A Beginner's Guide to Trading Cryptocurrency

In recent years, cryptocurrency trading has surged in popularity, captivating the interest of both seasoned investors and newcomers alike. With the potential for substantial profits, it's no wonder that many are eager to enter this dynamic market. However, navigating the world of crypto trading can be daunting for beginners. To help you get started on your crypto trading journey, here's a comprehensive guide:

1. Educate Yourself: Before diving into trading, take the time to understand the fundamentals of cryptocurrencies, blockchain technology, and how trading works. There are numerous online resources, courses, and books available to help you grasp these concepts.

2. Choose a Reliable Exchange: Selecting the right cryptocurrency exchange is crucial for your trading success. Look for platforms that offer a user-friendly interface, robust security measures, low trading fees, and a wide range of supported cryptocurrencies.

3. Conduct Research: Before making any trades, thoroughly research the cryptocurrencies you're interested in. Analyze their whitepapers, development teams, market trends, and potential for adoption. Stay updated on news and events that could impact their prices.

4. Develop a Trading Strategy: Define your trading goals, risk tolerance, and time horizon. Decide whether you'll be day trading, swing trading, or investing long-term. Develop a strategy based on technical analysis, fundamental analysis, or a combination of both.

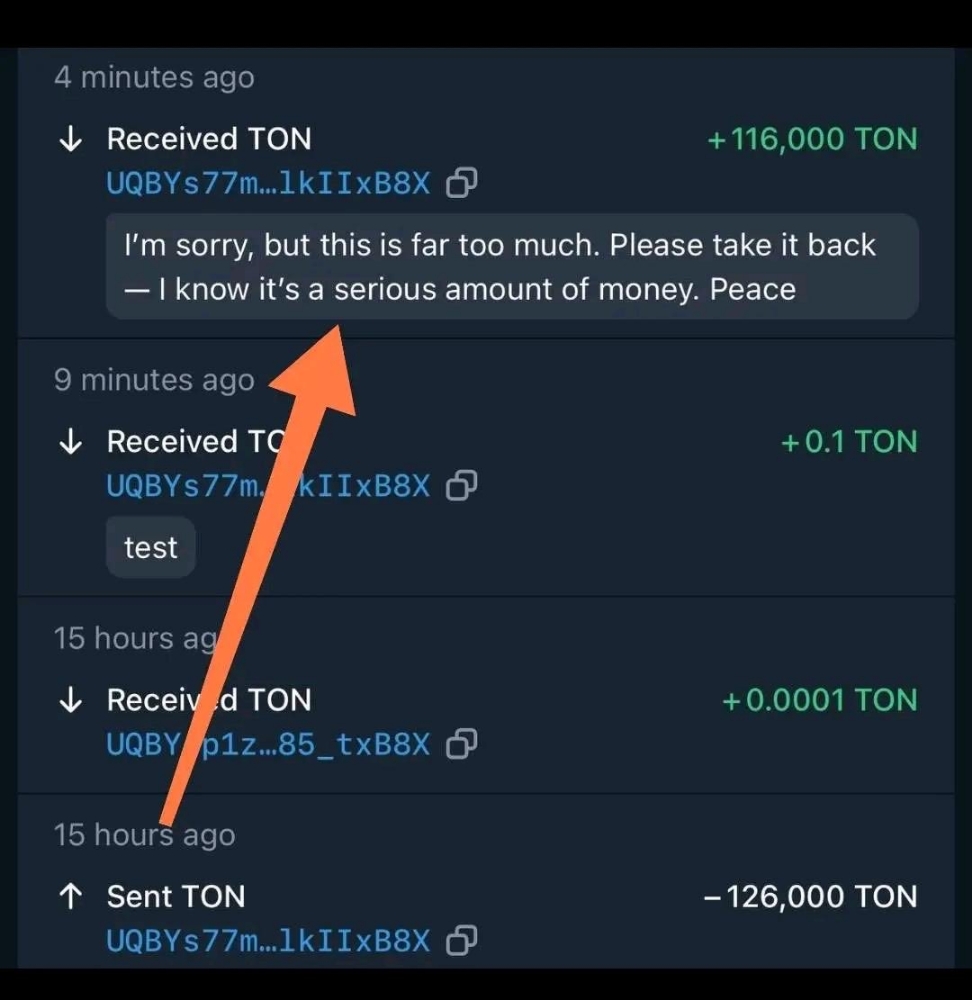

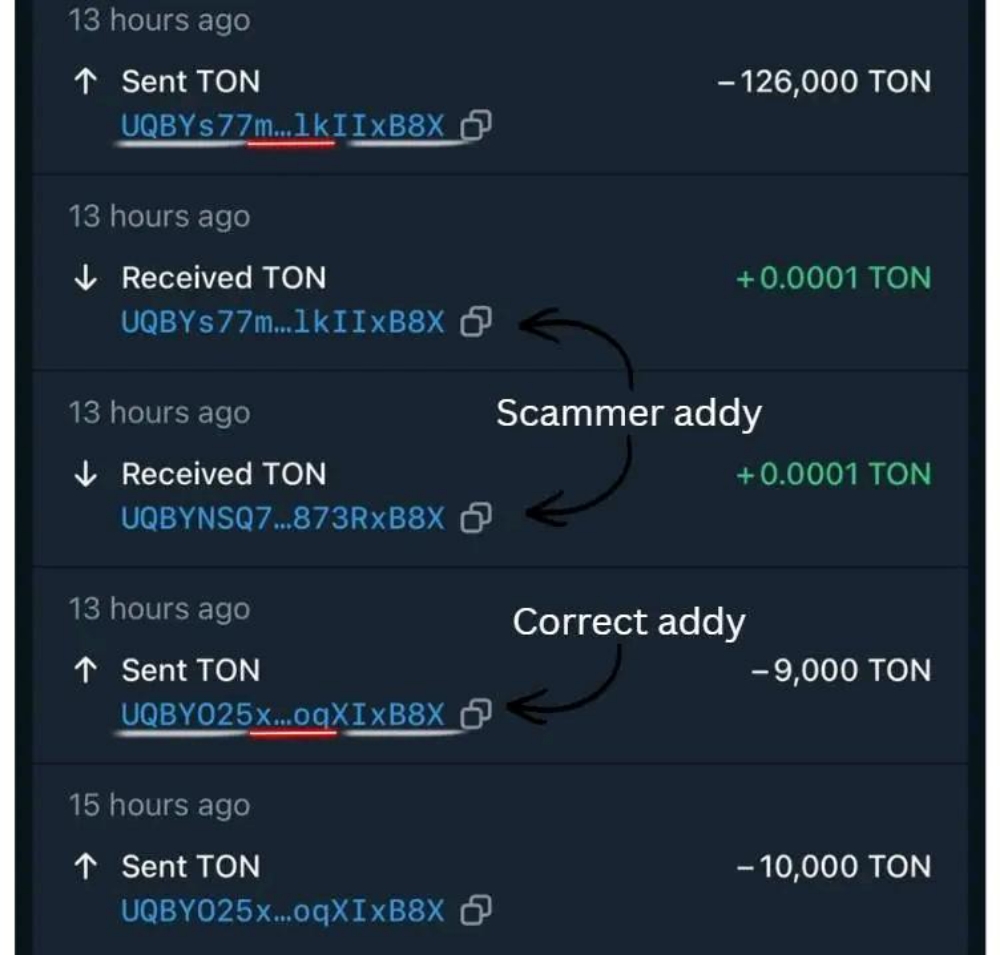

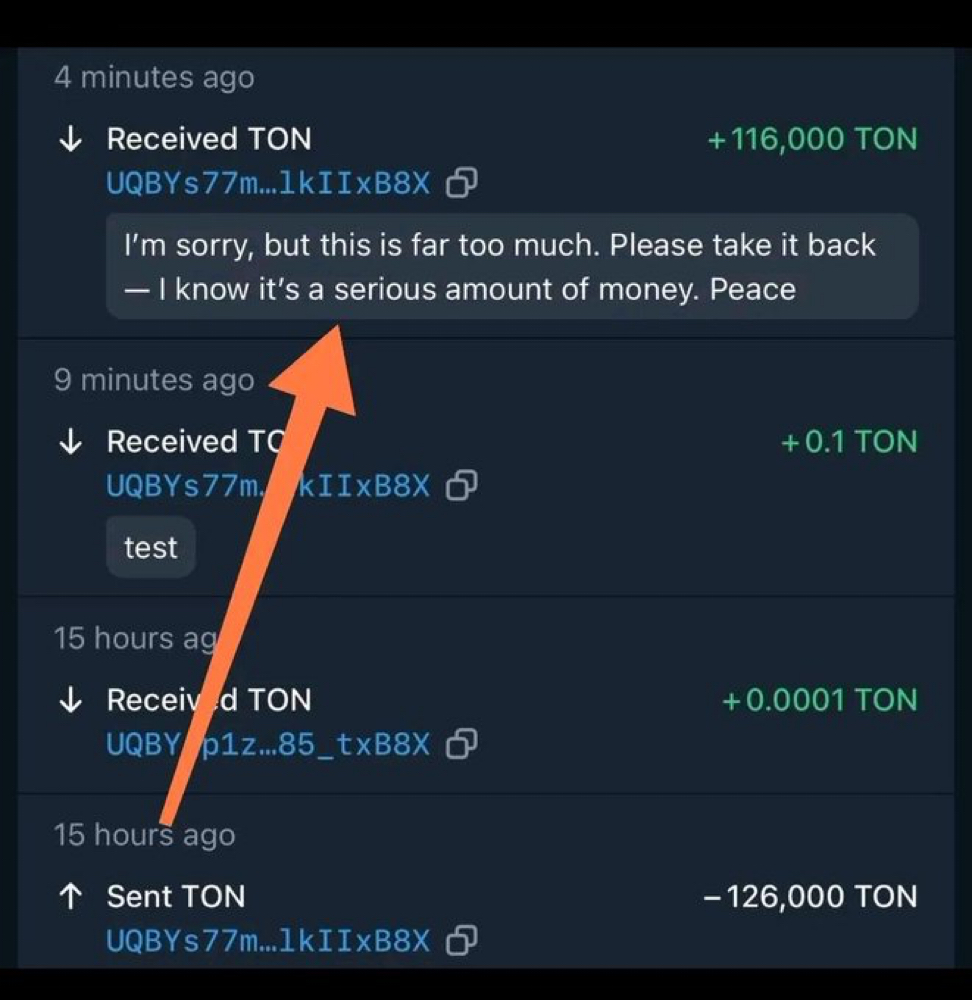

5. Practice Risk Management: Cryptocurrency markets are known for their volatility, which can lead to significant gains or losses. Implement risk management techniques such as setting stop-loss orders, diversifying your portfolio, and never investing more than you can afford to lose.

6. Start Small: Begin with a small amount of capital and gradually increase your investment as you gain experience and confidence. Avoid the temptation to invest all your funds into one trade, as this could lead to substantial losses.

7. Stay Disciplined: Emotions can cloud judgment and lead to impulsive decisions. Stick to your trading plan and remain disciplined, even during periods of market turbulence. Avoid chasing 'hot' tips or succumbing to FOMO (Fear of Missing Out).

