International Stable Currency (ISC)

A brief history of money

Money has three main functions. We can say that anything that with the following three properties can be money:

- Medium of exchange. Money can be used to buy and sell goods and services. This facilitates the trade and decreases transaction costs by reducing the need for barter to nil. If you need a pair of shoes, you just go to a store and pay with your money. No need to pay with your, say, grains, if you are a farmer.

- Unit of account. Money is the commonest measure of value across the economy. What this means is that a watch may cost 30 kgs of bananas or 12 hours of cleaning work. But it’s more typical to see its value as measured in fiat money, e.g., $1,500.

- Store of value. Since the value of money is retained over time, it allows people to store their wealth.

The next historic event in the history of money happened in 2008 when Satoshi Nakamoto published the whitepaper of Bitcoin. This is how crypto emerged. The first cryptocurrency, Bitcoin, could be used as a medium of exchange. You all probably remember a guy who infamously paid 10,000 BTC to buy two Papa John’s pizzas in 2010. But the problem is that cryptocurrencies are too volatile. You don’t want your money to be worth $50 today and then to plunge to $0.05 tomorrow.

Enter stablecoins. They are designed to keep their value against the benchmark asset, such as a commodity, fiat currency or another cryptocurrency. Most popular stablecoins are pegged to the US dollar which means they are designed to have a price close to $1. Though there were several epic failures in the relatively young history of stablecoins, such as UST whose depeg led to the collapse of the entire blockchain network of Terra, we can posit that they are doing for what they had been developed.

Inflation

But stablecoins, too, have a flaw. If you carefully read the last function of money above, you probably noted that I stealthily ignored an important property of money. That is, money doesn’t store value well. Money loses value over time due to inflation. Since fiat currencies lose their value in the inflationary regimes, fiat-backed stablecoins should depreciate as well. Your 10,000 USDT doesn’t have the same purchasing power as it did a year ago.

As the eminent Milton Friedman put it, inflation is a hidden tax. When prices start to rise, you have to spend more just to maintain your lifestyle. Every and each bit in consumer price index eats into your profit and decreases your purchasing power. You may not feel it but ruthlessly affect your purchasing power in a negative way.

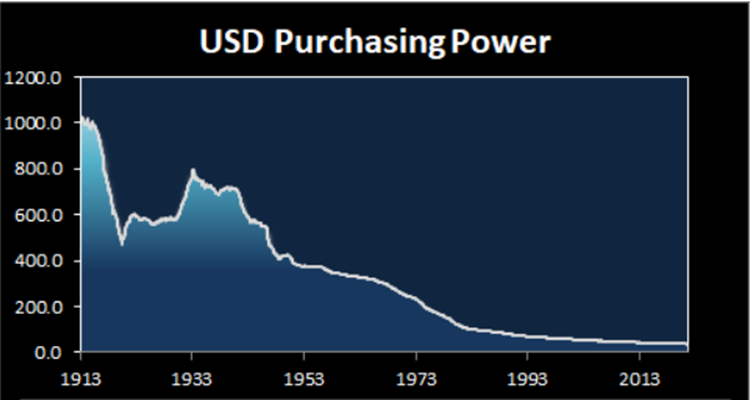

You don’t have trust my words. Go to https://www.usinflationcalculator.com/ which measures the US dollar’s purchasing power over time. US inflation data was made available starting from 1913. A quick glance at the website makes it glaringly evident that an item you’d paid $1 for in 1913 would cost you $30.78 in 2023! Which means that the US dollar has lost 96.8% of its purchasing power in 110 years. And don’t forget that we are talking about the global reserve currency, not about Turkish lira or Argentine peso, currencies of the countries with high two-digit or even three-digit inflation rates. Inflationary effect of fiat currencies spills over stablecoins which are designed to track their values. Whenever you hold your funds in stablecoins you lose purchasing power due to inflation. Even if you have put your stablecoin holdings into good use, e.g., you lent them or farm yields, you have to consider the hidden cost of inflation. Imagine providing liquidity to a pool in a lending protocol in a stablecoin for a year. Return is 1.5% but inflation rate is 2.5%. Though you nominally earn 1.5%, effectively you lose 1% due to inflation.

Inflationary effect of fiat currencies spills over stablecoins which are designed to track their values. Whenever you hold your funds in stablecoins you lose purchasing power due to inflation. Even if you have put your stablecoin holdings into good use, e.g., you lent them or farm yields, you have to consider the hidden cost of inflation. Imagine providing liquidity to a pool in a lending protocol in a stablecoin for a year. Return is 1.5% but inflation rate is 2.5%. Though you nominally earn 1.5%, effectively you lose 1% due to inflation.

