Yield Farming with AMMs: A Seasoned Investor's Guide

Hello, fellow investors! As someone who's navigated the waters of finance for decades, I've witnessed the transformation from traditional finance to the exciting realm of Decentralized Finance (DeFi). In this space, savvy investors have been reaping the rewards of high Annual Percentage Yields (APYs) through a process known as "yield farming." It's a world where liquidity is king, and understanding its dynamics is crucial for anyone looking to dip their toes into this innovative pool.

The Essence of Yield Farming

In my years of financial consultancy, I've seen few opportunities quite like DeFi. Here, the potential to significantly grow your assets eclipses traditional methods. Numerous DeFi projects entice users with attractive rewards to ensure a steady flow of liquidity for their tokens through liquidity pools. It's a revolutionary concept that's reshaping wealth management. Let me break down its essence for you.

A. Yield Farming Explained: In the simplest terms, yield farming is the process of leveraging DeFi platforms to generate high returns or yields on your capital. It's akin to traditional investing but turbocharged by the unique mechanisms of decentralized finance.

B. How It Works: Yield farming involves lending or staking cryptocurrency in exchange for interest or rewards. This is done through liquidity pools, which are essentially smart contracts that contain funds. By providing liquidity to these pools, investors can earn rewards, often in the form of additional digital tokens.

C. The Role of Incentives: Many DeFi projects incentivize participants by offering generous rewards for contributing liquidity. This is a win-win: the projects gain the necessary liquidity to operate smoothly, and the investors get a chance to earn impressive returns.

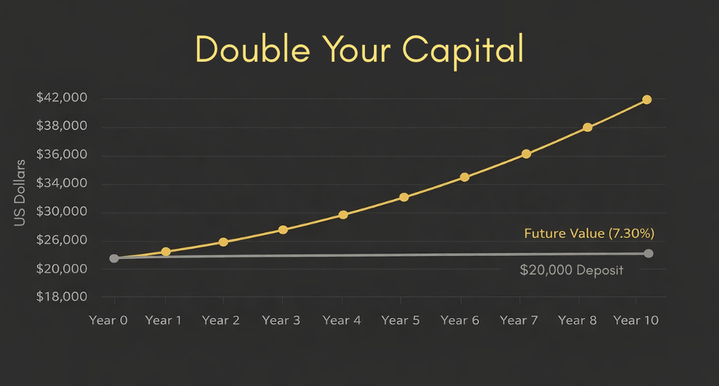

D. Comparison with Traditional Finance: Unlike traditional finance, where returns on investments can be modest and accrue over long periods, yield farming can offer significantly higher returns in a shorter time frame. However, this comes with a corresponding increase in risk.

E. Calculating Returns: Returns in yield farming are often represented as Annual Percentage Yield (APY). This rate reflects the expected earnings over a year and is a key metric for farmers to compare different yield farming opportunities.

F. My Perspective: From my vantage point, yield farming represents a paradigm shift in wealth management and financial planning. It offers a democratized platform where anyone with an internet connection and some capital can potentially earn substantial returns.

Liquidity Pools: The Lifeblood of DeFi

Let's talk liquidity. In my experience, an asset's value is intimately tied to its liquidity – essentially, what you can sell it for. Automated market makers (AMMs) utilize pools of paired assets to maintain this liquidity, enabling seamless trades for users. It's a cornerstone concept in modern investment strategies.

In my decades of experience in the financial industry, I've come to recognize the vital role of liquidity in any market. In the world of DeFi, this is where liquidity pools come into play, serving as the very lifeblood of the ecosystem.

A. What Are Liquidity Pools?: Liquidity pools are essentially reservoirs of tokens locked in a smart contract. They facilitate trading by providing liquidity to the market. In DeFi, these pools are critical for enabling efficient asset exchange without the need for traditional market makers.

B. The Mechanism of Liquidity Pools: These pools work by allowing users to deposit their assets into a collective fund. This pool of assets then powers the marketplace, enabling other users to trade, borrow, or lend within the DeFi platform. It's a mechanism that reminds me of the mutual dependence in a well-oiled financial system.

