DeFi Development for Higher ROI: What You Need to Know

The world of decentralized finance has moved fast — faster than most expected. What started as an experimental alternative to traditional banking has matured into a fully functioning financial ecosystem where lending, staking, earning yield, and exchanging assets happen without middlemen. Behind every successful protocol, however, sits careful planning, robust architecture, and the guidance of an experienced DeFi Development Company that understands how markets behave.

Higher ROI in DeFi doesn’t happen by luck. It happens through decisions — technical, economic, and strategic. This article breaks down the factors that actually influence return on investment in DeFi, how development strategy shapes sustainability, and what builders and investors should evaluate before stepping in.

Why DeFi Has Become a Major ROI Channel

Traditional finance is built on layers: verification, custody, settlement, transfer. DeFi strips these layers down to automated smart contracts. When systems are lean, transactions cost less, processes run faster, and capital moves globally without friction. This efficiency alone creates an environment where ROI has room to grow.

Some of the key growth drivers include:

- Lower operational overhead

- No centralized authorities or gatekeepers

- Passive yield through staking or liquidity pools

- High-velocity asset movement

- Fee-sharing opportunities for participants

When designed thoughtfully, DeFi can provide strong yields without requiring constant manual intervention — a reason both builders and users gravitate toward it.

How DeFi Development Leads to Better ROI

Different DeFi models produce value in different ways. Understanding them helps set realistic expectations.

Yield Aggregation & Farming

Users contribute liquidity to pools and earn rewards from trading fees. Well-balanced liquidity pools encourage participation, increasing both TVL and platform income.

Staking Mechanisms

Token holders lock assets to secure networks or support project stability. With enough volume, staking APY can remain competitive while still profitable for the protocol.

Lending & Borrowing Systems

Interest-based lending generates continuous revenue streams. With collateral-backed borrowing, risk remains controlled while liquidity circulates.

Automated Market Makers (AMM)

Decentralized swaps allow continuous trading without order books. Higher trading volume often correlates with higher fee collection.

In all four cases, intelligent DeFi Development — especially around smart contract design, risk management, and incentive structure — directly influences long-term returns.

Technical Elements That Influence Profitability

Strong returns don’t come only from token value; they come from infrastructure that supports scale. A well-built DeFi project usually focuses on:

Smart Contract Quality

Audited, gas-efficient, upgradeable contracts reduce attack surface and operational cost. Security failures drain ROI faster than anything else.

Tokenomics Design

Inflation, deflation mechanics, vesting schedules, reward emissions — these details decide whether a token grows or collapses under volume. Sustainable growth comes from balanced distribution, not aggressive short-term incentives.

Multi-Chain Interoperability

The ability to operate across chains like Ethereum, BNB Chain, Polygon, or Solana expands liquidity and user reach. More inflow = more opportunity for yield.

Security Measures

Pen-testing, code audits, bug bounties, monitoring — security may not directly generate profit, but it protects the yield you already earned. In DeFi, preservation of capital is part of ROI.

A well-structured system sets the foundation, yet real growth often depends on user trust, transparency, and stable participation.

Example Scenario: How ROI Scales in Practice

Consider a lending protocol reaching a TVL (Total Value Locked) of $8 million. If the platform charges a 0.3% interest margin above borrower APR, the monthly yield could exceed $24,000 with stable activity. This doesn’t include staking rewards, governance incentives, or liquidity pool fees — only operational spread.

Even moderate adoption, when sustainable, can create long-term earning potential. It highlights why planning, not just launching, determines success.

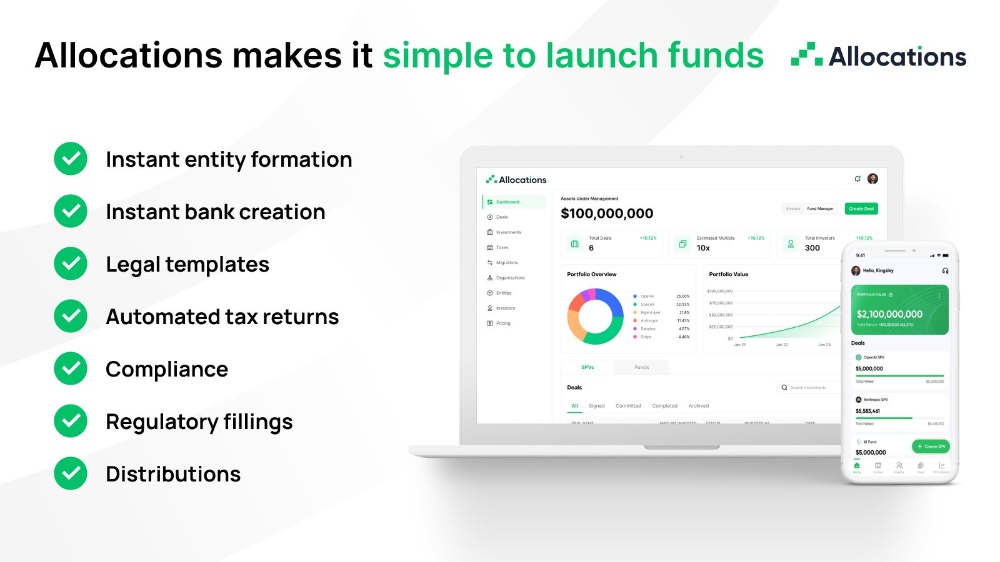

Selecting a DeFi Development Company — Key Factors to Evaluate

This choice shouldn’t be rushed. A development team influences security, performance, and user trust from day one.

Look for:

- A portfolio with live DeFi deployments

- Experience with smart contract audits and safe coding standards

- Capacity to build scalable infrastructure

- Understanding of tokenomics and incentive balance

- Transparent documentation and reasoning behind decisions

You’re trusting someone with economic architecture. Competence matters more than speed or hype.

Final Takeaway

DeFi is not guaranteed profit, but it is a realistic path to ROI when built with purpose. Smart development, security-first design, and balanced tokenomics create systems that last long after market hype fades. A knowledgeable DeFi Development Company can help translate ideas into working infrastructure — but the best outcomes come from asking the right questions and planning for sustainability over speculation.

The formula is simple:

Clear use case → secure architecture → scalable tokenomics → consistent yield → long-term returns.

FAQ

What does DeFi development involve?

The process includes smart contract coding, security audits, tokenomics design, dashboard integration, liquidity architecture and post-launch maintenance.

How can DeFi generate ROI?

ROI comes from staking rewards, yield farming, lending interest, AMM fees, governance incentives and long-term token appreciation.

Is DeFi safe for investors?

DeFi carries risk — especially with unaudited code or unstable tokenomics. Security reviews, audits, liquidity safeguards, and transparent governance reduce exposure.

Do all DeFi projects profit long-term?

No. Projects without strong tokenomics, security, or a real use-case often fail. Sustainability matters more than high short-term APY.

What should I evaluate before entering DeFi?

Consider platform credibility, audit records, liquidity depth, community transparency, and how rewards are distributed over time.