Finance

The Russian Ruble is still being crushed by the dollar… down 10% for the month, but it is much better than a few days ago…

"More intuitively, Cowen says simply, 'I would rather have current healthcare at current prices than 1972 healthcare at 1972 prices.' "

https://mail.blockworks.com/p/friday-charts-0a82

Create a budget: track income and expenses to save regularly. Build an emergency fund with 3–6 months’ expenses. Invest in diversified assets for long-term growth. Avoid unnecessary debt, and pay off high-interest loans first. Monitor spending, set goals, and review financial plans annually.

Freelancing is a type of work where individuals offer services independently, often on a project or contract basis, rather than being employed full-time by a company. Freelancers set their own schedules, choose clients, and may work in various fields like writing, design, or programming, often remotely.

"What does this tell us about the Japanese economy? Precisely nothing — in fact the Japanese services sector activity reading had a surprise rise in July, fueled by domestic demand, meaning that economy is chugging along nicely as well. All it told us was how overbought the Japanese sharemarket was."

https://www.crikey.com.au/2024/08/06/us-recession-fear-japanese-market/

Good old paper money still is a great business to be in (even if it's a fast disappearing business)

https://mail.blockworks.com/p/the-fed-is-losing-billions-everywhere

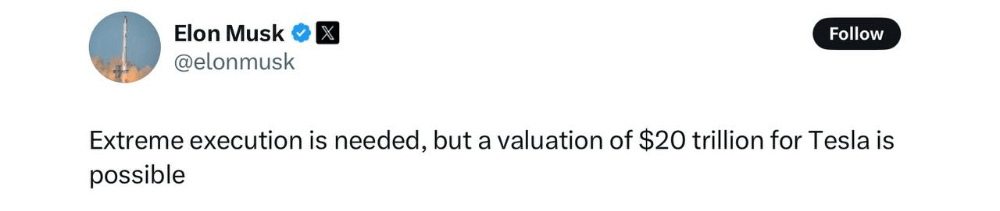

🚀 Would you bet against Elon Musk? He’s eyeing a $20 trillion valuation for Tesla — putting it in the same league as gold ($22T total value). Today, Tesla sits around $1T.

For context:

👑 Nvidia is the world’s biggest company at $4.2T

₿ Bitcoin is at $2.3T

Bold vision, Elon. Still a very long road ahead.