The Secret Deal for American Crypto: What Happened in the Senate This Week?

The halls of Congress were unusually busy this week as Wall Street lobbyists and DeFi developers sat down for a series of "quiet" meetings. The goal? To salvage the Digital Asset Market Clarity Act before its high-stakes Senate markup on January 15, 2026.

The "Alsobrooks Compromise"

The biggest hurdle has always been stablecoin yield. Traditional banks are terrified that if crypto exchanges can pay 5% interest on USDC or USD1, retail depositors will pull their money out of savings accounts.

Enter Senator Angela Alsobrooks (D-MD). Her proposed compromise—which reportedly gained traction in private sessions—allows for rewards based on user activity (like trading or paying for goods) but prohibits "pure interest" on balances. This "Activity-Based Reward" model protects bank deposits while allowing the crypto economy to innovate.

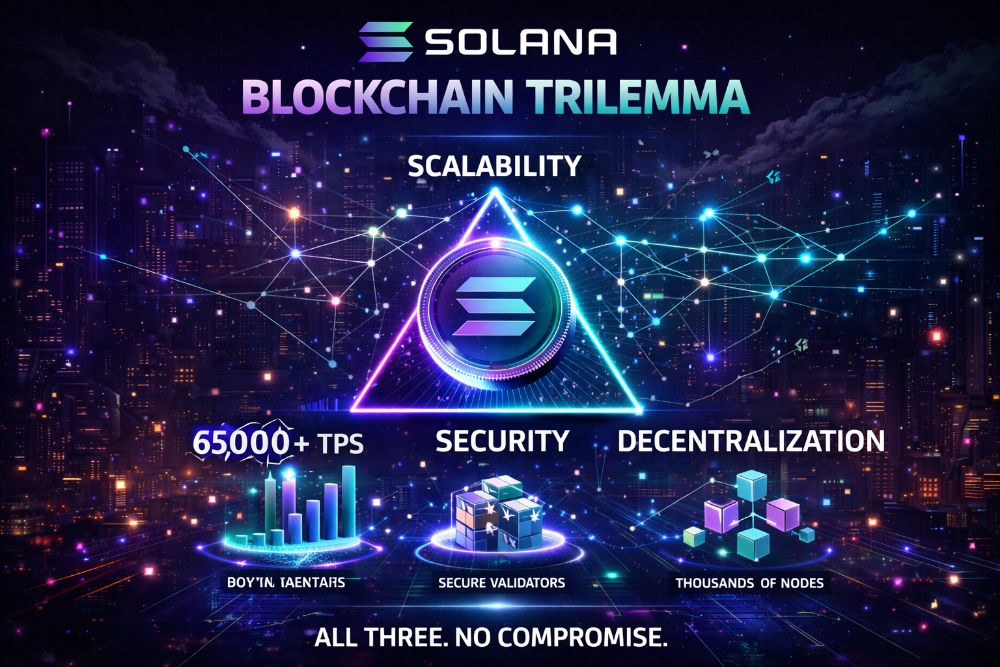

The SEC vs. CFTC: Drawing the Lines

For years, the industry has begged for a "Maturity Test." The current draft of the bill finally delivers one. It establishes a technical framework to determine when a project has become decentralized enough to stop being regulated as a security. This could mean "Altcoin Season" finally has a legal foundation in 2026.

Why Next Thursday is "Day Zero"

Senator Tim Scott (R-SC) has made it clear: if the bill doesn't pass the Banking Committee on January 15, it likely won't see a floor vote until after the midterms. This would push implementation into 2029—a delay the industry cannot afford.

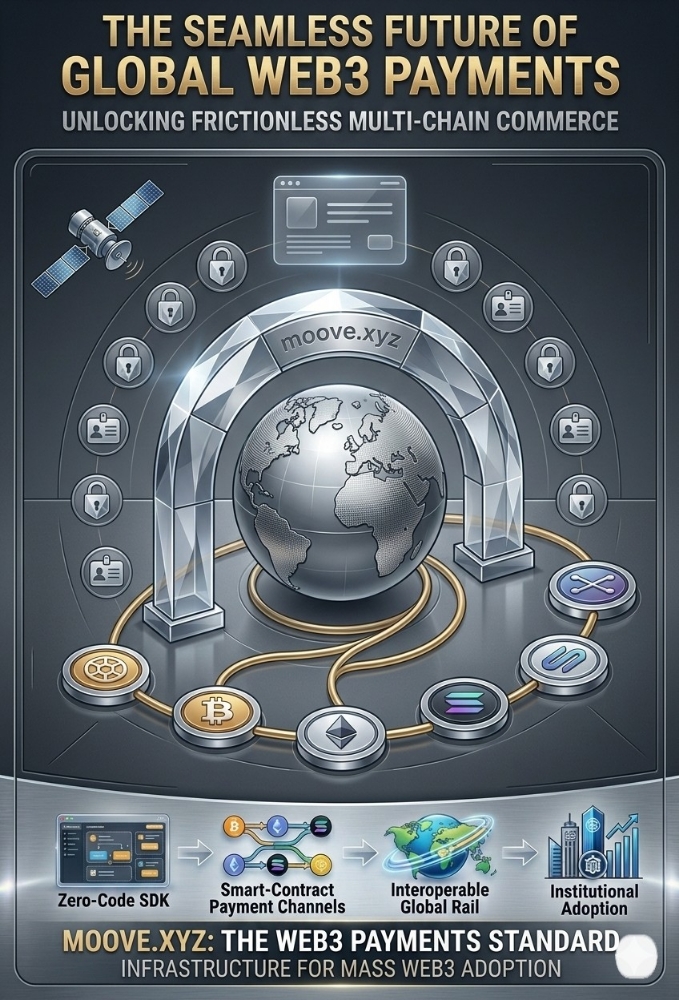

The stakes are higher than ever. If passed, this bill will be the ultimate bridge between the "Wild West" of early DeFi and the institutional-grade future of Wall Street.

Do you think the "Ethics Clause" targeting the President's family will kill the bill's chances? Let me know your thoughts below!