Exploring the Potential of Stablecoin Staking in Modern Finance

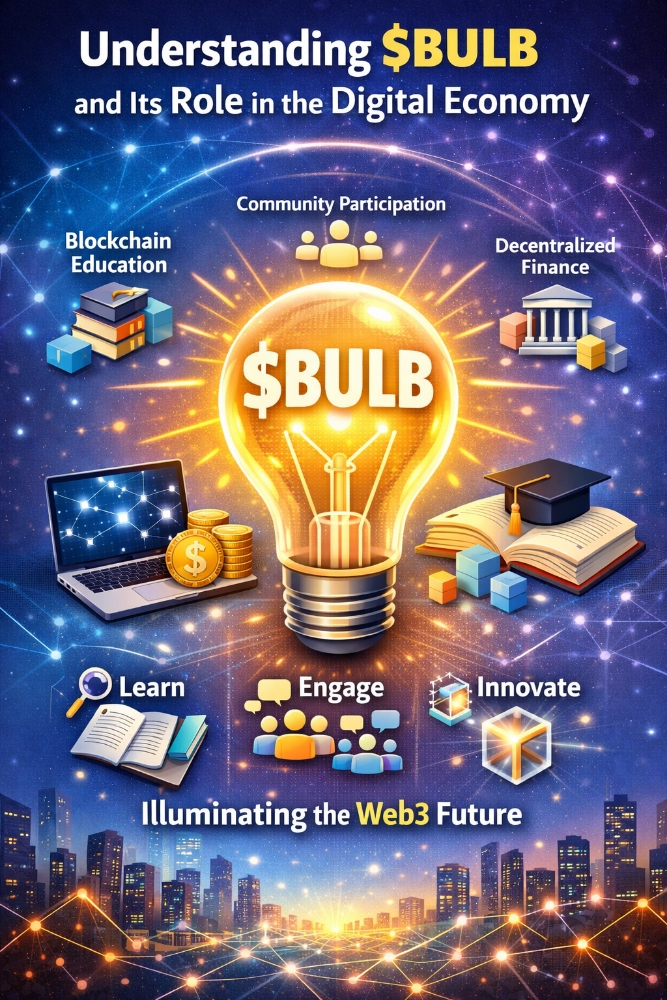

The cryptocurrency ecosystem is constantly evolving, with innovations that bridge traditional finance and decentralized systems. Among the most compelling developments is Stablecoin Staking, which has emerged as a reliable method for investors and institutions to earn predictable yields while maintaining low volatility. Unlike volatile cryptocurrencies like Bitcoin or Ethereum, stablecoins are pegged to fiat currencies, making them a safer option for staking and yield generation.

Understanding Stablecoin Staking

At its core, Stablecoin Staking involves locking stablecoins into a blockchain protocol to earn rewards over time. This process allows participants to contribute liquidity or secure network operations, depending on the staking model implemented by the platform. Unlike typical crypto staking, which can be highly volatile, stablecoin staking combines the benefits of low-risk assets with the passive income opportunities usually reserved for high-risk tokens.

Staking rewards are typically distributed in the form of the same stablecoin or occasionally in platform-native tokens, providing both liquidity and predictable earning potential. The predictable returns of stablecoin staking make it attractive for both retail and institutional investors who are wary of market volatility but still want exposure to blockchain-enabled finance.

Benefits of Stablecoin Staking

1. Predictable Returns: Unlike traditional crypto staking, where token value can fluctuate significantly, stablecoin staking ensures that the principal value remains stable. This predictability allows investors to plan financial strategies more accurately.

2. Network Security and Liquidity Support: By staking stablecoins, participants contribute to the stability and liquidity of decentralized finance (DeFi) protocols. Many platforms rely on staked assets to facilitate lending, borrowing, and other financial services, effectively reinforcing the network’s integrity.

