Exploring the Volatility of the Cryptocurrency Marketplace

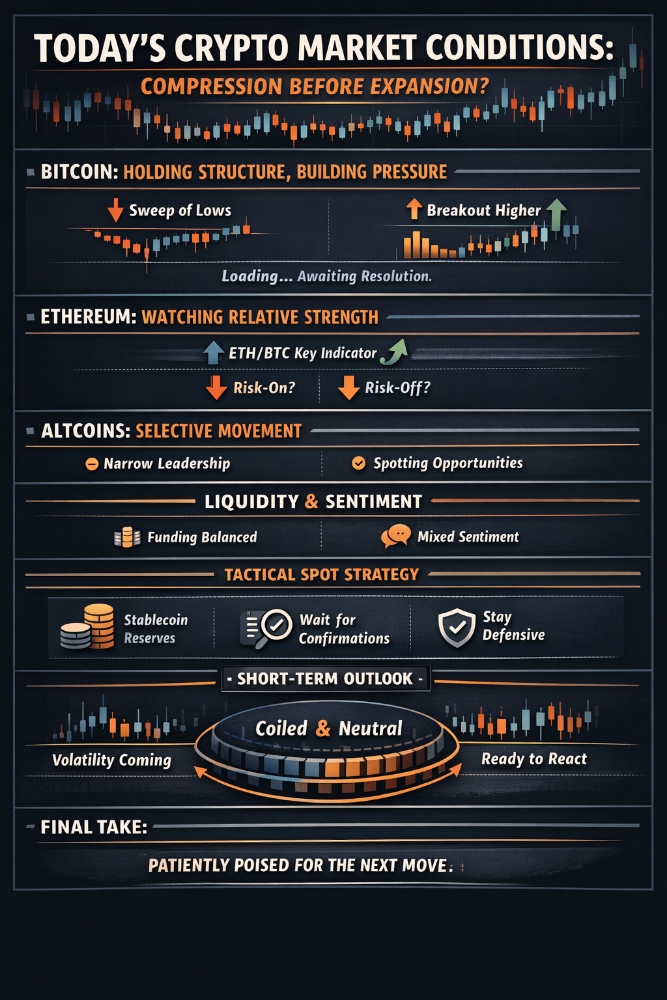

Cryptocurrencies have taken the financial world by storm in recent years, with many investors seeing them as a new and exciting opportunity for growth. However, one of the most defining characteristics of the cryptocurrency marketplace is its extreme volatility. Prices can fluctuate wildly in a matter of hours, making it a high-risk, high-reward investment option.

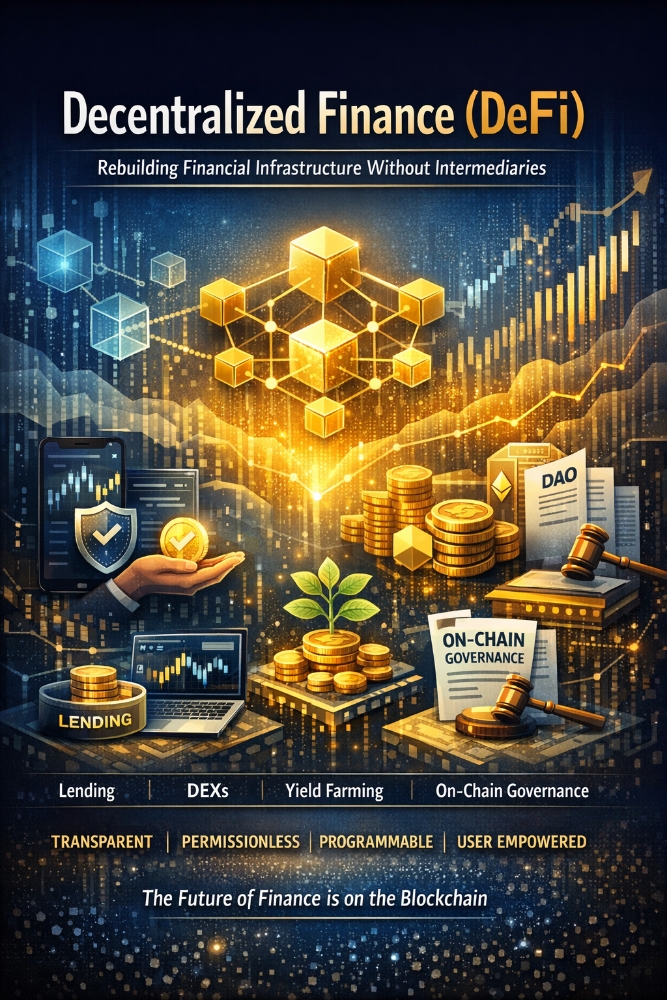

What Causes Cryptocurrency Volatility?

There are several factors that contribute to the volatility of the cryptocurrency marketplace. One of the main reasons is the relatively small market size compared to traditional assets like stocks and bonds. This means that even small trades can have a big impact on prices, leading to rapid fluctuations.

Another factor is the lack of regulation in the cryptocurrency space. Without the oversight of a central authority, prices are driven purely by supply and demand, which can lead to sudden and drastic price changes. Additionally, the speculative nature of cryptocurrencies can also contribute to volatility, as investors often buy and sell based on hype and market sentiment rather than underlying fundamentals.

Managing Risk in the Cryptocurrency Marketplace

While the volatility of the cryptocurrency marketplace can be daunting, there are ways to manage the risk and potentially profit from it. One strategy is diversification, spreading your investments across different cryptocurrencies to reduce the impact of price fluctuations in any one asset. Additionally, setting stop-loss orders can help limit potential losses by automatically selling your assets if they reach a certain price point.

It’s also important to stay informed about market trends and news that could impact cryptocurrency prices. By staying up to date on developments in the industry, you can make more informed decisions about when to buy, sell, or hold your assets.

The Future of Cryptocurrency Volatility

As the cryptocurrency marketplace continues to evolve, it’s likely that volatility will remain a key characteristic of the industry. However, some experts believe that as the market matures and becomes more mainstream, volatility may decrease over time. Regulatory developments and increased institutional involvement could also help stabilize prices and reduce the wild swings that are currently seen in the market.

Ultimately, the future of cryptocurrency volatility is uncertain, but one thing is clear: it will continue to be a defining feature of the market for the foreseeable future.

FAQs

What is cryptocurrency volatility?

Cryptocurrency volatility refers to the rapid and unpredictable price fluctuations that are common in the cryptocurrency marketplace. Prices can change dramatically in a short period of time, making it a high-risk investment option.

What causes cryptocurrency volatility?

Several factors contribute to cryptocurrency volatility, including the relatively small market size, lack of regulation, and speculative nature of the industry. Prices are driven by supply and demand, leading to rapid and drastic price changes.

How can I manage risk in the cryptocurrency marketplace?

There are several strategies for managing risk in the cryptocurrency marketplace, including diversification, setting stop-loss orders, and staying informed about market trends. By spreading your investments across different assets and staying up to date on industry developments, you can make more informed decisions about when to buy, sell, or hold your assets.