C. Importance in DeFi: In DeFi, liquidity is not just a convenience; it's a necessity. Liquidity pools ensure that assets can be easily traded, which in turn maintains the health and stability of the DeFi ecosystem. Without these pools, the friction in trading would be substantially higher, leading to inefficiencies and potential stagnation.

D. Incentivizing Liquidity Providers: To encourage users to contribute to these pools, DeFi platforms often reward them with fees generated from the transactions or with additional tokens. This reward system aligns with my philosophy of investment strategies, where incentives are crucial for participation and market growth.

E. Risks and Rewards: As with any investment strategy, there are risks involved in participating in liquidity pools, such as impermanent loss. However, the potential rewards can be significant, offering higher returns compared to traditional financial instruments.

F. My Viewpoint on Liquidity Pools: From my years of crafting investment portfolios and advising financial institutions, I see liquidity pools as a cornerstone of the DeFi architecture. They are not just mechanisms for enabling trades; they represent a shift towards a more inclusive and efficient financial ecosystem.

The Role of Liquidity Provider Tokens

Diving into AMMs requires users to deposit funds into these liquidity pools. These funds are then represented by Liquidity Provider (LP) tokens, acting as a sort of receipt. These tokens not only track the underlying assets and the accumulated fees but can also be staked for additional rewards. In my view, it's a clever mechanism that adds depth to the financial planning process.

Drawing from my extensive experience in the investment world, I've come to appreciate the ingenious mechanisms that drive the DeFi market, and Liquidity Provider tokens are among these pivotal elements.

A. Understanding Liquidity Provider Tokens: LP tokens are more than just digital assets; they are the backbone of liquidity in the DeFi ecosystem. When investors deposit funds into a liquidity pool, they receive LP tokens in return. These tokens represent their share of the pool and their stake in the liquidity provided.

B. Tracking Investments with LP Tokens: These tokens are not just receipts; they are dynamic instruments that track the amount of the underlying assets and the accrued fees in the liquidity pool. This means that the value of LP tokens can increase over time, reflecting the earnings from trading fees in the pool.

C. The Incentive Structure: One of the most remarkable aspects of LP tokens is how they incentivize participation. By holding these tokens, investors can earn a portion of the transaction fees generated by the DeFi platform. In some cases, these tokens can also be staked or used in other DeFi protocols to earn additional rewards.

D. Risk and Reward Dynamics: It's important to note that while LP tokens can offer significant rewards, they also come with risks, such as exposure to impermanent loss. This risk occurs when the price of the deposited assets changes compared to when they were deposited into the pool.

E. My Perspective on LP Tokens: In my years of creating wealth management strategies and advising on financial planning, I view LP tokens as a crucial innovation in DeFi. They provide a way for investors to actively participate in and benefit from the liquidity they provide to the market. These tokens are a testament to the evolving nature of investment strategies in the digital age.

F. The Future of LP Tokens: As DeFi continues to grow, the role of LP tokens is likely to become even more significant. They are not just a part of the DeFi ecosystem; they are a driving force behind its growth and sustainability.

Deciphering APY in DeFi

Yield farming is a constant hunt for the highest APY. While DeFi can be exceptionally lucrative, my years of experience compel me to caution against dazzlingly high APYs. They often come with risks, especially for long-term investment plans. Remember, if it looks too good to be true, it probably is.

In my many years of managing investments and navigating complex financial landscapes, I've come to recognize the importance of thoroughly understanding investment metrics. When it comes to DeFi, one such critical metric is the Annual Percentage Yield (APY).

A. Understanding APY: APY in the DeFi context refers to the annualized rate of return accounting for the effect of compounding interest. Unlike simple interest, compounding in DeFi can occur on a much more frequent basis, sometimes even daily, which significantly impacts the potential returns.

B. Calculating APY in DeFi: The calculation of APY in DeFi can be intricate, factoring in the frequency of compounding and the fluctuating nature of returns in these markets. It's not just a static percentage; it's a dynamic figure that reflects the volatile and often lucrative nature of DeFi investments.

C. APY as a Key Indicator for Yield Farmers: For yield farmers, APY is a beacon guiding investment decisions. It represents the potential profitability of various farming opportunities, helping investors like us to assess and compare different DeFi platforms and liquidity pools.

