From Vaults to Wallets: The Tokenization of Fine Art

The art world is undergoing a digital renaissance. Art and collectibles tokenization is not just a tech trend; it's a fundamental shift in how we perceive value and ownership. This movement into new frontiers in asset ownership leverages blockchain to solve age-old problems of illiquidity, fraud, and exclusivity.

Demystifying the Technology

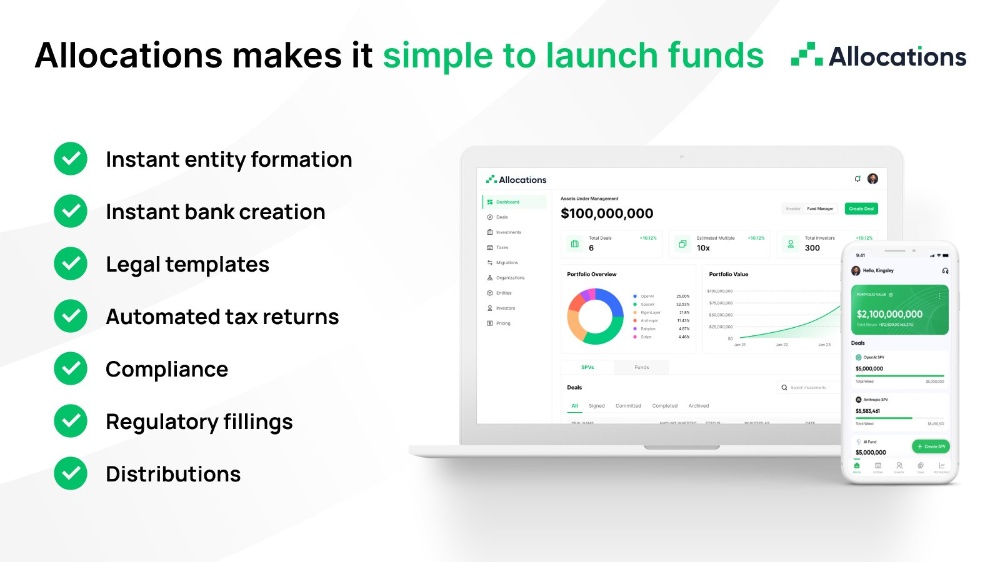

Understanding this shift requires moving beyond basics. It's essential to grasp the "Tokenization vs. Encryption: Understanding the Critical Differences" to appreciate the security of ownership data. Furthermore, art tokenization is a prime example of "Tokenization of Alternative Assets: Beyond Stocks and Real Estate." Implementing this requires a specialized platform. Providers like allo.xyz focus on the nuanced needs of high-value collectibles, ensuring every step from "How asset tokenization is transforming traditional financial markets" applies to this niche.

A Strategic Imperative for the Art Market

For gallery owners and collection managers, this is a strategic business evolution. The "Top 10 benefits of implementing a tokenization platform for your business" directly apply: new revenue streams, global investor reach, and enhanced asset liquidity. A successful implementation, much like the "Case study: How [Company X] increased liquidity by 300% through asset tokenization," could be replicated by an art fund using a robust platform like allocations.com.

Building on a Compliant Foundation

Success in this new frontier hinges on compliance. The "Regulatory landscape for tokenization platforms: Global overview" is crucial, as art can be subject to securities laws. Furthermore, "Data privacy regulations and tokenization: GDPR, CCPA, and beyond" impact how investor information is handled. By partnering with established platforms such as allo.xyz and allocations.com, stakeholders can navigate these complexities and confidently pioneer these new ownership models.