What does whale mean in cryptocurrencies?

With the popularity of cryptocurrency, many terms are emerging. There are many things that cause cryptocurrencies to rise and fall. Turmoil in the stock markets and inflation announcements of countries also cause fluctuations in cryptocurrencies.

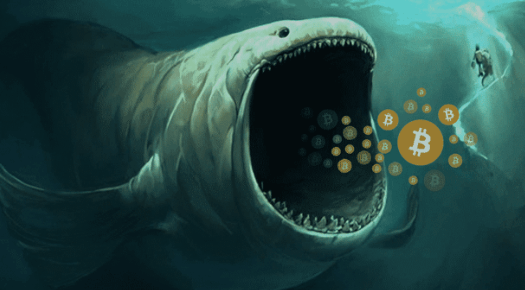

The main reasons are institutions and people called cryptocurrency whales. The frequently asked and highly curious question of what crypto money whale means is also an indicator of people who invest or are considering investing.

What does 'whale' mean in cryptocurrencies?

In the cryptocurrency exchange, the term 'whale' is used to describe individuals or organizations that own large amounts of a particular cryptocurrency. As these individuals or institutions hold large amounts of coins, they become valuable enough to manipulate the valuation of the particular cryptocurrency.

Whale movement is a signal to significant impact on the price of a cryptocurrency depending on the size, source and destination of the transaction. Whales are attracting more attention, especially considering the recent fluctuations.

Who are the cryptocurrency whales?

Whales can be individuals as well as investment firms and funds. The most important effect of whales is that they can instantly take the money out of your hands and drop the cryptocurrency. Cryptocurrency whales, which vary according to the volume of each cryptocurrency, also have a way of manipulating the stock market due to Bitcoin's limited mining capacity.

The best example for cryptocurrency whales is that although 15 percent of Americans are in crypto exchanges, only 100 people in the world can exchange Bitcoin as they wish. Some Bitcoin balias are as follows:

Satoshi Nakamoto

Tim Draper

Barry Silbert

How do cryptocurrency whales trade?

Bitcoin whales were initially traded on the most liquid Bitcoin exchanges. But with the advancement of the digital asset world, OTC brokers have begun to serve large Bitcoin investors to maintain anonymity and achieve greater liquidity.

OTC brokers, in some cases, provide liquidity on different exchanges in order to close trades and reduce the impact of large trades on the market.