8. Keep Learning: The cryptocurrency market is constantly evolving, so it's essential to stay informed and adapt to new developments. Continuously educate yourself, experiment with different trading strategies, and learn from both your successes and failures.

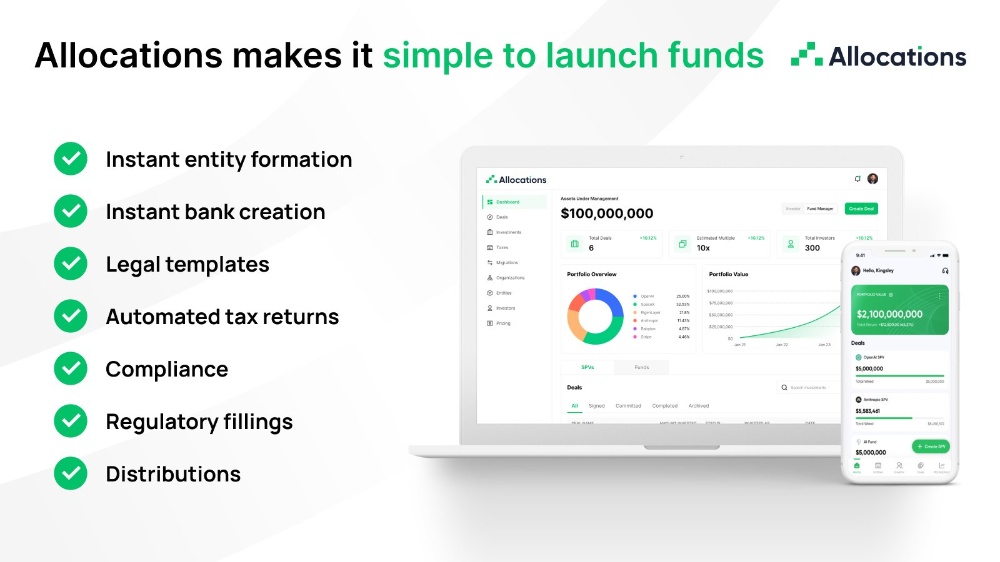

9. Utilize Trading Tools: Take advantage of trading tools and resources such as technical indicators, charting software, and trading bots. These tools can help you analyze market data more effectively and make informed trading decisions.

10. Be Prepared for Setbacks: Cryptocurrency trading is not without its challenges, and setbacks are inevitable. Stay patient, remain resilient, and view losses as learning experiences rather than failures.

In conclusion, while cryptocurrency trading can be lucrative, it also requires diligence, patience, and continuous learning. By educating yourself, practicing risk management, and developing a disciplined trading approach, you can increase your chances of success in the exciting world of crypto trading. Remember to start small, stay informed, and never stop honing your skills as a trader.