Regulatory Crackdowns: Navigating Mining Bans and Compliance in 2025

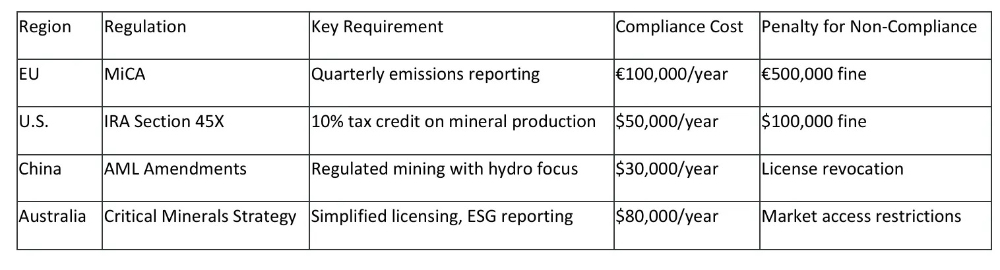

- Regulatory Landscape: EU’s MiCA and U.S. tax policies impose strict energy and financial reporting, reshaping global mining operations.

- Compliance Solutions: AI-driven RegTech and renewable energy adoption help miners meet mandates while sustaining profits.

- Global Trends: China’s mining resurgence and ESG-driven policies highlight a shift toward sustainable, transparent practices.

The Shifting Sands of Crypto Mining Regulation

Cryptocurrency mining, the computational engine securing Proof-of-Work (PoW) blockchains like Bitcoin, faces unprecedented regulatory scrutiny in 2025, driven by environmental and financial concerns. With Bitcoin’s $2.5 trillion market cap and a 700 EH/s hashrate, the $1.55 billion mining industry navigates a complex web of global policies, from the EU’s Markets in Crypto-Assets (MiCA) framework to U.S. tax incentives under the Inflation Reduction Act (IRA). Miners must balance profitability with compliance as governments target energy-intensive operations and tax evasion risks. The resurgence of mining in regions like China, alongside bans in high-energy-cost areas, underscores a dynamic regulatory landscape that demands strategic adaptation to sustain operations in a decentralized ecosystem.

Navigating the EU’s Energy Reporting Mandates

The EU’s MiCA regulation, fully implemented in 2025, mandates detailed energy consumption and emissions reporting for mining crypto coins like Bitcoin and Ethereum Classic, aiming to align with the European Green Deal’s 2030 climate goals. Miners must submit quarterly reports quantifying Scope 1 and 2 emissions, with 60% of Bitcoin’s hashrate now powered by renewables like hydro and solar to meet these standards. Non-compliance risks fines up to €500,000 or exclusion from EU markets. Platforms like ECOS integrate AI-driven RegTech to streamline reporting, while firms like CleanSpark, operating 40.1 EH/s in Iceland, leverage 99% geothermal energy to comply. Compliance strategies include:

1. AI Analytics: Tools forecast emissions, ensuring MiCA compliance.

2. Renewable Integration: 60% of EU mining uses clean energy.

3. Blockchain Transparency: Public ledgers verify emissions data.

4. LDAR Programs: Leak detection and repair systems reduce methane emissions.

5. Cross-Functional Governance: Legal and finance teams align on reporting.

U.S. Tax Policies and Incentives

In the U.S., the IRA’s Section 45X offers a 10% tax credit on critical mineral production costs, benefiting miners of lithium and cobalt but not yet covering Bitcoin mining extraction. Proposed expansions, expected by Q4 2025, may include crypto mining, incentivizing firms like Marathon Digital (53.2 EH/s) to invest in Texas’ solar-powered grids. The SEC’s 2025 climate disclosure rules require Scope 1 and 2 emissions reporting, with potential fines of $100,000 for non-compliance. Miners counter these costs with renewable energy adoption and tax-advantaged structures in states like Wyoming. U.S. policy impacts include:

1. Tax Credits: IRA’s 10% credit boosts critical mineral mining.

2. SEC Disclosures: Mandatory emissions reporting starts Q1 2025.

3. State Incentives: Wyoming offers tax exemptions for crypto miners.

4. Compliance Costs: $50,000-$200,000 annually for reporting systems.

Global Trends and China’s Resurgence

China’s 2025 policy shift, integrating crypto under AML regulations, has restored its 20% share of Bitcoin’s hashrate, centered in Sichuan’s hydro-powered farms. Globally, 100+ new mining policies emerged from 2020–2022, reflecting ESG priorities, with Australia and Canada offering tax breaks for sustainable mining. Kazakhstan’s high electricity costs ($0.12/kWh) led to a 5% hashrate drop, while El Salvador’s geothermal mining produced 474 BTC in 2025. Regulatory trends include:

- ESG Mandates: EU and Canada prioritize low-carbon mining.

- China’s Hydro Focus: 50 EH/s from Sichuan’s 40 GW hydro capacity.

- Global Diversification: Oman and UAE expand gas-powered mining.

- Policy Harmonization: OECD’s due diligence aligns supply chains.

Compliance Solutions for Profitability

Miners adopt AI-driven RegTech, like Chainalysis, to automate emissions and financial reporting, cutting compliance costs by 30%. Renewable energy, powering 60% of global hashrate, reduces electricity expenses to $0.03-$0.06/kWh in regions like Iceland and Canada. Firms like Bitfarms use immersion cooling to save 15% on energy, maintaining margins post-2024 halving (3.125 BTC reward). Strategic partnerships with local grids, as seen in Gridless’ Zambian operations, electrify communities while ensuring compliance. Solutions include:

- RegTech Adoption: AI tools streamline MiCA and SEC reporting.

- Renewable Energy: Solar and hydro cut costs and emissions.

- Community Partnerships: Miners fund local infrastructure for ESG credits.

- Tax Optimization: Wyoming and Texas offer crypto-friendly tax regimes.

Conclusion

In 2025, crypto mining navigates a tightening regulatory landscape, with the EU’s MiCA and U.S. IRA shaping operations in a $1.55 billion industry. China’s hydro-powered comeback, contributing 20% to Bitcoin’s hashrate, underscores global diversification, while ESG-driven policies push miners toward renewables and transparency. AI-driven RegTech, renewable energy, and strategic partnerships enable compliance without sacrificing profitability, as seen in firms like CleanSpark and ECOS. As regulations evolve, miners balancing innovation and accountability will thrive, sustaining Bitcoin’s $2.5 trillion ecosystem and driving a projected $2.83 billion market by 2032.

FAQ

1. What are the EU’s MiCA requirements for miners in 2025?

MiCA mandates quarterly Scope 1 and 2 emissions reporting, with 60% of mining using renewables to meet 2030 climate goals, risking €500,000 fines for non-compliance.

2. How do U.S. tax policies affect crypto mining?

The IRA’s 10% tax credit supports critical mineral mining, with proposed expansions potentially covering Bitcoin mining, while SEC rules require emissions disclosures.

3. Why is China’s mining resurgence significant?

China’s AML-regulated hydro farms contribute 20% to Bitcoin’s 700 EH/s, leveraging $0.03/kWh electricity to challenge U.S. dominance.

4. How can miners comply with global regulations?

Miners use AI-driven RegTech for reporting, adopt 60% renewable energy, and partner with grids to meet ESG and financial mandates.

5. What role do new mining coins play in compliance?

Coins like Kaspa and ETC, mined via GPUs, face lighter regulations but require emissions reporting under MiCA for EU operations.

6. What are the penalties for non-compliance in 2025?

EU fines reach €500,000, U.S. penalties hit $100,000, and China risks license revocation, impacting market access and profitability.

7. How do renewables support mining profitability?

Renewables like hydro and solar cut electricity costs to $0.03-$0.06/kWh, boosting margins and ensuring compliance with ESG mandates.