20 Best KYC Providers in 2024 (part2)

8. Sumsub

Founded in 2015, the Sumsub platform offers a range of features, including document verification, facial recognition, biometric authentication, and screening against various global sanctions and watchlists.

Sumsub serves a diverse range of industries, including finance, fintech, e-commerce, cryptocurrency, and gaming. The company prioritises user experience, data security, and compliance effectiveness in its offerings, aiming to provide reliable and scalable solutions for identity verification and compliance.

9. Seon

Seon is a company specialising in fraud prevention and detection solutions, particularly in online identity verification and risk management. Founded in 2015, Seon provides a platform that helps businesses identify and mitigate various fraudulent activities, including account takeover, payment fraud, identity theft, and synthetic fraud.

The Seon platform offers KYC tools and features to analyse user behaviour, detect suspicious activities, and prevent fraudulent transactions. These tools include device fingerprinting, IP geolocation, email and phone number verification, transaction monitoring, and machine learning algorithms for fraud detection.

Seon serves various industries, including finance, e-commerce, online gaming, travel, and telecommunications. The company prioritises accuracy, scalability, and ease of integration in its offerings, aiming to empower businesses to detect and prevent fraud while maintaining a seamless user experience for their customers.

10. Ondato

Founded in 2016, Ondato offers a comprehensive platform that uses artificial intelligence and machine learning technologies to streamline business identity verification processes.

Founded in 2016, Ondato offers a comprehensive platform that uses artificial intelligence and machine learning technologies to streamline business identity verification processes.

Ondato’s platform includes features such as document verification, facial recognition, biometric verification, and screening against various global sanctions and watchlists.

Ondato caters to various industries, including banking, fintech, cryptocurrency, e-commerce, and telecommunications, helping organisations of all sizes implement robust identity verification processes and safeguard against fraudulent activities.

11. IDwise

IDWise is pioneering in revolutionising remote digital customer onboarding through its cutting-edge automated AI-based global identity verification and e-KYC solution.

Their commitment to utilising the latest advancements in AI technology sets them apart, empowering trust across some of the world’s largest and fastest-growing markets, with a strategic focus on developing markets in the Middle East, Africa, and Southeast Asia.

Headquartered in London, UK, IDWise boasts a dynamic team of 35 dedicated “IDWisers” operating across four countries. Their client base includes large enterprises, encompassing six countries and various industries, including fintech, crypto, transport, and logistics. IDWise has facilitated over 3 million digital onboardings through its platform within a year since its inception.

12. Refinitiv

Formerly known as the Financial and Risk business division of Thomson Reuters, Refinitiv was acquired by a consortium led by Blackstone Group LP in 2018. The company offers various products and services to financial institutions, corporations, governments, and individuals.

Refinitiv provides real-time and historical market data, including stock prices, indices, commodities, foreign exchange rates, and fixed-income securities data. Traders, analysts, and investors widely use this data for market analysis and decision-making.

It also offers trading platforms, execution systems, and investment management solutions for buy-side and sell-side firms. These platforms enable users to execute trades, manage portfolios, and access market research and analytics.

Refinitiv provides risk management solutions, including credit, market, liquidity, and compliance risk management tools. It also offers solutions for anti-money laundering, know-your-customer, and sanctions screening.

13. ComplyAdvantage

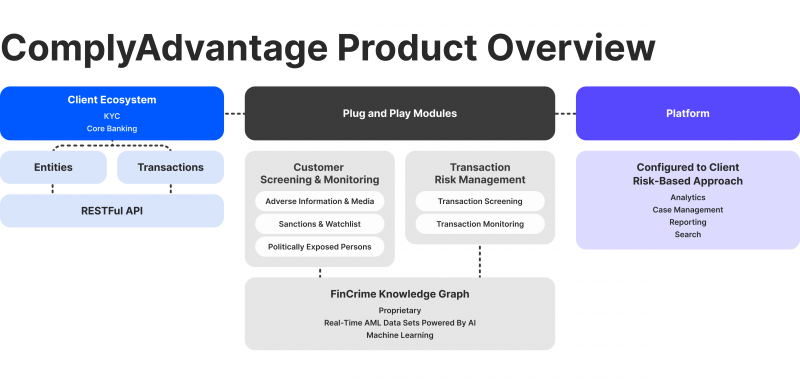

Established in 2014, ComplyAdvantage is a leading RegTech company headquartered in London. It specialises in robust KYC solutions to combat financial crime. Using advanced technologies like AI and machine learning, it assists organisations in fulfilling regulatory obligations and detecting fraud.

Established in 2014, ComplyAdvantage is a leading RegTech company headquartered in London. It specialises in robust KYC solutions to combat financial crime. Using advanced technologies like AI and machine learning, it assists organisations in fulfilling regulatory obligations and detecting fraud.

The company has expanded globally, offering services including AML onboarding, transaction monitoring, and real-time sanctions screening. Strategic partnerships with sync. and Kompli-Global have strengthened its offerings.

14. Mitek

Mitek Systems, Inc. is a global leader in mobile capture and digital identity verification solutions. Founded in 1986 and headquartered in San Diego, California, Mitek specialises in developing technologies enabling organisations to verify and authenticate identity documents, such as driver’s licences, passports, and ID cards, using mobile devices.

Mitek’s flagship product is Mobile Verify®, which allows users to capture and authenticate identity documents through a mobile app. Mitek’s solutions are used by various industries, including financial services, fintech, healthcare, and e-commerce.

In addition to Mobile Verify®, Mitek offers other solutions such as Mobile Deposit®, which enables users to deposit checks remotely using their mobile devices, and Mobile Fill®, which allows users to autofill forms using their mobile cameras.