3. Regulatory Alignment: Stablecoins, especially those backed by fiat reserves or regulatory-compliant frameworks, offer a more secure staking option in jurisdictions with strict financial regulations. This ensures that staking activities are less likely to encounter compliance-related issues.

4. Integration with DeFi Ecosystems: Stablecoin staking seamlessly integrates with decentralized lending, borrowing, and yield farming platforms, creating multiple revenue streams for investors without requiring them to manage high-risk tokens actively.

Mechanisms of Stablecoin Staking

There are several mechanisms by which stablecoin staking operates, depending on the platform and its purpose:

- Liquidity Pool Staking: Investors lock stablecoins into liquidity pools that support automated market makers (AMMs). These pools facilitate trading on decentralized exchanges (DEXs), and participants earn a portion of trading fees as rewards.

- Lending Protocol Staking: Some platforms allow staked stablecoins to be lent to borrowers, generating interest for the lender. The staked assets remain accessible, ensuring liquidity while still providing consistent returns.

- Validator and Node Participation: In blockchain networks with proof-of-stake or delegated proof-of-stake systems, stablecoin staking can be used to secure network operations by participating as a validator or delegating to a trusted node. Rewards are distributed proportionally based on the amount staked and network performance.

Risks and Considerations

While stablecoin staking is considered low-risk compared to volatile crypto staking, certain factors must be carefully evaluated:

- Platform Risk: Not all platforms offering stablecoin staking are equally secure. Smart contract vulnerabilities, platform insolvency, or mismanagement of reserves can impact returns. It is crucial to choose reputable protocols with strong security audits.

- Interest Rate Volatility: Some staking platforms offer variable rates depending on supply and demand dynamics. Investors must understand how reward rates are calculated and the potential for fluctuations.

- Regulatory Risk: While stablecoins often align with compliance standards, evolving regulatory frameworks can impact staking operations, especially in regions with stringent financial oversight.

How Investors Can Maximize Stablecoin Staking Rewards

To optimize returns from stablecoin staking, investors should adopt strategic approaches:

- Diversification: Spreading stablecoin holdings across multiple platforms and staking mechanisms reduces exposure to single-platform failures and ensures steady returns.

- Continuous Monitoring: Reward rates, platform upgrades, and regulatory announcements can significantly affect staking yields. Regular monitoring allows investors to adjust their staking strategies proactively.

- Reinvesting Rewards: Compounding staking rewards by reinvesting them increases long-term returns while leveraging the stability of the underlying asset.

- Choosing Regulatory-Compliant Platforms: Engaging with platforms that adhere to regulatory standards reduces legal risks and enhances the security of staked assets.

The Future of Stablecoin Staking

The growth trajectory of stablecoin staking is closely tied to broader adoption of DeFi and blockchain-based financial services. As more institutions explore decentralized finance, stablecoin staking is likely to become a mainstream tool for both risk mitigation and yield generation.

Additionally, innovations in cross-chain staking and interoperability will further expand opportunities. Investors may soon be able to stake stablecoins across multiple blockchain ecosystems, unlocking enhanced rewards without sacrificing asset stability.

For companies looking to integrate stablecoin development services, leveraging staking mechanisms can provide clients with value-added solutions that enhance engagement and generate passive income. This integration highlights how financial technology continues to evolve, combining the predictability of traditional finance with the flexibility and transparency of blockchain networks.

Conclusion

Stablecoin staking represents a convergence of stability and innovation in the crypto space. By offering predictable rewards, supporting network liquidity, and integrating seamlessly with DeFi platforms, it provides a compelling option for investors seeking low-risk exposure to blockchain finance.

As regulatory frameworks mature and technology evolves, stablecoin staking will likely play an increasingly pivotal role in the digital economy, bridging the gap between traditional finance and decentralized ecosystems. For both individual investors and enterprises, understanding the mechanisms, risks, and opportunities of stablecoin staking is essential to maximizing returns in the evolving world of digital finance.