WHAT IS CRYPTOCURRENCY?

Beyond the Buzz: A Beginner’s Guide to Understanding Cryptocurrency

If you’ve browsed the internet, watched the news, or spoken to a finance-savvy friend in the last decade, you’ve heard the term Cryptocurrency.

For some, it represents the future of money—a decentralized utopia where banks are obsolete. For others, it’s a volatile rollercoaster of memes and confusing jargon. But what is it really? And does it actually matter for your daily life?

Let's strip away the hype and break down the basics of the crypto revolution.

What is Cryptocurrency? (The Simple Version)

At its core, cryptocurrency is digital money.

Unlike the dollars or euros in your bank account, cryptocurrencies are not issued or controlled by a central authority like a government or a bank. Instead, they run on a technology called Blockchain.

The "Magic" Behind It: The Blockchain

Imagine a shared Google Doc that everyone can read, but no single person can delete or edit maliciousy.

* Traditional Banking: The bank keeps a private ledger. You have to trust them to get the numbers right.

* Blockchain: A public, digital ledger distributed across thousands of computers. Every transaction is recorded in a "block" and chained to the previous one. To hack it, you’d have to hack thousands of computers simultaneously—making it incredibly secure.

Why Do People Care? The 3 Big Benefits

Why bother with Bitcoin when Venmo or PayPal works just fine? Here are the three main arguments for crypto:

* Decentralization: No middleman. You can send money to someone in Japan on a Sunday at 2:00 AM without waiting for a bank to open or paying exorbitant international wire fees.

