A Professional Trading System

Combining Heiken Ashi Candles, EMA, and Ichimoku Kumo

In trading, the biggest problem is not a lack of indicators —

it is too much noise.

Traditional candlesticks, false signals, news volatility, and emotions often push traders into overtrading and impulsive decisions.

This article introduces a clean, real-world trading system built on three core components:

- Heiken Ashi Candles → Momentum clarity & noise reduction

- EMA (Exponential Moving Average) → Market structure & trend direction

- Ichimoku Kumo (Cloud) → Trend zones & no-trade areas

The goal is simple:

👉 Fewer trades – clearer trends – higher probability

1. Heiken Ashi Candles – Reading Momentum, Not Noise

Why not use standard candlesticks?

Traditional candles show raw price action, but they:

- Contain too many wicks

- Create confusion during consolidation

- Produce early false signals at the start of trends

What Heiken Ashi does differently

Heiken Ashi smooths price movement and answers one key question:

Is the market currently moving with strength?

Practical Heiken Ashi interpretation

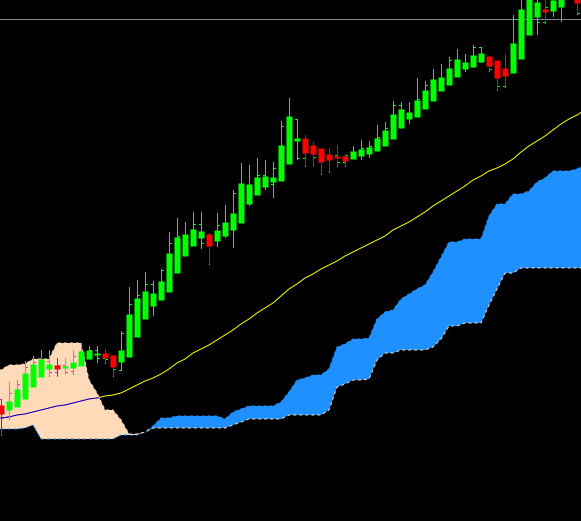

Strong bullish momentum

- Consecutive green candles

- Large bodies

- Little or no lower wicks

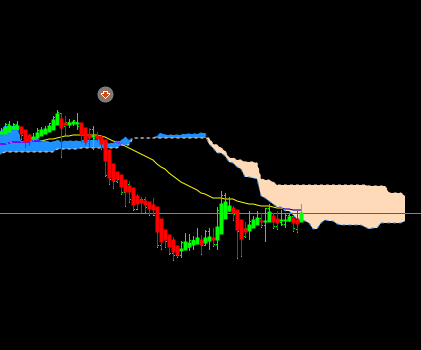

Strong bearish momentum

- Consecutive red candles

- Clear bodies

- Little or no upper wicks

No-trade warning

- Small mixed candles

- Long upper and lower wicks

- 👉 Market is ranging or distributing

⚠️ Never trade based on a single Heiken Ashi color change

Heiken Ashi is a confirmation tool, not a standalone trigger.

2. EMA – The Backbone of Trend Direction

Why EMA instead of SMA?

EMA reacts faster to price, making it suitable for:

- Scalping

- Intraday trading

- Short-to-medium trend following

Recommended setup

- EMA 50 → Primary trend filter

- (Advanced) EMA 200 → Higher-timeframe bias

Correct EMA trading mindset

Only BUY when:

- Price is above EMA 50

- EMA 50 is sloping upward

- Heiken Ashi remains bullish

Only SELL when:

- Price is below EMA 50

- EMA 50 is sloping downward

- Heiken Ashi remains bearish

📌 EMA is not for catching tops or bottoms

📌 EMA keeps you aligned with institutional flow

3. Ichimoku Kumo – Trend Filter & No-Trade Zone

The Ichimoku Cloud is the core filter of this system.

