The Crypto Conundrum: Did the ETF Arrival Fizzle the Boom?

For months, the air thrummed with anticipation. Every forum whispered "ETF," a magic word pregnant with promises of revolution. Bitcoin and Ethereum, the digital titans, held their breath at the precipice of legitimacy, their fate tethered to the whims of the SEC. Then, the verdict fell: Approval. And... crickets.

Instead of the seismic boom prophesied by breathless pundits, the crypto market met the news with a polite shrug. Prices danced, sure, but with a measured grace, a far cry from the wild gyrations predicted. This unexpected calm has left analysts scratching their heads and pondering a provocative question: Did the market, in its own perverse way, outsmart itself?

Price in the Premonition: Perhaps the most intriguing aspect of this muted response is the notion that the ETF news was, well, priced in. Months of relentless hype, endless news cycles, and breathless speculation had seemingly baked the anticipated impact into the very DNA of the market. Savvy investors, adept at reading between the lines of financial tea leaves, had already factored in the potential influx of institutional money, their buy orders pre-emptively positioned like dominoes waiting to fall.

This theory gains credence when we consider historical precedent. The launch of gold ETFs in the early 2000s, for instance, witnessed a similarly muted response. The market, having long anticipated the move, absorbed the news without significant drama. Could the same, then, be true for the digital titans?

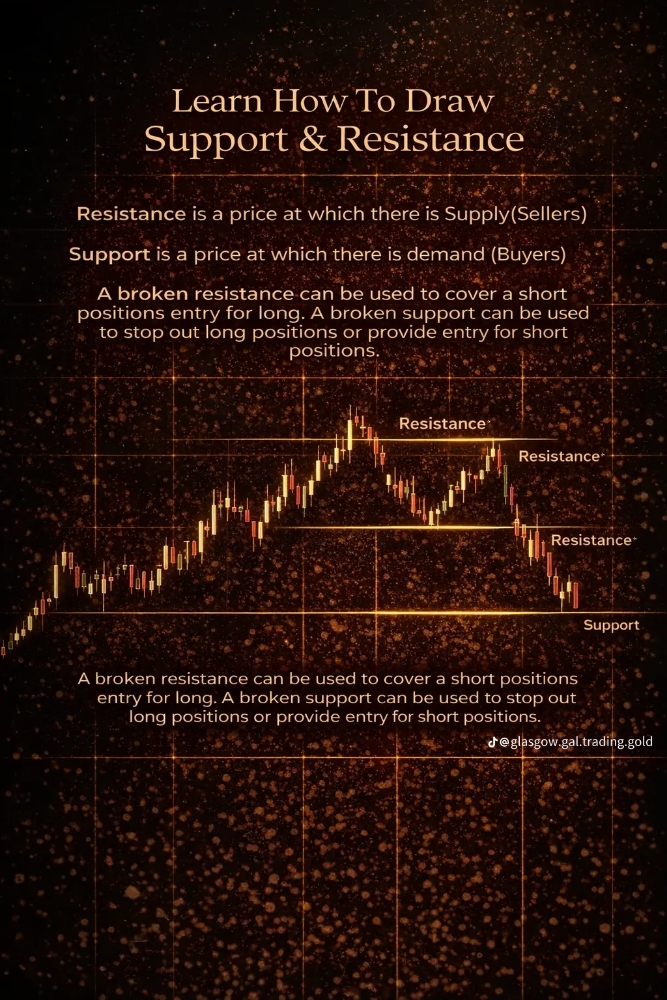

Technical Titans Stand Guard: Adding another layer of intrigue is the unwavering adherence to technicals. Support and resistance levels, those invisible boundaries dictating price movement, held firm even in the face of such monumental news. This suggests that the fundamental forces driving the market – supply, demand, and investor sentiment – remained largely unaltered. The ETF approval, then, might be seen as merely another chapter in the ongoing crypto saga, albeit one with a particularly juicy headline.

The Intriguing Unknown: Of course, declaring victory for technical analysis over the ETF hype machine might be a tad premature. The true impact of the approval is still unfolding, and the ETF rollout itself has yet to begin. Once market makers and big money start playing their hand, the story could take a dramatic turn. The initial guesstimates of demand might prove woefully inadequate, sending prices soaring or plummeting in response.

A Lesson in Expectation Management: Regardless of the ultimate outcome, this episode serves as a valuable lesson in managing expectations. In the echo chamber of hype that is the crypto space, it's easy to get swept away by grand pronouncements and rosy predictions. But as this muted response reminds us, reality often has a way of defying the narratives we construct. So, the next time a monumental event looms on the horizon, let's take a deep breath, remember the technical titans guarding their price territories, and approach the unfolding drama with a healthy dose of skepticism and a keen eye for the unexpected.

Beyond the Binary: But here's the rub: the crypto story is rarely about binaries. It's not boom or bust, hype or indifference. It's a nuanced tapestry woven from a multitude of threads – technological advancements, regulatory headwinds, investor psychology, and even global events. The ETF approval, then, might not be the sole arbiter of the market's fate. It might simply be a catalyst, a pebble dropped into the pond that sets off ripples of unforeseen consequences.

