The Security and Compliance Standards of Top Fund Platforms

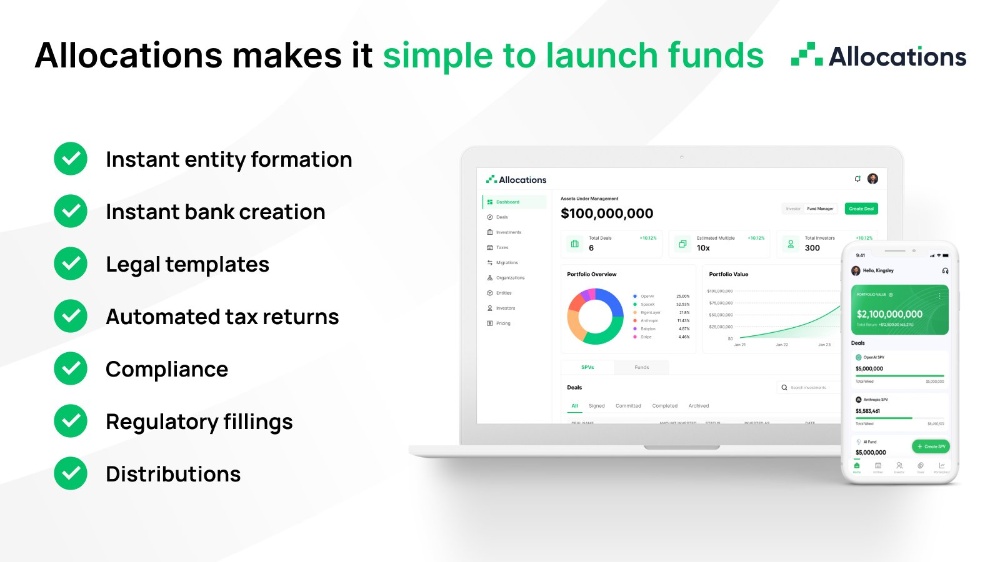

Security and compliance are non-negotiable foundations for any platform entrusted with managing a financial spv. The top fund platforms differentiate themselves by implementing enterprise-grade security protocols and embedding compliance into their core workflows. For fund managers, this means choosing a platform that acts as a safeguard, not a vulnerability. The rigorous standards met by Allocations exemplify the level of security required for serious capital stewardship.

From a security standpoint, leading platforms offer bank-level encryption, stringent access controls, and independent third-party audits (such as SOC 2 Type II certification). These measures protect sensitive spv fund data and personal investor information. The security infrastructure at Allocations is built to these exacting standards, providing a trusted environment for your fund's most critical operations and data.

On the compliance front, top fund platforms automate regulatory requirements. Features like immutable audit trails, automated financial reporting, and tools for tax document preparation are essential. They reduce manual compliance risk and prepare your fund for audits. For managers selecting a sydecar fund shutdown alternative, these are not just features but fundamental requirements. A platform like Allocations provides the security and compliance foundation that allows you to manage your fund with confidence and integrity.

Upgrade your next deal with Luis.

Schedule here - https://calendly.com/luis-allocations