Exploring Cross-Chain Bridges and Interoperability in the Multi-Chain Ecosystem

Welcome to LI.FI’s Cross Chain Insider newsletter. If you want to join this community of cross-chain aficionados learning about bridges, interoperability, and the multi-chain ecosystem, subscribe below.

Bridge Updates

1) LI.FI Presents Jumper: Crypto’s Everything Exchange 🤸♂️

LI.FI launches Jumper.Exchange: Crypto’s Everything Exchange, aiming to make navigating the multi-chain crypto ecosystem easier.

Jumper lets users swap any token on chain, using any bridge and any DEX. It supports 20 chains, routes users through 30 DEXs and DEX aggregators, and maintains 15+ bridge integrations.

2) Axelar Introduces Axelar Virtual Machine 🔥

Axelar launches Axelar Virtual Machine, an interoperability marketplace to scale the interchain. Axelar VM enables dApps to gain access to N chains and customize based on security models and other criteria.

At launch, the Axelar VM supports two products:

- Interchain Amplifier — connect to any chain.

- Interchain Maestro — set of interchain programs that automate complex multi-chain dApp management tasks.

3) Hyperlane & Wormhole Integrate Circle’s CCTP 🫡

Hyperlane has integrated Circle’s Cross-Chain Transfer Protocol (CCTP). The CCTP integration is built natively into Hyperlane’s core API. Users and devs can access CCTP on any Hyperlane-supported chain at launch.

Wormhole has integrated Circle’s CCTP, enabling devs to add generic messages on top of cross-chain, native USDC transfers. The integration is now live on testnet.

4) Squid Router Expands to Arbitrum 🤝

Squid, a cross-chain any-2-any swaps platform built on Axelar, has added support for Arbitrum.

5) LI.FI Integrates Connext V2 🦎

LI.FI announced that it has integrated Connect V2 (with the Amarok upgrade) into its stack. Users can now access cheap, fast, secure bridging on Jumper.exchange , whereas devs building x-chain with LI.FI can leverage xCalls (cross-chain contract calls) to perform complex cross-chain actions within the dApp.

6) Symbiosis $SIS BNB Chain Retrodrop 🐙

Symbiosis launched the $SIS token, the governance token of its ecosystem, on BNB Chain. To celebrate the launch, Symbiosis conducted a retroactive airdrop, rewarding users who have:

a) Executed cross-chain swap with more than $100 volume

b) On-chain swap users via OpenOcean

c) Top 50 holders of $OOE, $RBC, $RANGO, $LIME, $XDAO

Check your eligibility here.

Multi-Chain Ecosystem Updates

1) ERC-4337 (Account Abstraction) Deployed on Mainnet 🔥

ERC-4337, Account Abstraction, a standard for adding smart contract functionality to wallets, is now live on Ethereum Mainnet.

2) Polygon Releases Zero Knowledge Identity for Web3 💜

Polygon released the Polygon ID infrastructure stack to “ build a more equitable internet that places identity at the center of it.” The Polygon ID team announced 4 tools — Verifier SDK, Issuer Node, Wallet SDK, and Wallet App — designed to help devs easily integrate decentralized identity into their dApps.

3) Celer Launches Zero Knowledge Proof Development Framework 🧐

Celer Network announced the Zero Knowledge Proof Development Framework. a community evaluation platform that seeks to provide comprehensive benchmark results for a wide variety of zero-knowledge-proof (ZKP) development frameworks. The platform aims to aid developers trying to find the best ZKP framework for their specific use cases and performance requirements. Read more.

4) Introducing the Uniswap Mobile Wallet 🦄

Uniswap launched a self-custodial, open-sourced mobile wallet. Users can swap, send/receive ERC-20 tokens, NFTs, and explore dApps on Mainnet, Polygon, Arbitrum, and Optimism. The mobile wallet is currently available as a limited early release through Apple TestFlight.

5) Uniswap Kicks Off Cross-Chain Bridge Assessment Process 💪

Uniswap announced the creation of the Uniswap Bridge Assessment Committee and the kickoff of the Assessment process. The Committee consists of 6 members (1 PM and 5 engineers) tasked with assessing the set of bridges (8) and bridge agnostic solutions (3) from Uniswap’s cross-chain governance needs. Read more.

What’s Popping?

Why Multi-Chain, Why Now? The Case for Deploying dApps on Multiple Chains.

The crypto landscape is changing. We’re quickly moving from an Ethereum-dominated space to one with multiple vibrant blockchain ecosystems.

