The Rise of CHF-Backed Stablecoins in Switzerland

Switzerland’s position as a global financial hub has long been cemented by its stable monetary policy, robust regulatory infrastructure, and crypto-friendly ecosystem. In recent years, the emergence of CHF-Backed Stablecoins has further accelerated the country’s evolution into a frontier of digital finance. These innovative assets combine the price stability of the Swiss Franc (CHF) with the programmability and efficiency of blockchain networks — a convergence that is reshaping the future of cross-border transactions, decentralized finance (DeFi), and institutional treasury operations.

What Are CHF-Backed Stablecoins?

At their core, CHF-Backed Stablecoins are digital tokens pegged 1:1 to the Swiss Franc. Unlike volatile cryptocurrencies such as Bitcoin or Ether, these stablecoins maintain price stability by holding reserves in CHF or CHF-equivalents. The underlying mechanisms may vary — from fully collateralized bank holdings to algorithmic reserve management — but the essential objective remains the same: preserve value and ensure liquidity.

In technical terms, CHF-Backed Stablecoins act as digital representations of fiat value on distributed ledgers. Through smart contracts, they enable instantaneous settlement, composability with DeFi protocols, and programmable money features such as automated interest distribution or integration with tokenized financial instruments.

Switzerland’s Regulatory Framework and Crypto Valley

Switzerland’s regulatory clarity has been a catalyst for the adoption of CHF-Backed Stablecoins. The Swiss Financial Market Supervisory Authority (FINMA) has established frameworks that balance innovation with investor protection. These frameworks provide guidance on reserve audits, consumer disclosures, and anti-money-laundering (AML)/know-your-customer (KYC) compliance.

Switzerland’s “Crypto Valley” — centered in Zug — has attracted blockchain startups, institutional players, and digital asset custodians. This ecosystem fosters collaboration between traditional banks, fintech innovators, and regulators. Consequently, CHF-Backed Stablecoins have found fertile ground for experimentation, including integration with existing banking rails and participation in tokenized asset markets.

Use Cases Driving Adoption

1. Cross-Border Payments and Remittances

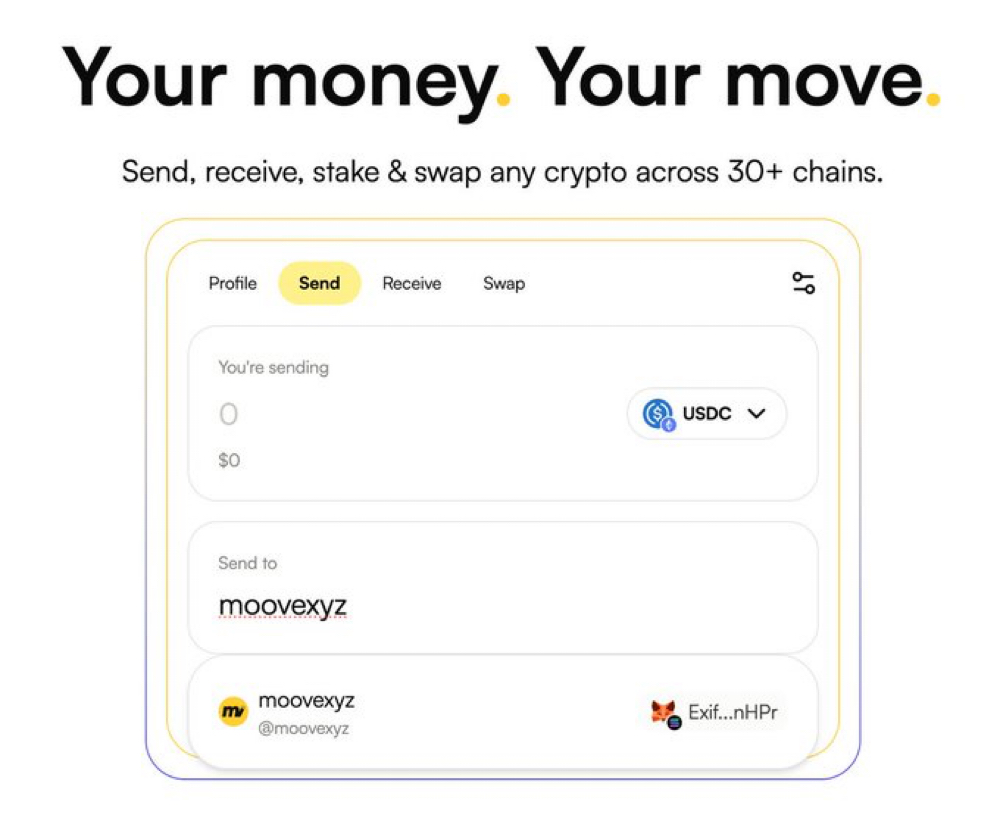

One of the most compelling applications of CHF-Backed Stablecoins is in cross-border value transfer. Traditional correspondent banking systems are slow and expensive, often involving multiple intermediaries and FX conversions. By contrast, CHF-Backed Stablecoins can be transferred peer-to-peer across borders in near-real time, significantly reducing settlement costs and latency.

This efficiency is particularly valuable for enterprises engaged in international trade or individuals who send remittances — enabling seamless value transfer without the typical friction associated with legacy systems.