Yet another, perhaps more significant drawback of the current stablecoins is that they are typically issued by centralized players, such as Tether Limited Inc. or Circle. We all saw what can happen to as large a digital asset as USDC when financial system experiences a not-so-large shock. Collapse of Silicon Valley Bank resulted in depeg of USDC which fell to 0.86 cents. Being a private corporation means that the company can choose not to be audited and thus not to disclose its reserves. This is what has been done over a long time by Tether whose reserves were audited only in January 2024.

So naturally an idea of a flatcoin was conceived. A flatcoin is a decentralized stablecoin which doesn’t lose its value due to inflation. Since it is pegged to the price of a particular basket of goods and services, it provides protection against inflation. When the price of that basket rises, the price of flatcoin increases as well. The idea is that as the flatcoin’s price is correlated to inflation rate, it retains its real value over time.

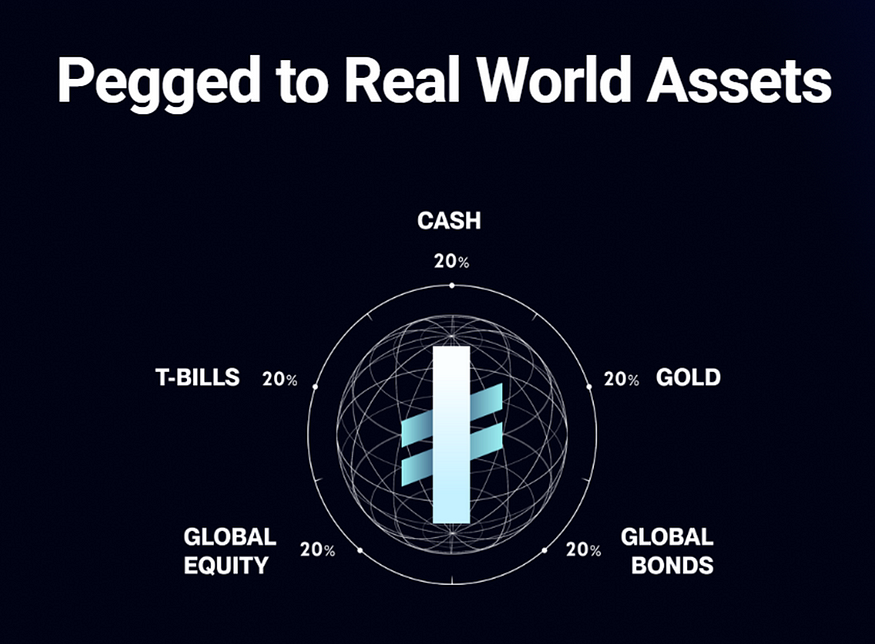

International Stable Currency (ISC) is a flatcoin built on Solana. It’s an inflation-resistant digital asset which is designed to appreciate in value over time. Unlike typical stablecoins mostly pegged to US dollar, ISC is not linked to USD only. Instead, it’s pegged to the basket of financial assets and commodities. At the time of writing, ISC reserves are equally allocated to cash, gold, short-term US Treasury bills, global bonds, and global equity markets. Apart from being inflation-resistant, and fully disclosed and diversified reserves, there is one thing that sets apart ISC from stablecoins. That is its decentralized governance. There will be a group of experts and ISC team members called Council which will guide the direction of ISC DAO by proposing initiatives to the DAO. The true decentralized nature of this governance is displayed by the fact that ISC DAO has the right to decline any proposal suggested by the Council.

Apart from being inflation-resistant, and fully disclosed and diversified reserves, there is one thing that sets apart ISC from stablecoins. That is its decentralized governance. There will be a group of experts and ISC team members called Council which will guide the direction of ISC DAO by proposing initiatives to the DAO. The true decentralized nature of this governance is displayed by the fact that ISC DAO has the right to decline any proposal suggested by the Council.

Conclusion

Stablecoin was an important concept in the evolution of money. But they have several shortcomings, losing value due to inflation being among the most important ones. Flatcoins, such as ISC fix the issue. It attempts to combine the best of both worlds. ISC is not as volatile as most digital assets and being pegged to the basket of underlying assets it grows in value over time. ISC reserves are transparent and can be found on its website. Also, unlike other stablecoins, ISC will be governed in a hybrid way where the DAO has the power to approve or decline any proposal suggested by the Council.