Lessons learned after the collapse of FTX

The FTX disaster has had a continuous impact on the entire market. But thinking positively, we can learn lessons from FTX's failure.

Just a few months after the demise of LUNA , we continue to witness another major project fall. More specifically, the main character this time is Sam Bankman-Fried, who was once the idol and inspiration of many people.

A few weeks ago, the FTX founder was still considered the hero who rescued the cryptocurrency market and the last hope of companies on the brink of bankruptcy. Yet this multi-billion dollar empire collapsed almost completely in just 6 days. Bankman-Fried was, to put it mildly, an inexperienced operator. Some harsher people even criticized him as a fraud.

Forbes calls Sam Bankman-Fried "a villain in the guise of a nerd".

Forbes calls Sam Bankman-Fried "a villain in the guise of a nerd".

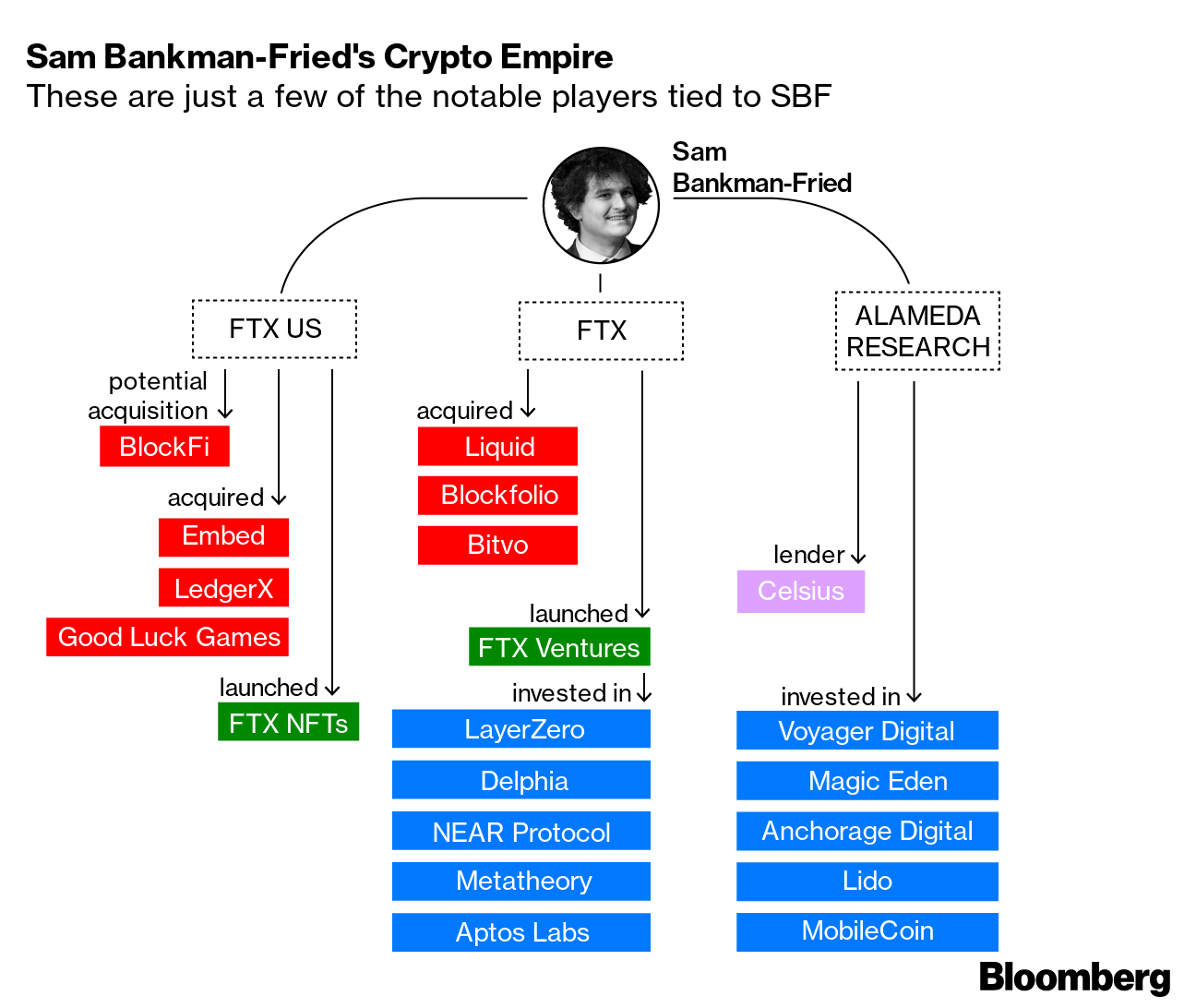

FTX's collapse swept away the assets of many people, from small retail investors to large funds with deposits on the exchange. In addition to the 134 companies directly affiliated with FTX, some projects even followed in FTX's footsteps and filed for bankruptcy. Needless to say, the domino effect of the incident is extremely large. However, this can be an opportunity for us to summarize valuable lessons in investing.

