Why is it so good to look at the indicators in the review, but not so good once it is used?

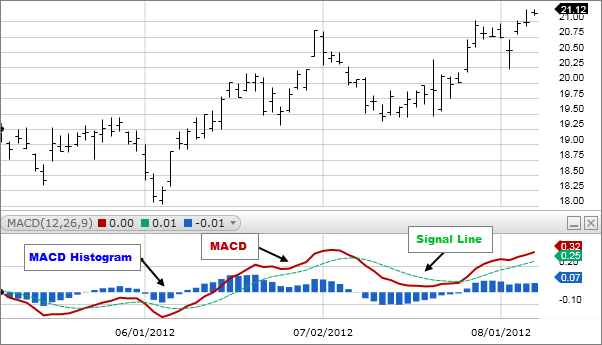

Generally, novices look at the MACD golden cross to buy, and the dead cross to sell. Indicators such as moving averages have a defect, which is not easy to be noticed by traders. Novices are easily confused, that is, "indicators have future functions". In academic terms, "future function" refers to the reference to future data function, that is, a function that refers to or utilizes price data that has not yet occurred at that time, and corrects the previously issued judgment.

In layman's terms, buying and selling signals are uncertain, often a buy is issued on a certain day, and if it continues to fall the next day, the signal mark will disappear and will be marked at a new position tomorrow, until the price starts to rise, the successful signal mark will not be released until the price starts to rise.

So if you review the history and find that every signal seems to be successful, in fact, most of the failed signal marks disappear automatically, that is, the problem of signal flickering mentioned in program trading, which leads to the success rate of indicators being reduced. Substantially inflated. To put it simply, the future function is that as the subsequent market progresses, the signal marks that failed in the previous period will disappear, while the successful signal marks will be preserved, so it creates the illusion of a high success rate.

This factor caused us to review the past, and we will feel that the indicators are very useful, and we will be full of praise. Using this indicator to trade is really accurate, true, and the success rate is really high. It can grasp the rising trend and the falling trend. If I used this indicator earlier, I would have made a fortune, this indicator is amazing.

But once it is used in actual combat, it is very difficult to use this indicator to buy and sell. It is not as accurate and effective as replaying the past historical market. It keeps losing money and slaps faces. .

Taking the golden cross of MACD as an example, indicators such as MACD have future functions, and the failure signal will disappear

The indicator has a future function, and this defect is very easy to confuse everyone. For example, from the review, the MACD has a golden cross, and the market has really risen later, and the MACD has a dead cross, and the market has really fallen later, how accurate it is. , you will shout "My mother, the market is such a cornucopia, I'm going to make a fortune".

Before your laughter falls back, your heart will feel sad. When you use it, you find that this is not the case. You lose money frequently. You can see it in the past and use it in the future. It doesn’t feel good.

In the actual intraday session, the intraday MACD became negative, and a dead cross appeared. The MACD was positive a few days ago. According to common sense, a signal to enter the short position was issued at this time. But when the market closed, the MACD returned to being positive again. Looking at the market closing, the MACD did not show a dead cross, and it was always positive, and there was no failed short-entry signal.

And in reality, there were about three dead forks in the market, and then they returned to the original state not long after, which led to three false signals in reality, but if you look at the end of the market, the false signals of these three failures do not exist. Greatly inflated the success rate. If you look back at the history, these signs of failure have disappeared, and what is left is the signal of success, which will be very useful.

You can also stare at the MACD indicator on the 1-minute chart and watch it go. You can find that MACD has an obvious future function, especially when the volatility suddenly increases and changes direction. In addition, the volatility tends to calm down and wait for a breakthrough. At these times, the MACD indicator will change due to subsequent price changes.

Not only MACD, but all indicators have future functions. Taking the moving average as an example, if you use a golden cross or a curved line to place an order, it will also have a future function.

If the price falls on the second day, and you look back at the moving average of the previous day, you will find that the moving average of the previous day is adjusted to a downward bend or flat, and the golden cross is gone, and it becomes entangled or returns to the state before the golden cross. But if you review the market, you can’t see these changes at all, and they will disappear automatically. The result you see in the review is: the moving average of the previous day did not bend at all, there was no golden cross, and there was no progress at all. Multiple signals, so the moving average is very accurate.

Looking at the market review, it is easy for us to unconsciously miss the time period when the indicator is invalid, leaving only the time period when the indicator is valid in our eyes.

Some people say that the above problems are false signals in the market. If the end of the market is used as a judgment signal, there are also a series of problems.

One of the problems is that the MACD is wound up and down, with a golden cross for a while, and a dead cross for a while, which will lead to frequent entry and stop loss, which is very ineffective, because the two lines are tightly entwined, and it seems to be a line. I can't see clearly. When replaying, it is easy to ignore this invalid time period.

We only saw the decline in the first period and the rise in the third period. MACD is effective and effective, but we ignore the invalid period in the middle

In practice, most of the market is oscillating, and the trending market is relatively small, so many times the MACD is entangled and cannot be seen clearly, so we tend to ignore it subjectively; and once there is a smooth market, the value of MACD is It is clear, it is a clearly magnified recognition at a glance, we are easy to pay attention to this market, so we leave a memory of this market in our hearts, resulting in deviations.

Not only for MACD, but also for other indicators such as moving averages, we are prone to this illusion, leaving the effective time period of the indicator inadvertently, missing the invalid time period, and even the invalid time period is greater than the effective time period.

So this is the essential reason why the indicator is very good in the review, but it is not so good once it is used!

Thanks for Reading