Solana Price Prediction: SOL likely to fall another 20% before buyers step in

- Solana price has faced intense selling pressure around the $200 psychological level.

- Technicals hint at another 10% to 20% correction on the cards for SOL.

- Sidelined buyers could get a buying opportunity on the potential retest of $134.

Solana (SOL) price has undone half of the gains noted in the past week as it trades below the $200 psychological level. This bearish outlook could lead to further corrections over the weekend or the next week.

Also read: Solana failed transactions exceed 70% as meme coin frenzy attracts bots

Solana price needs a breather

Solana price has shot up 1022% since September 2023. The two main reasons for this mind-melting rally are Bitcoin’s bull run and the overselling of SOL due to its connection with the now-bankrupt crypto exchange FTX. Last week, Solana soared 39%, registering the highest weekly gain of 2024.

But in the past five days, Solana price faced massive rejection around the $200 psychological level and is currently trading nearly 16% lower than the previous week’s closing level. This correction is potentially aided by:

- Bitcoin’s bearish outlook: BTC is crashing ahead due to the weekly sell signal. As profit-taking ensues, the pioneer cryptocurrency will likely take altcoins down with it.

- Bearish divergence: The weekly SOL chart has spawned a higher high while the Relative Strength Index (RSI) has formed a lower high, indicating a non-conformity termed bearish divergence. This setup often signals a slowdown in momentum which leads to a potential reversal or a short-term pullback.

- MRI's potential sell signal: The Momentum Reversal Index (MRI) has flashed a yellow down arrow, which spawns on the eighth consecutive up candlestick. This development warns that the next up candlestick for SOL would flash a sell signal that forecasts a one-to-four down candlesticks.

Considering the bullish market conditions, a reversal is unlikely, which suggests that SOL is in for a correction. Additionally, the bear market that began in early November 2021 saw a dead cat bounce to $200, which is where SOL is currently facing another sell-off. Therefore, the stable support levels where buyers might find Solana price attractive include the weekly foothold at $152 followed by $134, which is the midpoint of the previous bear market crash.

Ideally a sweep of the $134 would be the best place for accumulation, but due to the extremely bullish outlook investors should note that this move would be have low probability of occurring.

Read more: Meet the woman behind Solana hit meme coin ‘Doland Tremp’ SOL/USDT 1-week chart

SOL/USDT 1-week chart

On the other hand, if Solana price flips the $200 psychological level prematurely, the chances of an uptrend continuation are high. However, if Bitcoin price continues to shed, then SOL could follow in its footsteps.

A decisive weekly candlestick close below $134 would suggest a potential shift in trend. This development could attract weak hands to sell their holdings. If the panic sell-off has enough strength to push Solana price to produce a weekly close below $100, it would invalidate the bullish outlook. In such a case, Solana price could crash 11% and revisit the $89 support level.

Also read: Slerf appeals for donors to make presale investors whole for the lost $10 million

Cryptos feed

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Join Telegram

Bitcoin Price Outlook: How many more stabs at the lows before BTC aims for $70K?

- Bitcoin price is forming a falling wedge pattern on the 8-hour time frame amid ongoing profit booking and heightened volatility.

- JPMorgan anticipates a larger sell-off, saying BTC is still overbought despite the ongoing correction.

- Halving is out around four weeks, expected to kick-start the next bullish cycle, but the bank anticipates even more selling thereafter.

Bitcoin (BTC) price is suffering the implications of bearish sentiment related to a slow down in spot BTC ETF flows. As the influence of this fundamental continues to wane and with the halving coming in a few weeks, investment bank JPMorgan says the market should brace for even more sell offs.

Also Read: Bitcoin Weekly Forecast: BTC may have recovered, but is it out of the woods?

BITCOIN, ALTCOINS, STABLECOINS FAQS

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

What are stablecoins?

What is Bitcoin Dominance?

How many more stabs at the lows before Bitcoin aims for $70K?