2. Decentralized Finance (DeFi) Integration

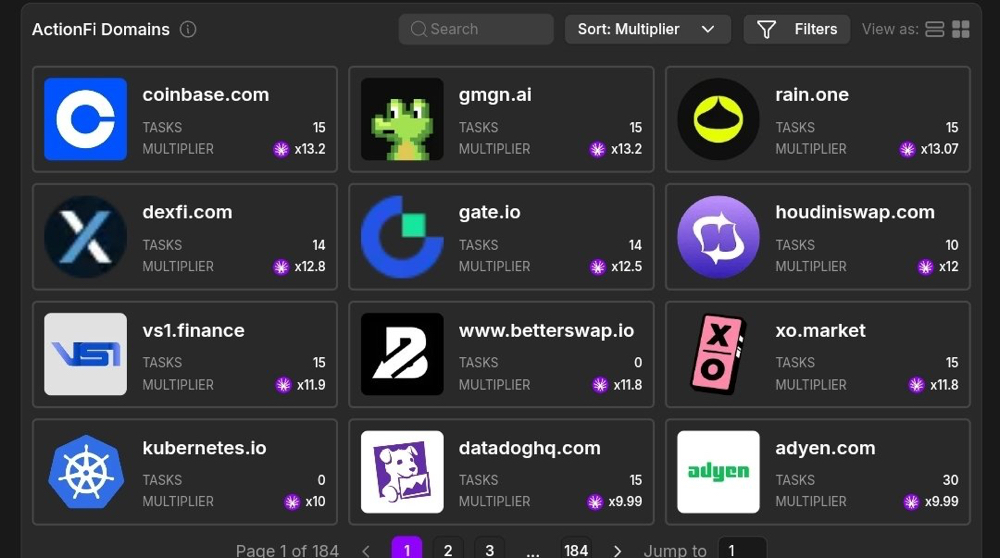

DeFi platforms — decentralized exchanges, lending protocols, and automated market makers — thrive on liquidity and collateralized value. CHF-Backed Stablecoins provide a native on-chain asset that reflects a fiat currency with global trust.

For instance, decentralized lending platforms can use these stablecoins as collateral, allowing users to borrow digital assets without exposure to volatile crypto prices. Liquidity pools denominated in CHF-Backed Stablecoins attract traders seeking predictable value and reduced slippage, enhancing market efficiency.

3. Treasury and Corporate Use

Corporations are increasingly exploring digital assets for treasury management. CHF-Backed Stablecoins allow firms to hold programmable cash, automate payouts via smart contracts, and engage with blockchain ecosystems without speculative risk.

Large multinationals and fintech firms in Switzerland are piloting tokenized cash management systems, integrating stablecoins into ERP platforms and payment workflows. This innovation not only streamlines internal financial operations but also positions Switzerland as an incubator for next-generation corporate finance tools.

Design Architectures of CHF-Backed Stablecoins

Understanding the technical underpinnings of CHF-Backed Stablecoins helps clarify their appeal:

Collateralized Models

- These require issuers to hold reserves equal to the volume of stablecoins in circulation. Reserves can be in cash, short-term government securities, or other liquid assets denominated in CHF. Regular audits and transparent attestations are critical to building trust.

Algorithmic Stability Mechanisms

- Some designs use algorithms and smart contracts to maintain parity with the CHF without direct fiat backing. While potentially more capital-efficient, these models rely on market incentives and can carry higher systemic risk during extreme volatility.

Hybrid Frameworks

- Combining collateral with algorithmic elements, hybrid stablecoins aim to balance stability, efficiency, and decentralization. For example, a reserve may be partially backed by CHF and partially backed by tokenized assets on-chain.

Challenges and Considerations

Despite their promise, CHF-Backed Stablecoins face challenges:

- Regulatory Compliance

- Ensuring ongoing compliance with evolving AML/KYC standards and financial legislation requires robust governance frameworks.

- Reserve Transparency

- To maintain trust, issuers must publish transparent audit reports. Lack of visibility into reserve composition can undermine confidence.

- Interoperability

- Building bridges between different blockchain networks and traditional financial systems remains technically complex, requiring standardized protocols and secure oracle integrations.

The Future Outlook

The adoption of CHF-Backed Stablecoins is poised for acceleration as financial institutions and DeFi participants align on interoperable infrastructure and compliance standards. Innovations like programmable money, on-chain credit systems, and tokenized securities markets signal a broader digital transformation of the Swiss financial landscape.

Switzerland’s proactive regulatory stance and ecosystem collaboration are likely to make it a global leader in fiat-linked digital assets. As companies experiment with new financial primitives, CHF-Backed Stablecoins will serve as the backbone for frictionless value exchange, bridging traditional finance with the evolving paradigms of digital finance.

Conclusion

The rise of CHF-Backed Stablecoins in Switzerland is not merely a technological trend — it represents a strategic shift toward digitized finance that harmonizes monetary integrity with blockchain innovation. By enabling real-time settlement, DeFi integration, and programmable financial logic, these stablecoins are redefining how value moves across borders and

platforms.

For enterprises looking to embrace this future, partnering with a reliable Stablecoin development company can provide tailored solutions that navigate both regulatory and technical complexities, ensuring resilient and scalable digital currency implementations.