Bitcoin ETF market eyes resurgence amid price dip Billion $ in Bitcoin Withdrawn From Coinbase

Coinbase’s Bitcoin reserves hit lowewst point in years amid whale activity.

Hovering a little below $52,000, Bitcoin is still down by approximately 25% since its all-time high of the previous bull run. The leading crypto asset, however, is seeing a tremendously improved sentiment among investors.

In fact, Bitcoin holdings on Coinbase, which is a leading crypto exchange in the space and the largest in the US, have fallen to their lowest level since 2017. And whales are betting big on the asset.

Whales Make Big Bets

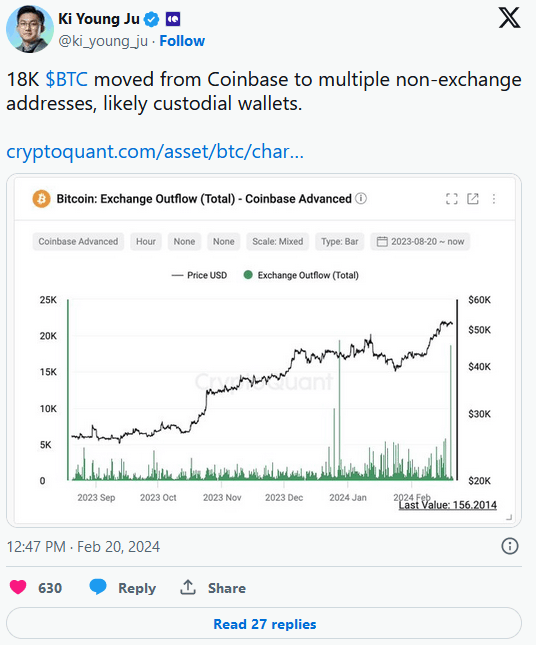

As per CryptoQuant analyst’s latest data, more than 18,000 BTC, valued at around $1 billion, were identified to have been removed from the platform by whales.

After the withdrawal of such a significant stash of Bitcoin from Coinbase, the funds were distributed across several new wallets, with values ranging between $45 million and $171 million.

Subsequently, Coinbase’s public order book now holds around 394,000 BTC, equivalent to a little over $20.5 billion. CryptoQuant founder Ki Young Ju further revealed that the funds were moved to multiple non-exchange addresses, likely custodial wallets.

Accumulation Game Strong

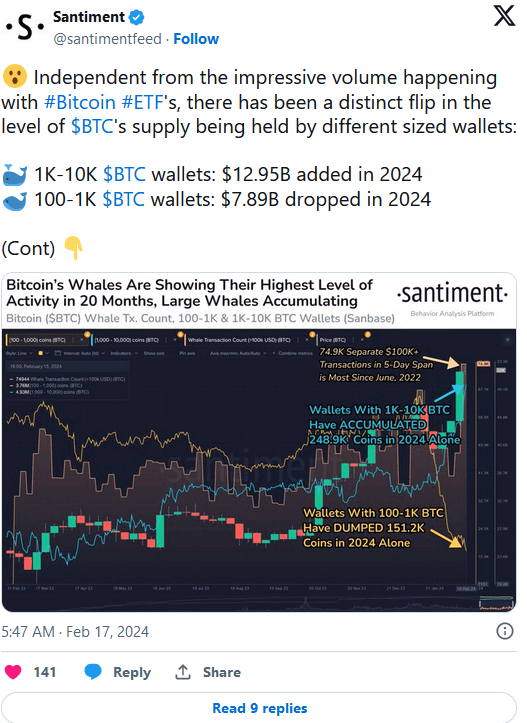

The demand for Bitcoin is evident as whales have engaged in the highest level of activity not seen in nearly two years. In 2024, large holders with 1,000 to 10,000 BTC in their wallets accumulated approximately $13 billion worth of the asset. Meanwhile, those with holdings ranging from 100 to 1,000 BTC shed their holdings by $7.89 billion.

Such a trend of whales moving their stash away from centralized crypto exchange is usually a positive sign. Last week, Bitcoin whale wallets acquired over 100,000 BTC, estimated to be approximately $5 billion, in a span of just ten days alone. Historically, such accumulation points signal price appreciation.

The latest whale movements come amid a market-wide rally spurred by the introduction of spot Bitcoin ETFs.

Following their successful launch and the subsequent massive inflow, all eyes are on the Bitcoin halving, which is likely to occur in April this year. Hence, the transfer to custodial wallets may indicate the increased confidence of a price surge ahead of the fact.

As Bitcoin (BTC) experiences a price dip, market analysts anticipate a potential resurgence in the spot Bitcoin exchange-traded fund (ETF) market. With new data and insights from industry leaders, the market’s response to BTC’s price movements is under scrutiny.

BTC Price correction spurs ETF interest

Recent data suggests that the spot Bitcoin ETF market could witness heightened activity in response to Bitcoin’s price movements. CryptoQuant CEO Ki Young Ju highlighted the potential for increased net flows into Bitcoin ETFs, particularly if the cryptocurrency’s price declines. Young Ju pointed out that demand for Bitcoin ETFs historically surges as BTC approaches specific support levels, with recent netflows indicating a shifting investor sentiment.

An essential factor in this equation is the behavior of new BTC whales, particularly those investing in ETFs. Young Ju noted that these investors have an on-chain cost basis of approximately $56,000, suggesting a threshold for potential capital influxes into the ETF market. As Bitcoin’s price hovers between $62,000 and $68,000, the possibility of a further decline remains plausible, with corrections typically seeing a maximum drop of around 30%.

Analyzing the recent correction, analysts attribute the price dip to overheated market conditions, characterizing it as a “pre-halving retrace” ahead of the Bitcoin halving event scheduled for April. Despite this correction, a report from CryptoQuant indicates that the Bitcoin bull cycle is far from over. The investment flows from new investors remain relatively low, and price valuation metrics are still below the levels observed in previous market peaks.

The potential impact of Bitcoin halving event

Historically, the upcoming Bitcoin halving event is a significant driver of BTC’s price trajectory, often leading to a parabolic uptrend. As the market anticipates this event, investors closely monitor Bitcoin’s price movements and the response of various market indicators, including ETF netflows and on-chain data.

The recent price correction in Bitcoin has sparked interest in the spot Bitcoin ETF market, with analysts predicting a potential resurgence in ETF activity. Key factors influencing this trend include the on-chain cost basis for new BTC whales and historical patterns of investor behavior surrounding BTC price movements. With the looming Bitcoin halving event, market participants remain vigilant, expecting potential shifts in BTC’s price dynamics and broader market sentiment.

As the cryptocurrency landscape evolves, monitoring these developments in the ETF market provides valuable insights into investor sentiment and market trends. Whether Bitcoin’s price continues to decline or embarks on a new upward trajectory remains to be seen. Still, the response of the ETF market will undoubtedly be a critical indicator of investor confidence and market sentiment moving forward.