Exploring Tokenomics: Unraveling the Economics of Cryptocurrencies

What Is Tokenomics?

Tokenomics, a mashup of "token" and "economics," delves into the study of everything that influences the value and demand of cryptocurrencies. It's like examining the gears and levers that make a cryptocurrency tick.

Here's a breakdown of key aspects of tokenomics:

Supply and Demand:

- Total Supply: This refers to the maximum number of tokens that will ever exist. Understanding this is crucial, as a limited supply can create scarcity and potentially push up the price.

- Distribution: How are tokens distributed? Are they primarily held by a few entities, or spread widely among users? This can impact price volatility and influence control over the network.

- Inflation: Some tokens have mechanisms that automatically create new tokens over time, potentially leading to inflation and decreasing value.

Token Utility:

- Use Cases: What can you actually do with the token? Does it grant access to a platform, voting rights, or other functionalities? A token with clear and valuable uses is more likely to attract demand.

- Burning Mechanisms: Some tokens have processes that remove them from circulation, like "burning," which can counteract inflation and increase scarcity.

Additional Factors:

- Transaction Fees: Some tokens include transaction fees, which can be used to incentivize network validators and contribute to token value.

- Governance: How are decisions made within the project? Does token ownership influence governance, and how?

Why is Tokenomics Important?

Understanding tokenomics helps you make informed decisions when investing in cryptocurrencies. By analyzing the supply, distribution, utility, and other factors, you can assess the potential value and sustainability of a project. Remember, a well-designed tokenomics model can contribute to a thriving ecosystem and a resilient token price.

If you'd like to delve deeper into specific aspects of tokenomics or explore tokenomics models of particular projects, feel free to ask! I'm happy to help you navigate this complex and fascinating field.

In the fast-paced world of cryptocurrencies, understanding the dynamics of tokenomics is crucial for anyone looking to delve into the space. Tokenomics, a fusion of "token" and "economics," encapsulates the economic principles governing a token's existence and functionality. This blog aims to demystify tokenomics, emphasizing its significance and impact on the success of crypto projects.

Tokenomics Essentials: Beyond White Papers and Roadmaps

When conducting fundamental research on a crypto project, one cannot overlook tokenomics. Beyond scrutinizing white papers, evaluating the founding team, examining the roadmap, and tracking community growth, understanding tokenomics is pivotal for gauging a blockchain project's future potential. Well-designed tokenomics is instrumental in ensuring sustained, long-term development for crypto projects.

Tokenomics at a Glance: Decoding the Rules of the Game

In essence, tokenomics involves the strategic design of rules governing a token's behavior to influence user actions. Drawing parallels with traditional monetary policies, where central banks regulate economies through money creation and policies, tokenomics achieves similar objectives in the crypto realm. Notably, the transparency, predictability, and immutability of tokenomics are facilitated through code rather than bureaucratic decisions.

Let's take a deep dive into the tokenomics of Bitcoin as an illustrative example. With a capped supply of 21 million coins and a programmed issuance through mining, Bitcoin's tokenomics involves a systematic reduction in block subsidies through halving events every four years. This calculated approach ensures transparency and predictability, enhancing the cryptocurrency's value and resilience.

