A REAL-ACCOUNT TREND TRADING SYSTEM

Combining Heiken Ashi Candles & Kumo Cloud for High-Probability Trades

This article shares a real trading system used on a live account, not a demo and not theoretical concepts.

The core idea of this system is simple:

Trade only when the trend is clear, momentum is strong, and risk is controlled.

There is no prediction, no guessing tops or bottoms — only confirmation and discipline.

1. Why Combine Heiken Ashi and Kumo Cloud?

Most traders fail because they:

- Enter too early

- Trade against the main trend

- React emotionally to market noise

This system solves those problems by combining:

- Heiken Ashi candles → smooth price action & filter noise

- Kumo (Ichimoku Cloud) → define trend direction and market structure

Together, they create a clean, visual, rule-based framework that works well in real trading conditions.

2. Role of Heiken Ashi Candles (Entry Clarity)

Heiken Ashi candles do not show raw price — they show average price behavior, which helps identify true momentum.

How Heiken Ashi is used:

- Strong BUY bias

- Consecutive green Heiken Ashi candles

- Little or no lower wicks

- Strong SELL bias

- Consecutive red Heiken Ashi candles

- Little or no upper wicks

🔹 This removes hesitation caused by normal candle noise

🔹 Prevents over-trading in choppy markets

🔹 Keeps the trader aligned with momentum, not emotions

3. Role of the Kumo Cloud (Trend Filter)

The Kumo Cloud is the core trend filter of the system.

Market conditions:

- Price above the Kumo

- → Market is bullish → ONLY BUY setups allowed

- Price below the Kumo

- → Market is bearish → ONLY SELL setups allowed

- Price inside the Kumo

- → Market is unclear → NO TRADE

📌 This single rule eliminates most losing trades caused by sideways markets.

4. Signal Confirmation Logic (C + A Engine)

Beyond visual trend confirmation, the system uses internal logic:

- C (Momentum Engine)

- Derived from CCI

- Confirms that momentum is strong (e.g. above +100 or below −100)

- A (Trend Strength Filter)

- Derived from ADX

- Ensures the trend has real strength, not false movement

A valid trade requires:

✔ Price clearly above/below Kumo

✔ Heiken Ashi candle agrees with direction

✔ Momentum (C) confirms strength

✔ Trend strength (A) above threshold

Only when ALL conditions align → trade is executed.

5. Entry, Stop Loss & Take Profit Rules

This system prioritizes capital protection.

Entry:

- At candle close after full confirmation

- No chasing price, no impulsive entries

Stop Loss:

- Placed beyond recent structure

- Always defined before entering the trade

Take Profit:

- Based on Risk–Reward, minimum 1:1

- Often extended to 1:1.5 or 1:2 in strong trends

📌 Small position size (e.g. 0.01 lot) is used consistently to reduce psychological pressure.

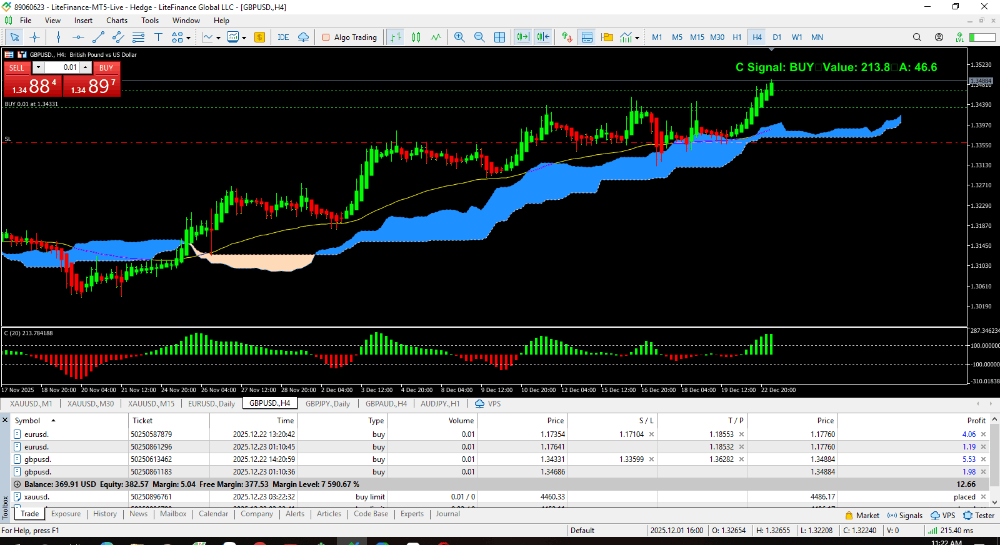

6. What You See in the Real Account Screenshot

From the live account shown:

- Trades are selective, not frequent

- Drawdown is controlled

- Profits are built step by step

- No martingale, no grid, no gambling behavior

This is how professional consistency looks — not flashy, but sustainable.

7. Who This System Is For

✔ Beginner traders who want clear rules

✔ Intermediate traders seeking consistency

✔ Traders planning to automate (EA-ready logic)

✔ Those who prefer Forex pairs over Gold or Crypto

8. Honest Reality Check

This system:

- ❌ Does NOT win every trade

- ✅ DOES control losses

- ✅ DOES survive bad market phases

- ✅ Focuses on long-term account growth

Trading is not about being right every time.

It’s about staying in the game long enough for probability to work.

⚠️ This article is for educational purposes only and not financial advice.

If you want deeper breakdowns of specific trades, logic diagrams, or EA implementation ideas, feel free to engage in the comments — I’ll share more real-world insights step by step.

read all my blog https://ea-fx-gold.blogspot.com/