How investment works

Investing is less about chasing quick wins and more about building quiet discipline over time. At its core, investing is the decision to delay consumption today so your money can grow and work for you tomorrow. It is not gambling, and it is not guesswork. It is strategy, patience, and consistency.

The most successful investors understand one simple truth: time in the market beats timing the market. Trying to predict every rise and fall often leads to emotional decisions. Instead, steady contributions into well researched assets whether stocks, bonds, real estate, or emerging technologies allow compounding to do the heavy lifting.

Risk is unavoidable, but it can be managed.

Diversification spreads exposure.

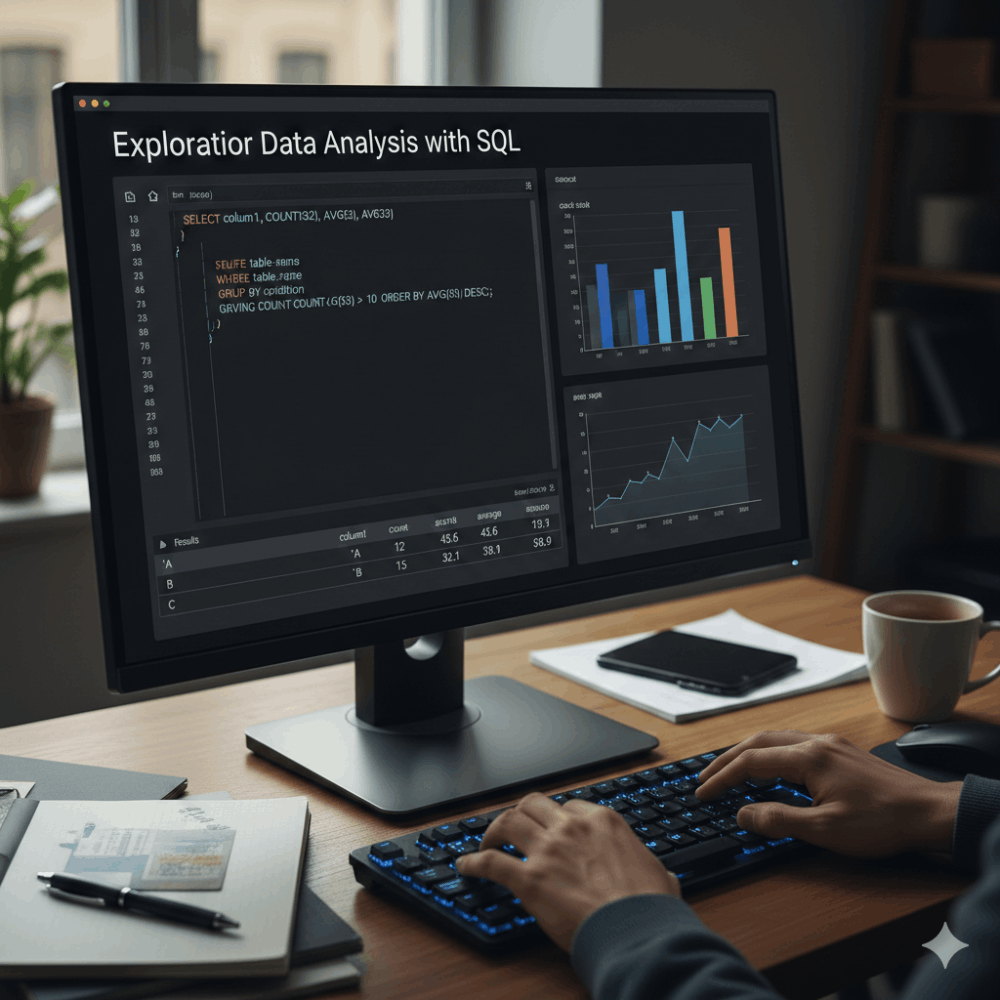

Research reduces uncertainty.

Long term thinking filters out noise.

Markets will fluctuate.

Headlines will create fear and excitement. The disciplined investor stays focused on fundamentals and avoids reacting to every trend.

Equally important is self awareness. Your goals, timeline, and risk tolerance should shape your strategy. Investing for retirement looks different from investing for short term growth. Clarity prevents costly mistakes.

Ultimately, investing is about ownership. It is about placing your capital into ideas, businesses, and systems you believe will create value. Done wisely, it transforms income into independence and turns patience into power.