Talking About Bancus, The Cryptocurrency Debit Card (Again 😁).

Bancus is the Cryptocurrency Debit Card that aims to free money from its chains, promising to be the financial passport of the crypto era: a card without borders, without banks, without limits. An inevitable revolution or a brilliant mirage?

I think I'm not mistaken when I state with absolute certainty that few obsessions have been as constant throughout human history as the pursuit of freedom. Political freedom, freedom of thought, freedom of movement. But there is a silent freedom, perhaps more powerful than all the previous ones, that has remained sequestered for centuries: financial freedom. Bancus appears on the scene as a herald of that promise, wrapped in the technological narrative of blockchain and digital assets. Its proposal is as simple as it is radical: "The dream of money without walls" - a card capable of spending cryptocurrencies anywhere in the world, without banks, without intermediaries, without permissions.

In an ecosystem where most attempts to create "crypto cards" have ended up tamed by the very mechanisms they claimed to combat, Bancus bursts forth with an incendiary pitch: to be the key to a parallel global economic system. The question is inevitable: are we facing the utopia that crypto idealists so long hoped for, or another illusion that will end up trapped in the web of regulation and reality?

Bancus didn't emerge in a vacuum. It arrives at a time when frustration with traditional banking is at an all-time high. Financial scandals, runaway inflation in multiple economies, governments printing money as if they were casino chips, and at the same time, a banking system that continues to charge exorbitant fees, impose arbitrary limits, and close accounts without explanation.

The creators of Bancus saw an opportunity in this gap. Inspired by the Bitcoin ethos—"be your own bank"—they decided that it wasn't enough to store cryptocurrencies or speculate with them on exchanges. The real revolution needed to happen in everyday life: buying a coffee, booking a flight, paying for a streaming service. Cryptocurrencies would cease to be just an investment asset and become a living, breathing currency in every transaction.

Bancus, at least in its narrative, presents itself as the realization of that dream. A card that converts cryptocurrencies into immediate purchasing power, without asking banks for permission or relying on complex withdrawal processes.

The Bancus card is described as a universal bridge. It works in the same terminals and ATMs that currently accept Visa or Mastercard, but behind the plastic beats a different heart: instead of dollars or euros backed by traditional bank accounts, the transaction is backed by cryptocurrencies stored in digital wallets.

In practice, every time a user pays with Bancus, the system automatically converts the crypto balance into local currency, facilitating the transaction. It does so with a crucial premise: maintaining user autonomy. The official narrative insists that Bancus does not seek to "custodial" money, but rather to give it mobility. The proposal seems simple, but it holds a disruptive edge: by reducing dependence on banks and governments, Bancus aims to become a financial passport that ignores customs or local regulations.

The pitch sounds revolutionary, but how real is it? Herein lies the central tension of the Bancus phenomenon. On the one hand, its proponents see it as the holy grail of the crypto ecosystem. Finally, they say, a way to close the loop: mining, investing, holding, and spending, all without having to return to the cage of the banking system. For many, Bancus embodies Satoshi Nakamoto's true vision: a financial system independent of the control of the powerful.

But the reality is less idyllic. To this day, card use is still tied to certain intermediaries: payment processors that convert cryptocurrencies into fiat currency in real time. Although Bancus disguises this with a narrative of autonomy, in practice it is not completely immune to the workings of the system it claims to combat. Then there is the issue of anonymity. Although Bancus claims to reduce bureaucracy, global regulatory pressure requires some level of user identification. Dreams of total privacy collide head-on with laws to prevent money laundering and terrorist financing.

The utopia stumbles, but it doesn't collapse. Because even with these nuances, the user experience is radically different from that of a traditional bank card. The mere existence of Bancus is a direct challenge to the status quo. For decades, banks have been the guardians of money, imposing rules on individuals and businesses. Now, a card that promises to operate outside that control is seen as an existential threat.

Imagine the scene: a citizen in a country with hyperinflation, like Venezuela or Zimbabwe, who until now relied on cash dollars or restricted accounts in international banks, suddenly has a tool that allows them to spend Bitcoin directly at their local supermarket. For that citizen, Bancus isn't a technological gadget: it's survival.

For banks, however, it's an earthquake. Every transaction that goes through Bancus is a transaction that escapes their radar, their fees, their control. Financial institutions have historically reacted to crypto innovations with a mixture of contempt and fear. First they called them "frauds", then they tried to compete, and now, faced with projects like Bancus, they find themselves in a silent war. Because what's at stake isn't simple commissions: it's the monopoly of financial power.

Not everything is bright on the horizon for Bancus. There are obvious risks that threaten its viability.

- Regulation: World governments frown upon money escaping their hands. Bancus could be subject to bans, blockades, or legal prosecution in multiple countries.

- Security: Any platform that handles crypto is an attractive target for hackers. A breach in the infrastructure could destroy trust in seconds.

- Sustainability of the model: Real-time crypto-to-fiat conversion depends on constant liquidity. If the ecosystem enters a crisis, how solid is Bancus's backing?