Bitcoin price is still shedding with the dump now going into two full weeks. Analysts ascribe this to ongoing outflows, an outcome that continues to spell bearish sentiment in the market. For instance, BlackRock, the issuer of the GBTC spot BTC ETF, had recorded nearly $13 billion in outflows year-to-date as of March 21. This marked the biggest outflow among over 3,400 US-listed ETFs.

$GBTC getting a 'second wind' of outflows, $1.4b this week along, now double any other ETF in outflows YTD and have set record for cumulative outflows for any ETF in history. All that and they STILL rank 3rd overall (out of 3,400 ETFs) in annual revenue generated. https://t.co/HitMwpu7dR

— Eric Balchunas (@EricBalchunas) March 21, 2024

Meanwhile, American multinational financial institution JPMorgan anticipates an extended fall in Bitcoin price, adding that BTC is still overbought even as the dump continues. Speaking to a news site, Nikolaos Panigirtzoglou, an analyst and managing director at JPMorgan, attributed the dump to profit booking. Panigirtzoglou added that this could continue into the halving event, which now stands around 32 days away, according to NiceHash.

One of Nansen’s analysts, Aurelie Barthere, told FXStreet that the firm’s risk management indicators turned risk-off last week, signaling at least a pause in the BTC rally.

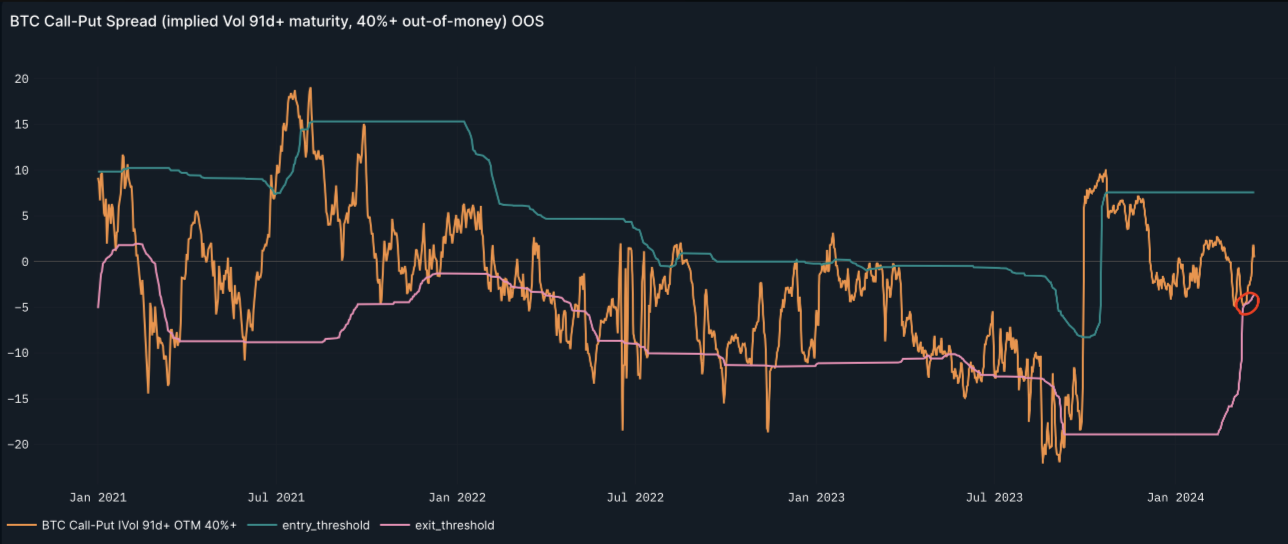

“Our main scenario is that this is likely a consolidation in the crypto bull run and not the end of it,” said Barthere, adding, “The arguments in favor of this scenario are: crypto and other risk assets are now out of the way, with a re-pricing (one less Fed rate cut in 2025) now having digested The FOMC meeting. If this scenario materializes, BTC is likely to revisit all-time highs. The proximity of the BTC halving is of course also helping.” BTC call-put spread

BTC call-put spread

While JPMorgan anticipates even more profit booking post-halving, Barthere said, “The data we will watch is the release of the US March 2024 CPI report on April 10.”