Real trading purpose of the Kumo

- Defines strong vs weak trends

- Separates trading zones from noise

- Prevents entering low-quality setups

Golden rules for using the Kumo

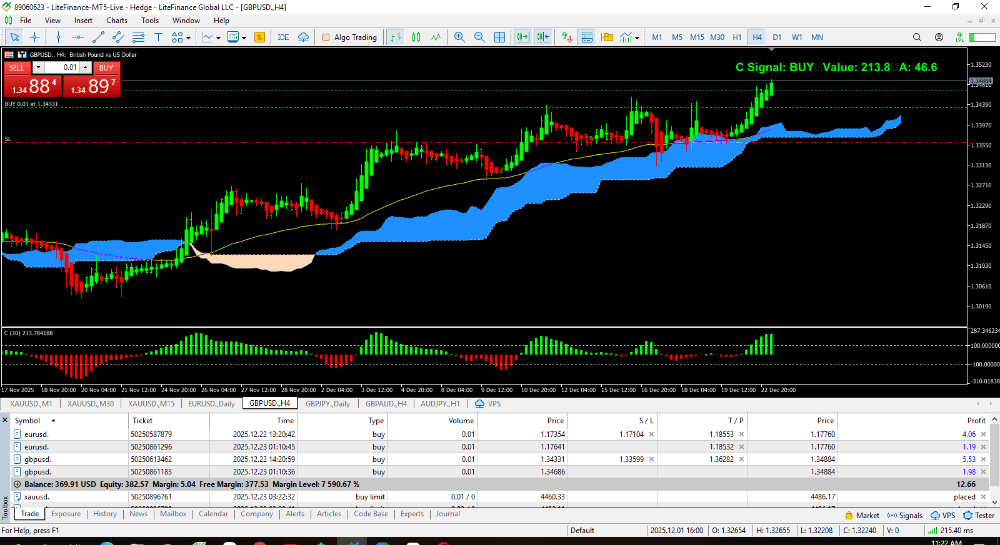

Safe BUY conditions

- Price above the cloud

- Future cloud is bullish

- Thick cloud → strong trend

Safe SELL conditions

- Price below the cloud

- Future cloud is bearish

- Thick cloud → stable momentum

⛔ Never trade inside the cloud

- This is a consolidation zone

- High stop-loss probability

- Most retail losses occur here

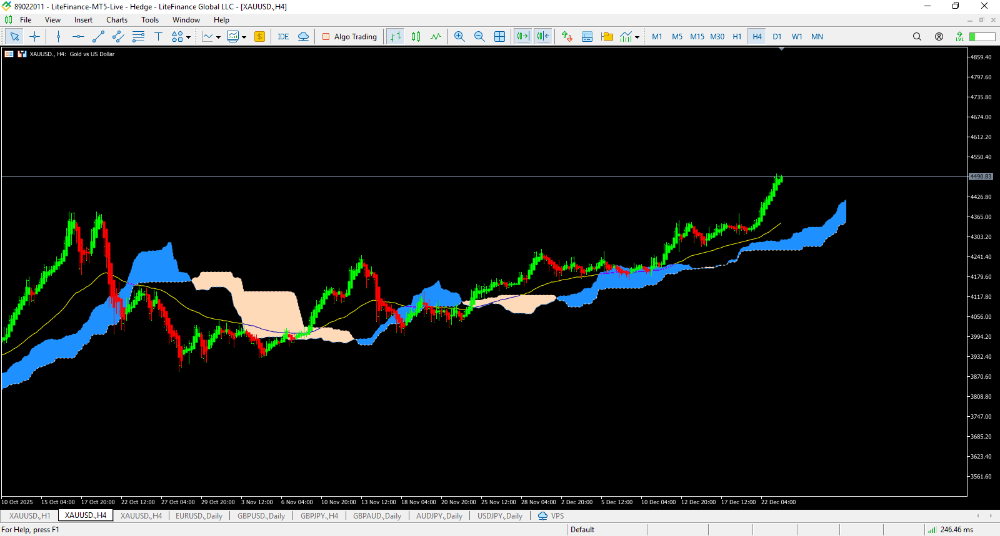

4. Combining Heiken Ashi, EMA & Kumo into One System

BUY setup example

- Price above the Kumo

- EMA 50 below price and sloping up

- Consecutive bullish Heiken Ashi candles

- No entries inside the cloud

👉 Enter BUY after the Heiken Ashi candle closes with confirmation

SELL setup example

- Price below the Kumo

- EMA 50 above price and sloping down

- Stable bearish Heiken Ashi candles

- Avoid selling directly into the cloud

5. Trade Management & Professional Mindset

- Stop Loss

- Below the nearest swing low (BUY)

- Above the nearest swing high (SELL)

- Never place SL emotionally

- Take Profit

- Minimum RR 1:1.5 – 1:2

- Or trail using Heiken Ashi color shifts

🧠 This system does not aim to catch tops or bottoms

🧠 It focuses on riding the main trend where capital flows

6. Common Mistakes Traders Make

❌ Trading inside the Kumo

❌ Using Heiken Ashi alone

❌ Trading against EMA due to “price is too far”

❌ Ignoring trend strength and context

👉 Losses come from discipline breakdown, not indicators

Final Thoughts

The combination of Heiken Ashi – EMA – Ichimoku Kumo is not a magic formula, but it delivers:

✔ Clear structure

✔ Reduced noise

✔ Strong discipline framework

✔ Suitable for both manual trading and EA automation

If you want:

- A clean, rule-based system

- Fewer but higher-quality trades

- A solid foundation for algorithmic trading

👉 This is a system worth mastering seriously.

This article is for educational purposes only and not financial advice.

If you want deeper breakdowns, real trade examples, or EA logic implementation, feel free to engage in the comments — I’ll share practical insights step by step.

read all my blog https://ea-fx-gold.blogspot.com/