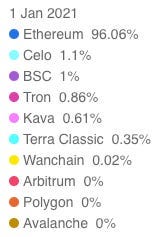

At the beginning of 2021, most of the capital in crypto was locked in Ethereum’s DeFi ecosystem (~96.06%). At that time, the scope of what dApps on other blockchains offered was limited, and there wasn’t much innovation or incentives to lure users to these chains. Total Value Locked (TVL) across chains as on 1 Jan 2021 • Source: DeFi Llama

Total Value Locked (TVL) across chains as on 1 Jan 2021 • Source: DeFi Llama

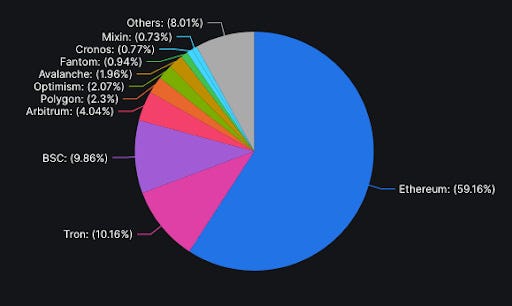

However, the market structure has changed, and we’re seeing the multi-chain thesis unfold. Ethereum is still king, but there are over 150 blockchains in crypto, many of which have seen meaningful traction in terms of users and capital inflow in the past few years.

- Ethereum dominates TVL across chains, but the extent of the domination has fallen from ~96% in 2021 to ~59% at the time of writing (it was below 50% for the first time in crypto history before the Terra blockchain collapse).

- EVM-Chains like Arbitrum, Polygon, Optimism, Avalanche, and BNB Chain, among others, either did not exist or had close to nothing in terms of TVL and traction in 2021. This has significantly changed, with these 5 chains alone attracting nearly 20% of the TVL in DeFi.

- Total Value Locked on All Chains (173 chains) • Source: DeFiLlama

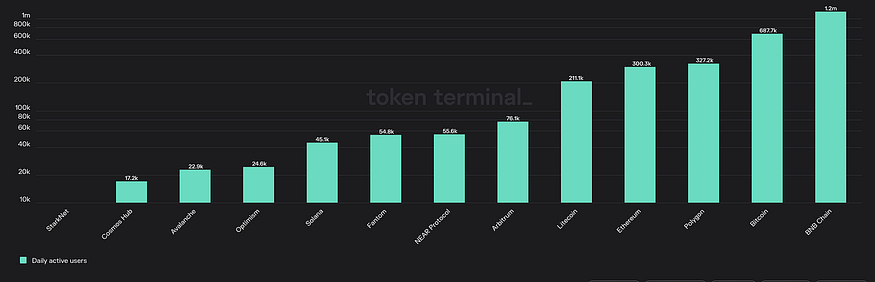

- The daily active users metrics is dominated by highly scalable chains with large throughputs that offer users low-cost and fast transactions such as BNB Chain, Polygon, L2s.

- Chain % share for monthly average daily active users • Source: Token Terminal

- Top chains based on monthly average daily active users • Source: Token Terminal

This type of market structure, where users and capital are spread across chains, necessitates the need for dApps to follow the money and be present where the users are.

Having said that, deploying a dApp on all the chains has its own complications; frankly, most blockchains have yet to see enough traction to make this decision a no-brainer for dApp developers. However, there are certain blockchains or at least specific clusters of them that make a strong case. On a high level, these clusters include EVM chains, Bitcoin, Solana, and the Cosmos ecosystem. The jury’s still out on whether even some of these clusters have seen enough adoption to make the complexity of deploying a dApp on them worth it. However, there’s a consensus that deploying your dApp on EVM chains is a must because:

- Most of the capital is deployed on EVM chains.

- EVM chains have a large active user base.

- EVM chains are interoperable, so it’s relatively easy to port dApps from one chain to another.

- Most bridges only support EVM chains, and as a result, there’s more efficiency in capital flows between chains.

Users are spread across EVM chains. Capital is distributed across EVM chains. Most developers are building on EVM chains. Thus, it’s fair to say that the cluster of EVM chains has become the access point to crypto’s multi-chain ecosystem.

The growing narrative of multi-chain makes deploying dApps on multiple chains not just a prudent move but a strategic imperative for teams. Deploying on multiple chains will allow dApps to:

- Tap into a wider user base

- Access different liquidity sources

- Gain exposure to new markets.

It also reduces the risk of dApps becoming irrelevant in case of a market shift for a particular blockchain becoming less popular or, even worse, the entire ecosystem collapsing (s/o Terra).

Closing Thoughts

In summary, with the market structure rapidly evolving into a multi-chain landscape, dApps need to adapt and innovate quickly, and deploying on multiple chains is a powerful way to achieve this, providing them with limitless opportunities. Moreover, there has been a significant advancement in the development of cross-chain technology that can make this move across chains seamless for dApps. For instance, multi-chain DeFi middleware solutions offer products that abstract the infrastructure level complexity of deploying on multiple chains by providing a tech stack that caters to every need.

Moreover, there has been a significant advancement in the development of cross-chain technology that can make this move across chains seamless for dApps. For instance, multi-chain DeFi middleware solutions offer products that abstract the infrastructure level complexity of deploying on multiple chains by providing a tech stack that caters to every need.

The multi-chain thesis is unfolding. dApp developers should take note of this multi-chain movement and take the necessary steps or risk being left behind the competition that’s quicker to adapt.