Beyond the Horizon: So, what does the future hold for the crypto market post-ETF? The crystal ball remains cloudy, but a few possibilities shimmer on the horizon. Perhaps institutional money will indeed flood in, propelling prices to new heights. Maybe the regulatory landscape will shift, paving the way for wider adoption. Or, perhaps, the market will continue to chart its own path, unfazed by external pronouncements, driven by its own internal rhythms and dynamics.

The Unpredictable Dance: One thing, however, is certain: the crypto market remains a thrilling dance, a waltz between innovation and uncertainty, greed and fear. And whether you're a die-hard HODLer or a cautious skeptic, it's a dance worth watching, a story worth following, for within its unpredictable steps lies the potential to reshape the very fabric of finance. So, buckle up, grab your popcorn (digital, of course), and enjoy the show. The crypto saga is far from over, and the next act promises to be even more captivating than the last.

The recent buzz surrounding crypto ETFs has many investors dreaming of moon missions and parabolic surges. Yet, amidst the hype, a cautious voice whispers: slow down, it's not that simple. While the success of gold ETFs, tripling in price over three years, offers tempting comparisons, comparing apples to crypto oranges might be misleading. Here's why the crypto ETF party might be a slow burn, not a big bang:

Distinguishing Apples from Oranges:

- Different Beasts: Gold and crypto cater to distinct needs. Gold, a traditional hedge against inflation, saw ETF inflows primarily from institutional investors seeking portfolio diversification. Crypto, still in its nascent stages, attracts a more speculative crowd chasing potential high returns. This difference in purpose translates to different adoption timelines.

- Supply and Demand Dynamics: Gold's finite supply, coupled with ETF-driven demand, tightened the market, pushing prices up. Crypto, however, has a more complex supply model with various issuance schedules and potential for token creation events. This makes predicting the impact of ETFs on supply, and consequently price, significantly trickier.

The Long Game:

- Institutional Arrival, Not Invasion: While ETFs might indeed open the door for institutional money, their entrance won't be a tsunami but a gradual trickle. Regulatory hurdles and internal risk assessments will likely keep a lid on the pace of institutional adoption.

- Bear Market Battlefield: The real impact of ETFs might be revealed during the next crypto winter. With traditional investors seeking safe havens during economic downturns, their crypto holdings might be the first to go, potentially triggering short-term price dips. However, these dips could also present compelling entry points for long-term investors, setting the stage for a post-bearmarket boom fueled by accumulated institutional capital.

So, Where Does That Leave Us?

The ETF arrival shouldn't be mistaken for a magic bullet. It's a piece of the puzzle, a step towards wider crypto adoption. Expecting overnight riches would be akin to hoping for a lottery win every day. Instead, we should view this as a slow simmering, a gradual maturation of the crypto market. The real fireworks might be reserved for the next bull run, ignited by the combined firepower of long-term institutional investment and a battle-tested crypto ecosystem forged in the bear market crucible.

Beyond the Binary:

This isn't to say the ETF impact will be nonexistent. We might see short-term price fluctuations, increased market liquidity, and perhaps even a shift in market sentiment. However, the grand narrative, the crypto Holy Grail moment, is likely further down the road. So, buckle up, grab your hodling hat, and enjoy the ride. The crypto saga is far from over, and the next chapter promises to be a slow burn thriller, not a one-night fireworks extravaganza.

This perspective offers a counterpoint to the hype while acknowledging the long-term potential of ETFs. Remember, in the ever-evolving world of crypto, patience is not just a virtue, it's a superpower.

1. Scarcity and Gradual Impact:

- Add a sentence to the "Price in the Premonition" section: "However, some argue that the true impact of the ETF lies in its long-term effect on Bitcoin scarcity. As ETFs hold onto these coins, gradually taking them out of the available market, supply could tighten, potentially leading to price increases over time."

- Consider adding a section titled "The Scarcity Factor," exploring the potential long-term impact of ETF-driven scarcity on price dynamics.

2. Beyond Hype and FUD:

- In the "The Intriguing Unknown" section, acknowledge different perspectives: "While some expect a surge in institutional money, others believe the news has already been priced in. The 'buy the dip' crowd argues that any short-term dips will be followed by long-term price appreciation due to fundamentals like increased adoption and scarcity."

- You can also add a short quote from a prominent analyst or economist representing this "beyond hype and FUD" perspective.

3. Sell the News, Buy Higher:

- Integrate the point about "crypto bros" into the "A Lesson in Expectation Management" section, highlighting the potential disconnect between hype and reality: "Some anticipated a 'sell the news' event based on speculation, but this underestimates the long-term bullish sentiment among many investors, particularly those focused on fundamentals like scarcity and adoption."

- You can consider adding a humorous meme or image capturing the "sell the news, buy higher" sentiment popular among experienced crypto investors.

Check Out my Recent Posts:

NEW AIRDROP: SubQuery

Kripto Paralar: Potansiyeliyle Gelen Riskler

Thank you for taking the time to read.