Why RWAs Are the Future of On-Chain Investing with Allo

The financial world is undergoing a massive shift — real world asset tokenization explained. Tokenizing assets like stocks, bonds, and real estate makes them tradable on-chain with greater transparency, efficiency, and accessibility.

This is where Allo is leading the charge.

Unlike traditional stocks vs tokenized stocks, where access is limited by geography, market hours, and intermediaries, tokenized assets give investors 24/7 tokenized stock trading with instant settlement. With fractional ownership of tokenized shares, even smaller investors can participate in opportunities that were once reserved for institutions.

With Allo, you can trade stocks on Allo xyz, unlock global access, and explore cross-border stock investing blockchain solutions.

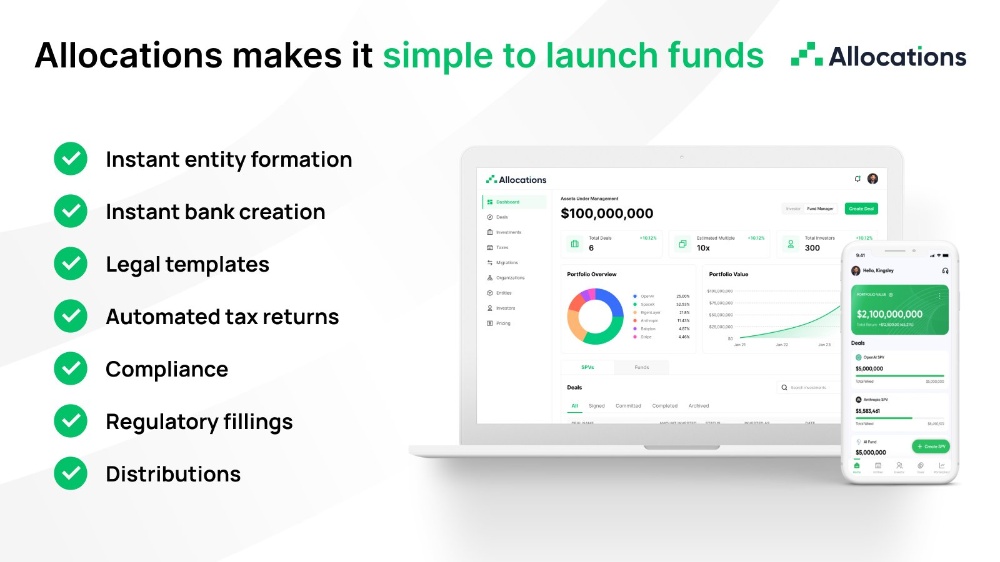

Key innovations include:

- Allo RWA token explained: a bridge between traditional assets and blockchain liquidity.

- RWA token utility and governance: ensuring transparency for investors.

- RWA liquidity solutions: unlocking more efficient capital markets.

Allo has already tokenized $2.2B in RWAs, staked $50M in BTC, and launched a $100M lending facility — proving its commitment to building the future of finance.

For anyone wondering how to buy tokenized stocks online, or seeking a beginner’s guide to tokenized stocks, Allo makes the process seamless, secure, and built for the future.