- Exaggerated promises: Some critics accuse Bancus of selling smoke, exaggerating its true autonomy, and hiding its remaining dependencies on the traditional financial system.

These criticisms are not minor. In an ecosystem plagued by fraud and failed projects, suspicion is inevitable.

To understand the impact of Bancus, a story is worth a thousand numbers.

- An Argentine programmer receives payments in cryptocurrency for his freelance work. Until now, he had to go through long and expensive processes to convert it into pesos. With Bancus, he simply goes to a café and pays with his card. The cashier doesn't know, nor care, that the cappuccino was paid for in Ethereum.

- A mother in the Philippines, with a migrant son who sends her remittances in USDT, no longer needs to go to exchange houses that charge exorbitant fees. She receives the cryptocurrency, loads her Bancus card, and buys directly on the local market.

- A businessman in Nigeria, tired of banks blocking his international transfers, uses Bancus to pay suppliers abroad, circumventing the barriers of a hostile financial system.

In all these fictional yet credible stories, Bancus appears as a silent lifeline, an act of everyday resistance against financial systems that oppress more than they liberate.

The most fascinating thing about Bancus is not what it already is, but what it promises to be. The card is not just a product: it's a manifesto. It represents the idea that technology can erode the walls that banks and governments have built around money. The key question is: will Bancus be the spearhead of a global movement, or will it remain just another experiment in the graveyard of failed crypto projects?

The future will depend on several factors: the ability to adapt to regulation without losing its disruptive spirit, the solidity of its technical infrastructure, and, above all, the willingness of millions of users to embrace the idea that financial freedom is possible.

Bancus is, at the same time, a promise and a warning. A promise because it reminds us that technology can break chains that seemed unbreakable. A warning because the path is fraught with pitfalls, risks, and powerful enemies. Perhaps in a few years, we'll look back and remember Bancus as the beginning of a new financial era, where money stopped obeying banks and governments and instead obeyed only its owners. Or perhaps we'll remember it as another shining mirage, a utopia that never managed to escape the clutches of reality.

Whatever the outcome, one thing is certain: Bancus has lit a spark in the global conversation about the future of money. And sparks, when they find enough oxygen, can set the world ablaze.

OTHER LINKS 👍:

🔎 Discover Cryptocurrency Trading with AI. 🤖 Robot Trader (➕💲5️⃣ FREE). 💡 LET TECHNOLOGY WORK FOR YOU 😎

- 🤖 Bot GPTrading: https://app.gptrading.ai/invite/01JZJT6KQNTM3KZVMRQYA7NPGX

- 📈 Zaffex Broker: https://broker.zaffex.com/auth/register?referrerUserId=01JZJSMDFAW5ECTRZH852EYR0J

- ✍️ Tutorials: https://www.youtube.com/@TeamReferralFamily

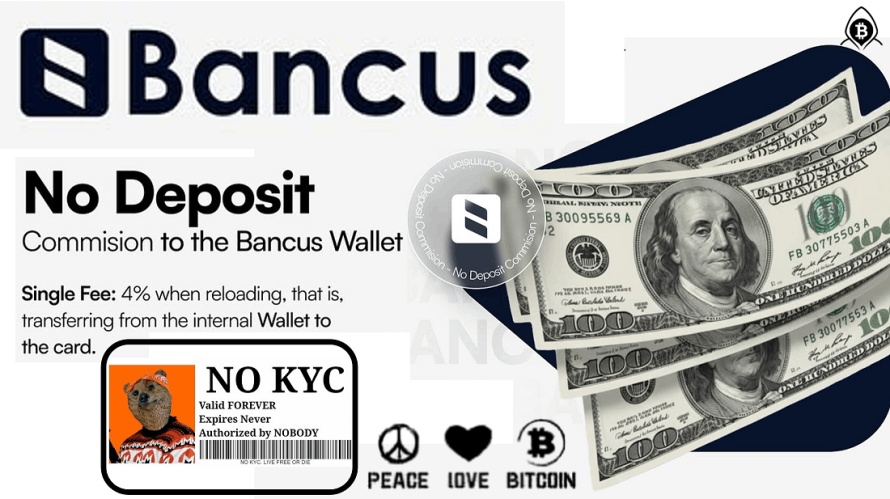

💳 Get the BANCUS Cryptocurrency Debit Card 🥳 NO KYC VERIFICATION REQUIRED. Participating in their REFERRAL PROGRAM allows you to accumulate sufficient funds to purchase it WITHOUT INVESTMENT.

- 🔗 https://go.bancus.io/?ref=CD89QYCG

- 💰 Referral Reward Levels 👉

Card Purchase:1º-$7.50, 2º-$11.25, 3º-$7.50;Of the Top-Up Amount:1º-0.285%, 2º-0.43%, 3º-0.285% - 👉 Plastic Card: ATM: $200 daily, Merchant: $2,500 monthly, Reload: $2,500 maximum | Metal Card: ATM: $600 daily, Merchant: $2,500 daily, Reload: $50,000 maximum.

"If you don't find a way to earn money while you sleep, you'll work until you die" - Warren Buffett