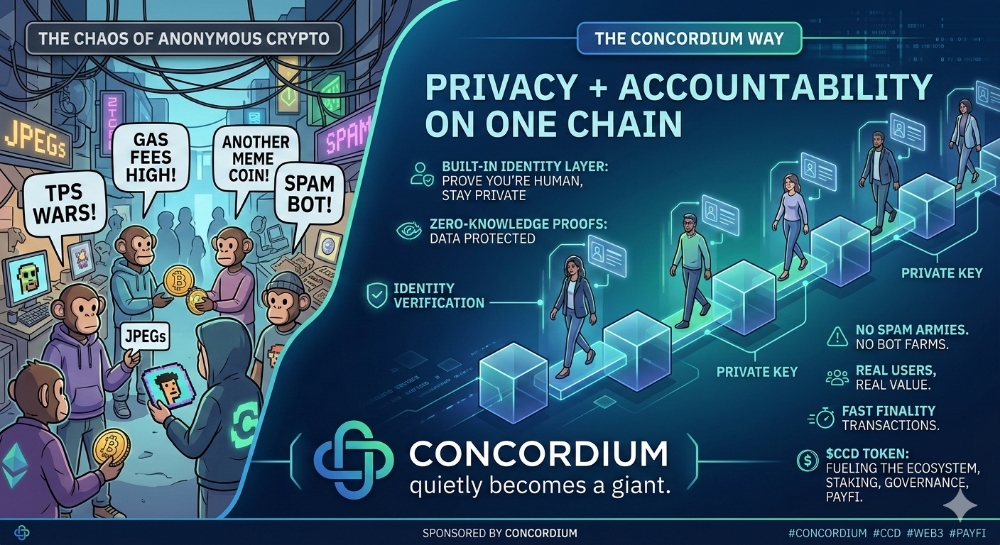

- Network Congestion: The demand for Ethereum network resources fluctuates. During periods of high demand or congestion, transaction fees tend to increase as users compete for limited block space.

Challenges Posed by High Transaction Fees:

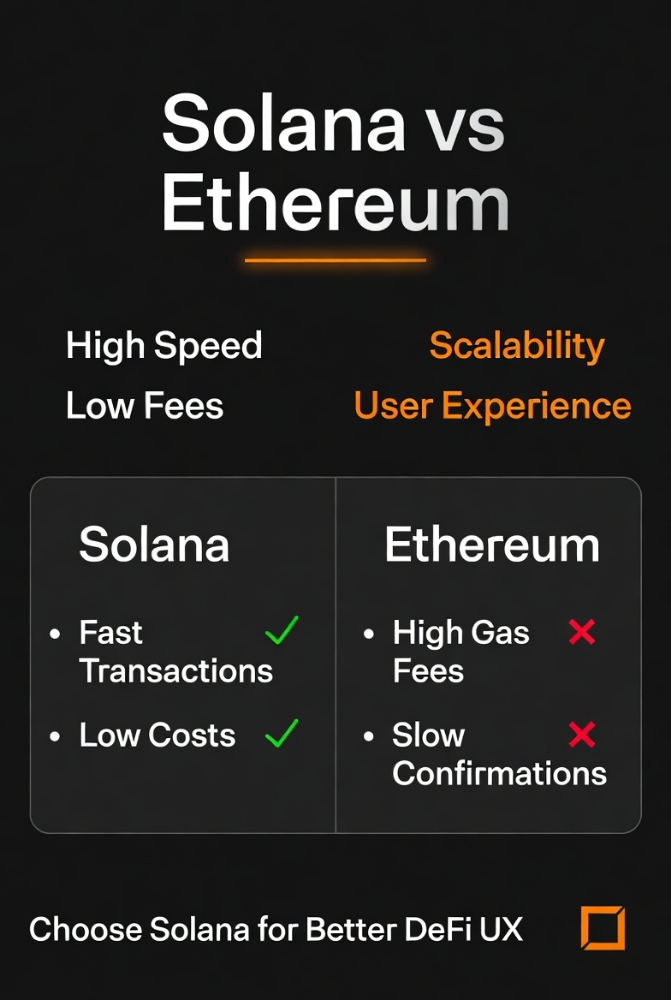

- Scalability Concerns: High transaction fees can impede the scalability of Ethereum, limiting its ability to handle a growing number of transactions efficiently.

- User Experience: Elevated transaction fees impact the user experience, especially for small transactions, as the cost might outweigh the value being transferred.

- Decentralization Debate: Critics argue that high transaction fees may centralize the network, as only users with significant resources can afford to participate fully.

Potential Solutions and Developments:

- EIP-1559: Ethereum Improvement Proposal 1559 aims to address fee volatility by introducing a mechanism that adjusts transaction fees based on network demand. It includes a base fee that is burned, reducing the overall supply of ETH.

- Layer 2 Solutions: Layer 2 scaling solutions, such as Optimistic Rollups and zk-rollups, aim to alleviate congestion by conducting transactions off-chain and then settling them on the Ethereum mainnet, reducing fees and increasing throughput.

- Ethereum 2.0: The ongoing Ethereum 2.0 upgrade is transitioning the network from a proof-of-work to a proof-of-stake consensus mechanism. This transition is expected to enhance scalability and reduce energy consumption, potentially mitigating high transaction fees.

Best Practices for Users:

- Gas Optimization Tools: Utilize gas optimization tools and calculators to estimate optimal gas prices and limits for transactions.

- Off-Peak Usage: Consider conducting transactions during periods of lower network congestion to benefit from lower transaction fees.

- Alternative Networks: Explore alternative Ethereum-compatible networks (sidechains) that may offer lower transaction fees for specific use cases.

Conclusion:

Ethereum transaction fees, while presenting challenges, are a crucial aspect of the network's functioning. Ongoing developments, such as EIP-1559 and Ethereum 2.0, showcase the commitment of the Ethereum community to address scalability and fee-related issues. As users navigate the dynamic landscape of transaction fees, understanding the factors at play and embracing emerging solutions will contribute to a more efficient and user-friendly Ethereum ecosystem.