Bitcoin drops below $60k, traders liquidate $115m in 4 hours

The price of Bitcoin immediately dropped below the $60,000 level as the halving approaches.

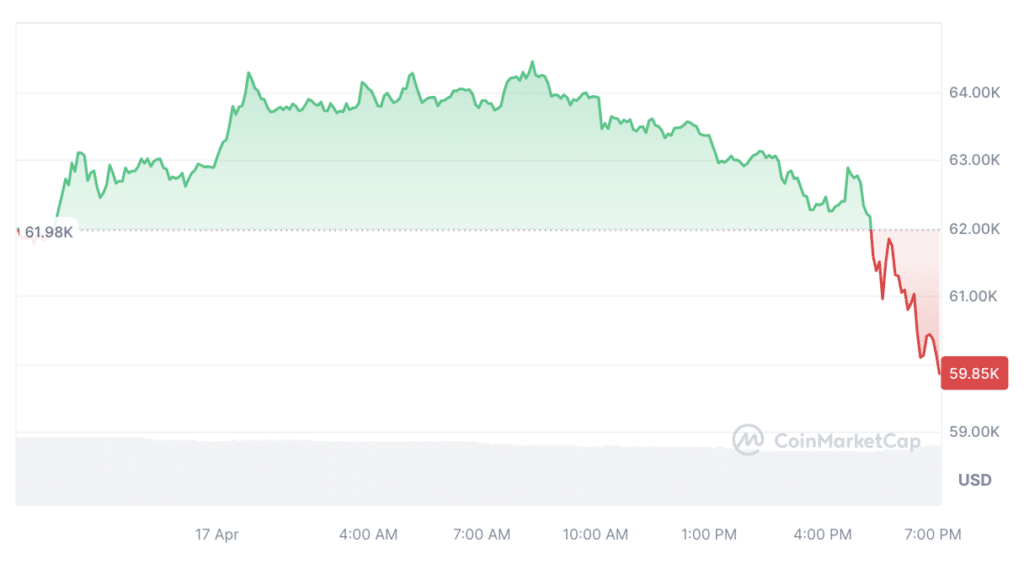

According to CoinMarketCap data, Bitcoin (BTC) is down more than 3% in price over the past 24 hours, trading at $59,800 when writing. Cryptocurrency trading volumes decreased by almost 12% to $40 billion.

Source: CoinMarketCap

Source: CoinMarketCap

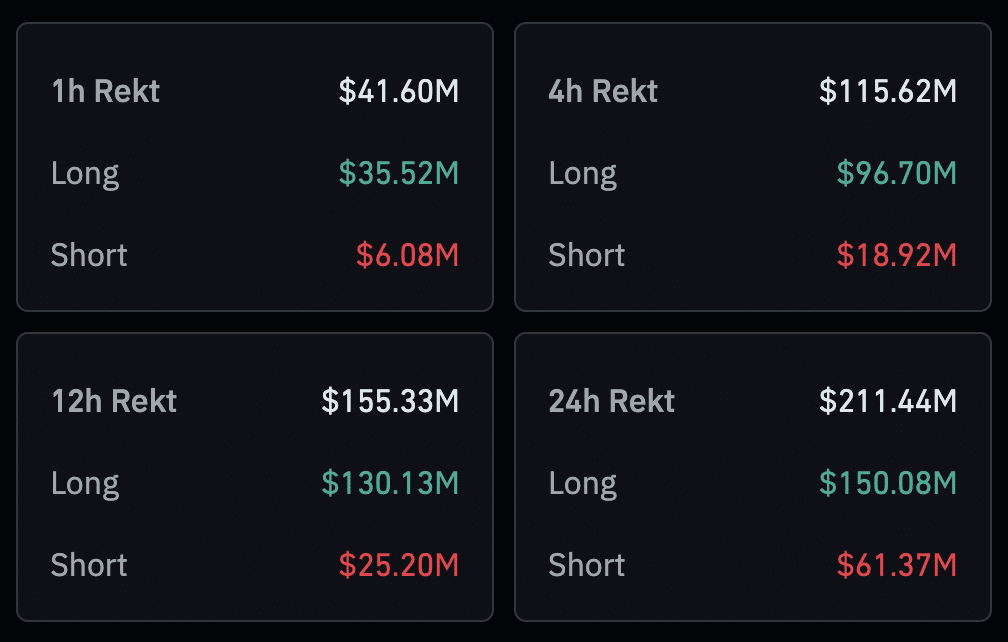

CoinGlass data shows that traders are actively liquidating positions. In the last four hours, traders have offloaded over $115 million worth of assets, $96.70 million of which were long positions and the rest short. The largest share of liquidations occurred on the OKX crypto exchange, totaling $43.81 million.

Source: Coinglass

Source: Coinglass

In a few days, the impending BTC halving will occur, with traders potentially exiting positions due to the seismic event. The halving will reduce miner rewards by 50%, stifling the number of coins uploaded to the market — a feature that some Bitcoin supporters consider optimistic.

In the run-up to the halving, the coin has experienced increased volatility, not only because of the halving. The sell-off also comes as investors continue to withdraw funds from popular Bitcoin ETFs after U.S. Federal Reserve Chairman Jerome Powell said the central bank needs to see more progress on the inflation front before cutting rates.

Markus Thielen, head of research at 10x Research, notes that crypto miners began accumulating Bitcoins in January 2024 to increase the imbalance between supply and demand. As a result, BTC’s price rose sharply and reached its historical maximum in March.

On the other side, digital asset mining companies will gradually eliminate accumulated coins after halving, putting pressure on the price of cryptocurrencies.

Bloomberg analyst Eric Balchunas assessed the prospects for spot cryptocurrency ETFs in Hong Kong.

According to the Balchunas, his asset estimate is currently $1 billion for the first two years. The ETF analyst noted this is positive but still far from the $25 billion estimate cited by some analysts.

“But a lot depends on infrastructure improvement. We also think this helps HK as ETF leader in Asia region.”

Eric Balchunas, Bloomberg analyst

However, the expert noted that mainland Chinese investors will likely not be eligible to buy Hong Kong-listed Bitcoin and Ethereum spot ETFs as the purchase of virtual assets is prohibited in the region.

Balchunas also clarified his $500 million estimate a few days ago. According to the analyst, the previous forecast was short-term, and the new estimate is based on allowing more time for infrastructure development.

Earlier this week, Hong Kong’s Securities and Futures Commission (SFC) approved Boshi International, HashKey Capital, China Asset Management, and Harvest Investment applications to launch spot Bitcoin and Ethereum ETFs.

Local authorities are actively working to regulate the crypto market. The transparent legal environment created by Hong Kong regulators has made the region attractive for crypto projects, thanks to which the particular administrative region of China has become a major crypto center.