Decentralized Finance (DeFi) and its Impact on Crypto Trading

In recent years, the world of cryptocurrency has witnessed a remarkable evolution with the rise of Decentralized Finance (DeFi). DeFi represents a paradigm shift in traditional finance by leveraging blockchain technology to create an open and decentralized ecosystem of financial applications and services. One of the most significant areas where DeFi has made its mark is in crypto trading, transforming the way individuals engage with digital assets.

Understanding DeFi:

DeFi encompasses a broad range of financial services and applications built on blockchain networks, primarily Ethereum. These services include lending and borrowing platforms, decentralized exchanges (DEXs), derivatives trading, yield farming, liquidity provision, and more. What sets DeFi apart is its decentralized nature, which eliminates the need for intermediaries like banks or brokerage firms, allowing users to directly interact with smart contracts.

Impact on Crypto Trading:

1. Accessibility:

DeFi has significantly enhanced accessibility to crypto trading by removing barriers to entry. Traditional financial systems often exclude individuals from certain regions or those lacking the necessary documentation. With DeFi, anyone with an internet connection can participate in trading, lending, or borrowing activities, empowering individuals worldwide to access financial services.

2. Peer-to-Peer Trading:

Decentralized exchanges (DEXs) facilitate peer-to-peer trading of digital assets without the need for intermediaries. This model ensures greater privacy, security, and control over assets since users retain custody of their funds throughout the trading process. Furthermore, DEXs operate 24/7, enabling seamless trading across different time zones without the constraints of centralized exchange hours.

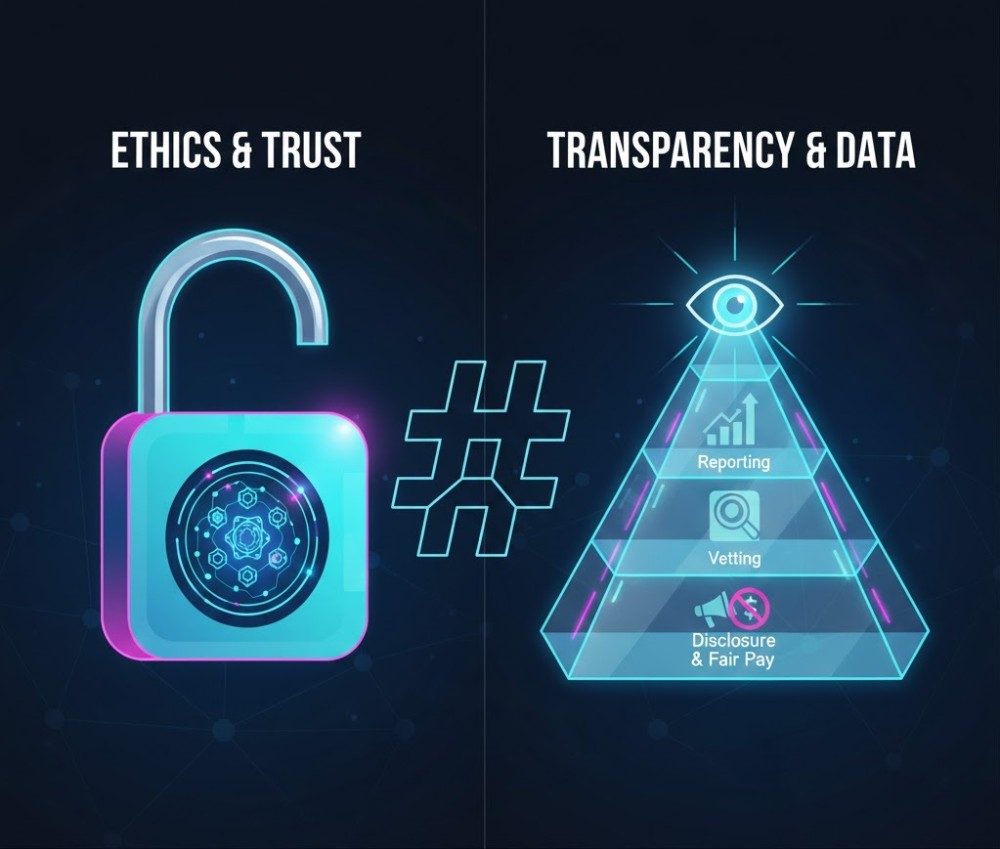

3. Transparency and Security:

The transparency of blockchain technology underpinning DeFi offers greater security and trust in the trading process. Smart contracts execute trades automatically once predefined conditions are met, eliminating the risk of manipulation or fraud often associated with centralized exchanges. Additionally, users can verify transaction details on the blockchain, ensuring transparency and accountability within the ecosystem.

4. Decentralized Governance:

Many DeFi protocols incorporate decentralized governance mechanisms, allowing token holders to participate in decision-making processes. Through voting mechanisms, users can propose and vote on changes to protocol parameters, upgrades, or the allocation of funds. This democratized approach to governance promotes community involvement and fosters a sense of ownership among users.

5. Financial Inclusion and Innovation:

DeFi has the potential to revolutionize traditional financial systems by providing inclusive and innovative solutions. Through decentralized lending and borrowing platforms, individuals who were previously excluded from traditional banking services can access capital or earn interest on their assets. Moreover, the composability of DeFi protocols enables developers to build new financial products and services, fostering continuous innovation within the ecosystem.

Challenges and Future Outlook:

Despite its transformative potential, DeFi is not without challenges. Security vulnerabilities, smart contract bugs, and regulatory uncertainties pose risks to users and the broader ecosystem. Additionally, scalability issues and high gas fees on Ethereum have led to congestion and limited accessibility for smaller traders.

However, ongoing developments in blockchain technology, interoperability solutions, and the emergence of alternative DeFi platforms offer promising solutions to these challenges. Projects exploring layer 2 scaling solutions, cross-chain interoperability, and decentralized governance models aim to enhance the efficiency, security, and accessibility of DeFi.

In conclusion, Decentralized Finance (DeFi) has emerged as a disruptive force in the world of crypto trading, offering greater accessibility, transparency, and innovation. While facing challenges, the relentless pursuit of decentralized solutions to traditional financial services signifies a transformative shift towards a more inclusive and equitable global financial system. As DeFi continues to evolve, its impact on crypto trading and the broader financial landscape is likely to be profound and enduring.