“Too big to fail”

This "FTX big case" is probably much more serious than the previous LUNA. In fact, FTX is larger in scale and involves more players in the cryptocurrency market. From retail investors, FTX users to investment funds and other projects, all are significantly affected. Therefore, this can create a domino effect on the entire market.

Such a scary impact, but how many people expected that Sam Bankman-Fried 's once powerful empire would end up like it has today? And that is the lesson I want to mention in addition to basic experiences such as capital allocation, not putting all your eggs in one basket and making mistakes.

The financial and business world has a famous term "Too big to fail". This is also the title of a film based on the theme of the 2008 financial crisis. The film opens a perspective on the consequences of companies in the financial sector at that time and how they coped with the crisis.

FTX is one of the top exchanges in the cryptocurrency market. In terms of user size, FTX is only behind Binance . Bankman-Fried is also a tough name in the world. According to Forbes, Bankman-Fried is recognized as the richest person in the world under 30 years old.

Sam Bankman-Fried's empire. Source: Bloomberg.

Sam Bankman-Fried's empire. Source: Bloomberg.

Besides, the founder of FTX has a large network of relationships, especially related to politics. These things show that FTX is a force and a big empire in this market. That's why many people think that FTX can never collapse.

Before the incident broke, a large amount of FTT worth about 500 million USD was sold on Binance. When the question is raised, many people ask in return: "Can someone like Sam Bankman-Fried not have $500 million?" And it's true that Bankman-Fried doesn't really have $500 million. Forbes estimates that half of Bankman-Fried's assets come from FTX, which depends on illiquid tokens and collateralized loans.

Back to the story, the problem is that almost everyone thinks that FTX is "too big to fail" - too big to fail. Unfortunately, they misunderstand the meaning of this term and impose the thinking "the bigger something is, the harder it is to collapse" to every situation. LUNA is a typical example. Around the end of 2021-early 2022, LUNA emerged as a potential project with large capitalization, high stability and low transaction fees.

In the end, the truth proves that nothing is impossible. Terra Empire's billions of dollars quickly dropped to zero in just one week. Investing in the financial sector is inherently unpredictable, but crypto is even younger and has more potential for volatility. Therefore, we always have to prepare ourselves for all the worst situations.