Bitcoin price outlook as JPMorgan anticipates more selling pressure

Bitcoin price remains in a downtrend amid increasing bearish calls among investors. While it continues to hold above the ascending trendline, the market is strongly leaning toward the downside, and BTC price could extend the fall.

The Relative Strength Index (RSI) is moving below the 50 mean level and has crossed below its signal line (yellow band), denoting a bearish stance. The Awesome Oscillator is also in negative territory, accentuating the bearish thesis.

Increased profit booking could see Bitcoin price extend the fall, with a slip below the trendline clearing the clog for BTC to test the support at $60,840. In a dire case, the slump could extrapolate for a liquidity sweep before a potential recovery. BTC?USDT 8-hour chart

BTC?USDT 8-hour chart

On the other hand, if buyers come in at current levels, Bitcoin price could start recovering. While shattering the upper boundary of the wedge pattern would be a good sign, overcoming the $69,000 threshold would be the sounding bell that could draw in more buyers.

If the bulls manage to push Bitcoin price above the $70,080 resistance level, the next logical move would be to clear the $73,777 peak before a possible foray beyond $74,000.

Also Read: Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Crashing spot ETF flows ferment BTC investor sentiment

Cryptos feed

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Join Telegram

Bitcoin Cash (BCH) and Solana (SOL) Advocates Align with Pushd (PUSHD), Foreseeing an Uprising in Online Retail

The crypto space is undergoing even more change and investors who can take advantage of it could become very rich from it. From the Bitcoin (BTC) halving to an expected Q2 bull run, there is so much that could happen in the next few months. Preparing for it all is no easy task but it can be made a little easier if you know where to look.

The crypto space is undergoing even more change and investors who can take advantage of it could become very rich from it. From the Bitcoin (BTC) halving to an expected Q2 bull run, there is so much that could happen in the next few months. Preparing for it all is no easy task but it can be made a little easier if you know where to look.

Our analysis helps readers align themselves with the market and make the best choices. This article arms readers with the necessary information needed to go from being average investors to extremely successful ones. Our focus for this article will be on a new opportunity, Pushd (PUSHD) and tokens like Bitcoin Cash (BCH) and Solana (SOL) which are buying it.

Bitcoin Cash (BCH) Cruising

Bitcoin Cash (BCH) is a permissionless payment medium modelled after Bitcoin (BTC). It makes international transactions easy and fast. Bitcoin Cash (BCH) has moderate popularity and is relied on by a decent number of people.

For chart movements, Bitcoin Cash (BCH) is worth $419.61 per unit at press time. It is growing at pace, already 55% better than 30 days ago. Despite the market crash, it is only 5.10% less in 24 hours on March 22.

Solana (SOL) Hours Away from a $200 Return

Solana (SOL) is a super fast decentralized blockchain network. It was designed as an alternative to Ethereum (ETH) with a focus on speed and cost efficiency. Solana (SOL) sees some of the most traffic on any network and remains very popular.

Its price has been steadily, up to $176 per Solana (SOL) as of press time. Solana (SOL) has gained 2.41% from a week ago, in a period where most other tokens are struggling. Its 30 day analysis shows it has improved by over 65% going back a month.

Pushd (PUSHD) Gets More Investors

The number of new sign ups for Pushd (PUSHD) is going up very fast in the last few days. It appears as if interest in the token is skyrocketing. Some of this can be attributed to the condition of the market but there appears to be growing interest in the project.

Pushd (PUSHD) is a decentralized digital store. Users can sign up, buy and sell goods on the platform. It offers many benefits like low fees and instant transactions. Pushd (PUSHD) challenges the status of e-commerce and alters it with blockchain technology.

It makes it easier to get goods from far away and is more beneficial to sellers with its rates and commissions. Pushd (PUSHD) also provides many rewards for users who complete tasks or milestones on the platform.

Buying Pushd (PUSHD) seems like a smart idea. It only costs $0.125 and has good rewards for investors who buy. It also pays out money to presale investors so there are many ways to earn with Pushd (PUSHD).

Find out more about the Pushd (PUSHD) presale by visiting the website here.