Key Elements of Tokenomics: A Comprehensive Overview

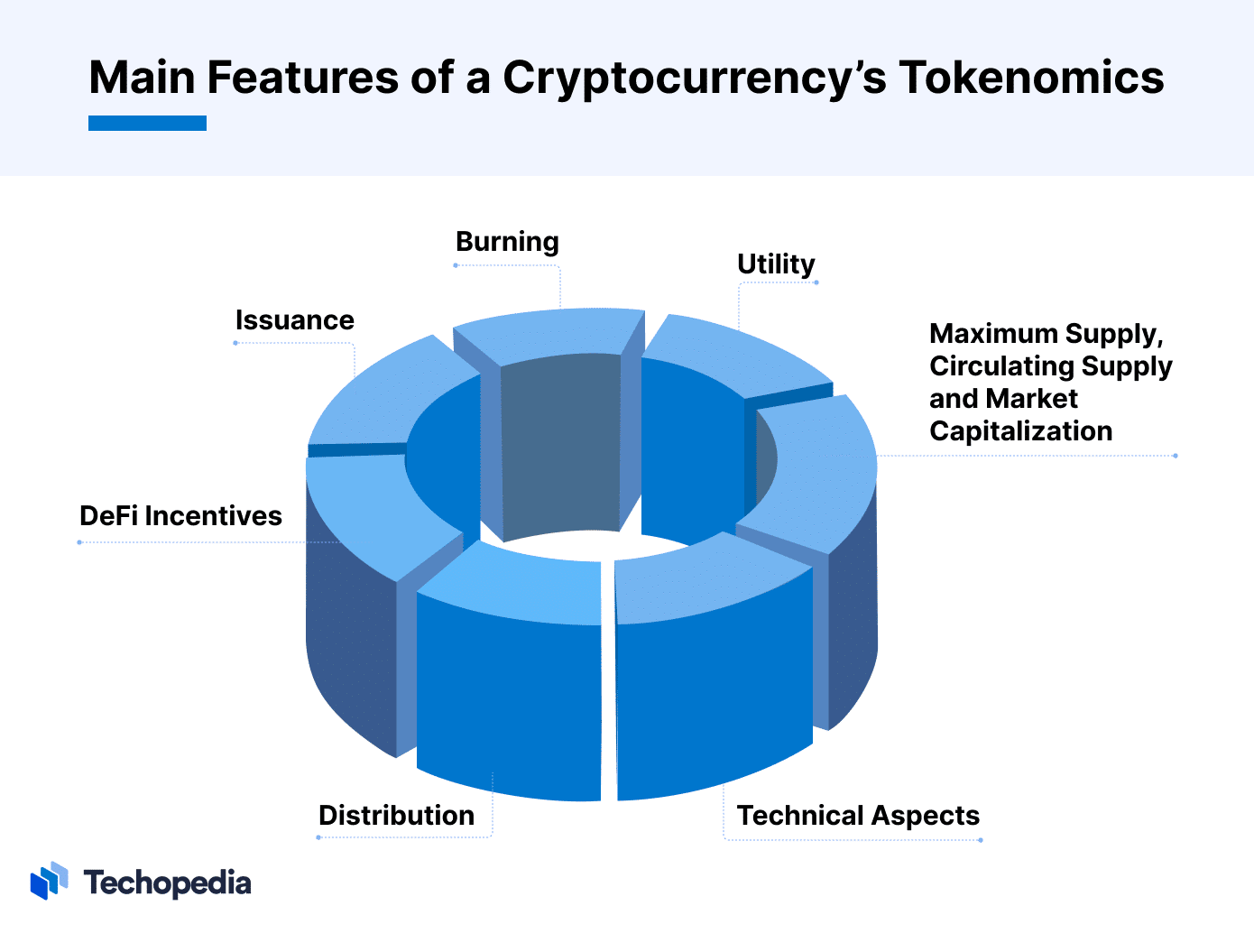

Tokenomics encompasses various factors influencing a cryptocurrency's value, constituting the structure of its economy. Key elements include token supply, utility, distribution, burns, and incentive mechanisms.

Token Supply: The interplay of supply and demand significantly influences a token's price. Metrics such as maximum supply and circulating supply provide insights into a token's growth potential. For instance, while Bitcoin has a fixed maximum supply of 21 million coins, other tokens, like Ethereum, may have dynamic supplies that increase over time.

Token Utility: Understanding the use cases designed for a token is paramount. Whether it powers a blockchain, facilitates transactions, or serves as a governance token, a token's utility defines its role in the ecosystem. This understanding is critical for predicting the token's future trajectory.

Analyzing Token Distribution: Examining how tokens are distributed is essential for assessing potential trading behaviors. Differentiating between fair launches and pre-mining launches, and considering factors like lock-up and release schedules, provides insights into a token's stability and potential value.

Examining Token Burns: Token burning, the practice of permanently removing tokens from circulation, can impact a token's supply dynamics. Projects like BNB and Ethereum implement token burns to create deflationary pressure, contrasting with inflationary models.

Incentive Mechanisms: The mechanism through which a token incentivizes participants is central to tokenomics. Whether through Proof of Work, Proof of Stake, or innovative DeFi mechanisms, these incentives shape the sustainability and integrity of the network.

Evolution of Tokenomics: From Bitcoin to NFTs and Beyond

Since the inception of Bitcoin in 2009, the world of tokenomics has witnessed significant evolution. Successful models, like Bitcoin's enduring tokenomics, contrast with less resilient designs that have faced challenges. The rise of non-fungible tokens (NFTs) introduces novel tokenomics models based on digital scarcity, opening avenues for further innovation.

Closing Thoughts: Navigating the Crypto Landscape with Tokenomics

In conclusion, tokenomics is a foundational concept for anyone venturing into the realm of cryptocurrencies. It encapsulates the major factors shaping a token's value and utility. Emphasizing that no single factor holds a magic key, this blog advocates for a comprehensive assessment of multiple factors to inform judgments on a project's future prospects and token price. As the crypto landscape continues to evolve, tokenomics remains a key compass for navigating the complexities of this dynamic ecosystem.

💬 Comment below with your thoughts, reactions, or any experiences you've had with tokenomics. What aspects stood out to you? Anything you'd like to explore further? Let's turn this blog into a lively hub of ideas and insights! 🌟🗣️

Check Out My Latest Blogs:

1- SendingMe Galxe Campaign: Mint Early Supporter NFT

2- The Crypto Conundrum: Did the ETF Arrival Fizzle the Boom?

3- NEW AIRDROP: SubQuery

4- Kripto Paralar: Potansiyeliyle Gelen Riskler

5- From Zero to Dropshipping Hero

6- Don't Get Hooked:Crypto Phishing Scams

7- Cryptocurrency: Don't Let Rug Pulls Steal Your Gains