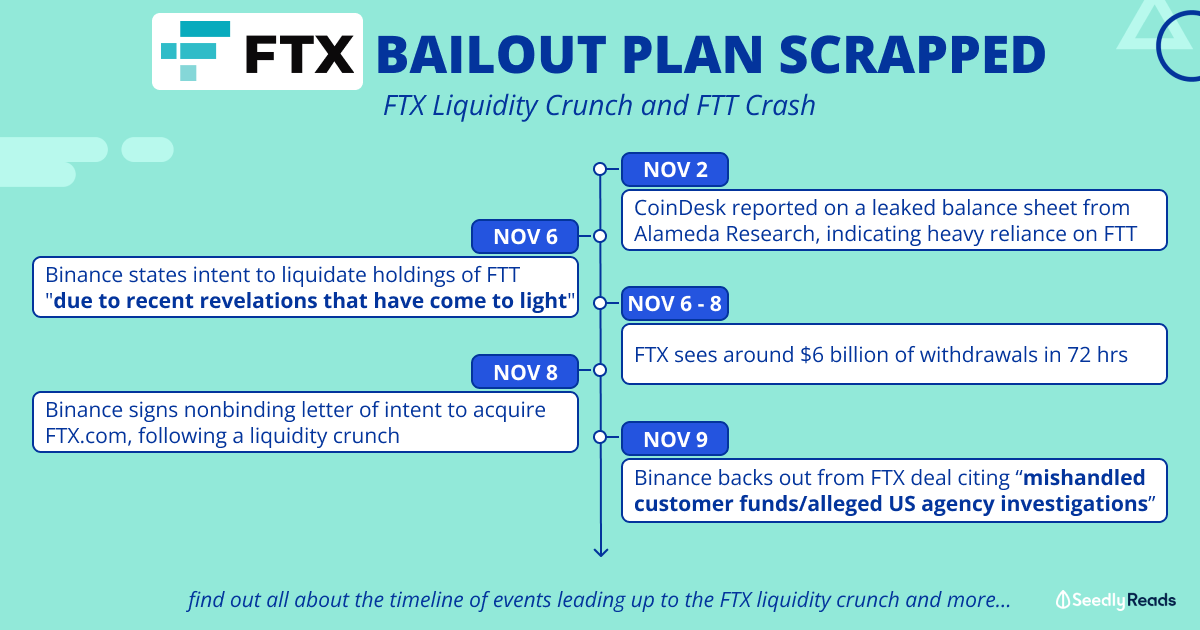

In fact, when Alameda Research's balance sheet was exposed, I was still not 100% certain that FTX would fail, especially in less than a week.

Developments of the FTX disaster. Source: Seedly.

Developments of the FTX disaster. Source: Seedly.

However, “Too big to fail” does not mean that a large company will never fail. “Too big to fail” refers to a company that is large in scale and has a strong position. Once collapsed, that company will become a giant domino, knocking down a series of other factors in the market.

Looking back at the past, we have seen many once great empires fall. For example, Lehman Brothers was founded in 1847 and was once the 4th largest investment bank in the US. The wound left by Lehman Brothers contributed to the financial crisis in 2008. The 150-year-old Nokia legend was also not exempt from fate. Yahoo, the social network that once took the 8x generation by storm, has gradually died under other competitors.

Therefore, the first lesson is not only for independent investors but also for investment funds: Anything can always happen. No matter how big a company is, it can go bankrupt.

Read more FTX's bankruptcy journey .

Story of faith

The second lesson is actually somewhat related to the first lesson. Let's ask: Why do many people think that FTX is unlikely to collapse?

After all, the essence of the problem lies in our beliefs. If you put your trust in the wrong person and lose money, you don't need to be too miserable or torment yourself. This can be a valuable lesson for you, me and many others in the future.

Not only ordinary investors, but also experienced traders find it difficult to escape this psychological trap. Even large investment funds like Multicoin Capital have expressed the view that FTT cannot fail after Coindesk leaked its balance sheet. After FTX filed for bankruptcy, Kyle Samani, founder of Multicoin, quietly deleted his previous tweets defending FTX.

Sam Bankman-Fried possesses an image of power. Source: Bloomberg.

Sam Bankman-Fried possesses an image of power. Source: Bloomberg.

Most people see Bankman-Fried as a talented young man with a lot of money and connections, even related to American politics. Bankman-Fried spent about 400 million USD to support the Democratic Party in the US election race. With such a powerful force behind him, will Bankman-Fried surely be able to overcome this incident? As a result, Bankman-Fried could do nothing but file for bankruptcy.

In investing, trust probably accounts for about 70-80% of the factors that determine the price of a coin or token. FTT is no exception. Previously, when I bought FTT, I believed that Bankman-Fried was a good person, FTX was a developing exchange and the applicability of FTT in the future would be extremely open.

Or with Bitcoin, we buy Bitcoin not really to pay for goods (in places that accept this means of payment). We buy because we believe that Bitcoin will gain more attention and thereby increase its price sharply in the future.

Thus, the price of an asset is made up of two factors: belief and value. If the belief is too great compared to the value, this may be a bubble. And in the case of broken trust, that bubble will explode very loudly and very quickly.

Famous YouTuber Nas Daily once had a video with millions of views expressing respect for Bankman-Fried. However, after the incident, he decided to delete that video and make a new one expressing the opposite point of view. Nas has lost trust with Bankman-Fried. Nas's friend lost his retirement fund when depositing money on FTX.

From being the idol of many people, praised by the media as a crypto "prodigy", now the words used to describe Bankman-Fried are only negative. The price of an asset is made up of beliefs. When trust was broken, people turned away, FTT's price began to plummet. When FTT collapsed, Bankman-Fried tried to raise more capital but failed. If it were before, Bankman-Fried could easily call for millions and billions of dollars. Considering the current situation, few people still want to enter FTX's deal with dozens of problems like that.

summary

What I want to send today is to be alert and mentally prepared for all events. For investors, you can completely put your trust in the wrong place. We are still human after all and sometimes we can make mistakes. However, don't let yourself get lost in that blind belief. Be careful and stop in time to protect yourself. With projects, remember that community trust is the key factor determining the product's future. When trust is broken, the situation will be very difficult to salvage.

Read more: Sam Bankman-Fried's flip.