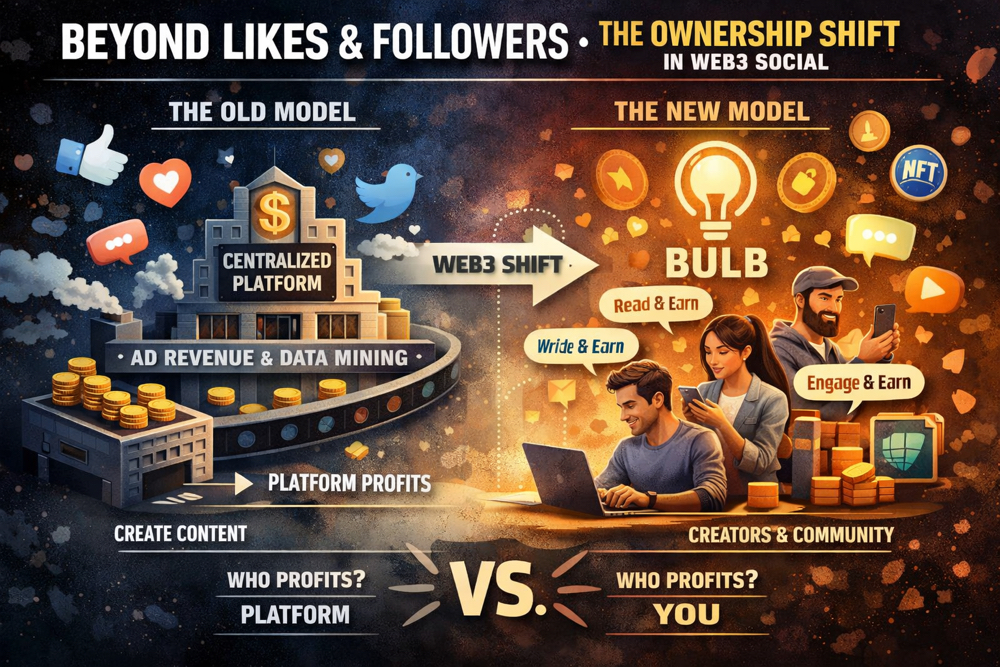

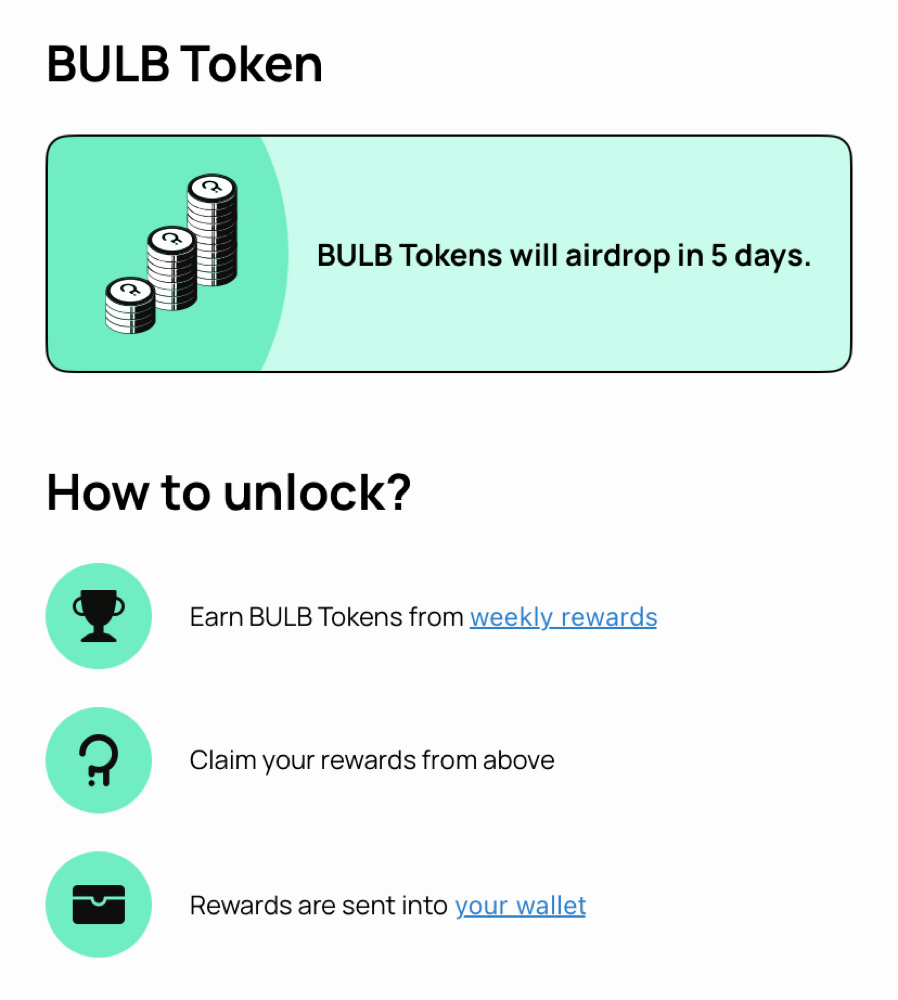

* Ownership: In the crypto world, you hold your own assets in a digital wallet. As the popular saying goes: "Not your keys, not your coins." You are your own bank.

* Innovation (Smart Contracts): Cryptocurrencies like Ethereum aren't just money; they are programmable. They allow for "Smart Contracts"—agreements that automatically execute when conditions are met (e.g., "If the flight is delayed 2 hours, automatically refund the ticket price").

The Major Players You Should Know

There are thousands of cryptocurrencies, but they generally fall into a few categories:

* Bitcoin (BTC): The original. Often called "Digital Gold." Its primary use case is a store of value—a way to preserve wealth over time.

* Ethereum (ETH): The builder's platform. This is where developers build decentralized apps (dApps), NFTs, and other financial tools.

* Altcoins: "Alternative coins." These range from serious technological projects (like Solana or Cardano) to "Meme coins" (like Dogecoin) which are driven largely by internet culture and community hype.

* Stablecoins: Cryptos pegged to real-world assets like the US Dollar (e.g., USDC or USDT). They offer the speed of crypto without the wild price swings.

The Elephant in the Room: The Risks

It would be irresponsible to write about crypto without highlighting the dangers. This is a frontier market, and it comes with hazards:

* Extreme Volatility: It is normal for cryptocurrencies to drop 20%, 50%, or even 80% in value. It is not for the faint of heart.

* Security Responsibility: If you lose the password (private key) to your digital wallet, there is no "Forgot Password" button. Your money is gone forever.

* Scams: The industry is rife with bad actors. If a project promises "guaranteed returns," run the other way.

How to Dip Your Toes in (Safely)

If you are curious and want to learn by doing, here is a conservative approach:

* Educate First: Don't buy what you don't understand. Read whitepapers or trusted educational resources (like Investopedia or Coinbase Learn).

* Start Small: Only invest money you are 100% okay with losing. Treat it like the cost of education, not a lottery ticket.

* Use Reputable Exchanges: Stick to major, publicly audited exchanges (like Coinbase, Binance, or Kraken) when you are starting out.

* Think Long Term: Trying to day-trade crypto is a quick way to lose money. The most successful participants usually buy and hold ("HODL") for years.

Final Thoughts

Cryptocurrency is still in its "dial-up internet" phase. It is clunky, volatile, and confusing—but it is also revolutionizing how we think about value, ownership, and the internet.

Whether you decide to invest or just watch from the sidelines, understanding this technology is no longer optional. It’s part of the future financial landscape.