D. The Attraction of High APYs: DeFi is renowned for offering exceptionally high APYs compared to traditional finance. These attractive rates can lead to substantial portfolio growth, but they also come with higher risks. Sky-high APYs can be indicators of either a very lucrative opportunity or a potentially unsustainable model.

E. A Word of Caution: In my advisory role, I always emphasize the need for caution. High APYs in DeFi can sometimes be misleading, especially if they are not sustainable in the long run. The lure of high returns should be balanced with a thorough assessment of the risks and the stability of the underlying DeFi protocol.

F. My Perspective: As an experienced investor, I view APY as an essential tool in the DeFi toolkit. However, it should not be the sole factor in making investment decisions. Understanding the mechanisms behind these yields, the sustainability of the DeFi platforms, and the inherent market risks are just as important.

Navigating Impermanent Loss

Now, let's tackle a tricky aspect – impermanent loss. While providing liquidity in AMMs can earn trading fees and staking rewards, there's a catch. The automated nature of these pools can lead to losses when compared to merely holding onto your tokens. It's a risk-reward scenario that requires careful consideration.

In my extensive experience with investment strategies and wealth management, I've encountered various risks, but few are as unique to the DeFi space as impermanent loss. Understanding and navigating this risk is key for any astute investor in DeFi.

A. Understanding Impermanent Loss: Impermanent loss occurs when you provide liquidity to a DeFi pool, and the price of your deposited assets changes compared to when they were deposited. This loss is termed 'impermanent' because it only becomes realized if you withdraw your assets from the pool at a different price than when you deposited them.

B. How Impermanent Loss Happens: The automated market makers (AMMs) in DeFi maintain a constant ratio of the paired assets in a liquidity pool. When the price of one asset changes significantly compared to when it was deposited, the ratio of the assets in the pool adjusts accordingly. This leads to a divergence in the value of your deposited assets compared to holding them outside the pool.

C. The Role of Volatility: The greater the volatility of an asset, the higher the potential for impermanent loss. As a seasoned investor, I advise extra caution when dealing with highly volatile assets in liquidity pools.

D. Strategies to Mitigate Impermanent Loss:

- Diversification: Diversifying your investments across different pools can help mitigate the risk of impermanent loss in any single pool.

- Stablecoin Pairs: Choosing pools with less volatile assets, such as stablecoins, can reduce the risk of significant price changes.

- Active Management: Regularly monitoring your investments and adjusting your strategies in response to market movements can be crucial in managing impermanent loss.

E. Weighing the Risks and Rewards: It's important to weigh the potential rewards from liquidity provision, such as trading fees and yield farming rewards, against the risk of impermanent loss. In many cases, the rewards can offset the risk, but this balance can vary widely between different pools and market conditions.

F. My Take on Impermanent Loss: From my vantage point, impermanent loss is a necessary consideration in the world of DeFi investing. Understanding its mechanics and how to manage it is vital for any investor looking to navigate this space successfully.

Summary: Balancing High Yields with Calculated Risks

In the constantly evolving DeFi landscape, the pursuit of high yields is tantalizing. Liquidity is undoubtedly essential, and many projects generously reward those who contribute to it on AMMs. However, as a seasoned investor, I advise caution. Sky-high APYs aren't sustainable in the long run, and the volatility associated with more speculative assets can sometimes tip the scales unfavorably. Always weigh the potential gains against the inherent risks in this dynamic world of DeFi.

After decades in the financial sector, one fundamental truth I've embraced is the delicate balance between risk and reward. This principle is especially pertinent in the realm of DeFi, where high yields often come hand-in-hand with significant risks.

A. The Allure of High Yields in DeFi: DeFi's innovative landscape has opened doors to investment opportunities that far surpass traditional financial avenues in terms of potential yields. The lucrative APYs and rewards from liquidity provision and yield farming are undeniably attractive, offering a chance for substantial asset growth.

B. Understanding the Risks: However, with these high yields come risks that must be

carefully navigated. Volatility in the crypto market, the complexity of DeFi protocols, and challenges like impermanent loss are real concerns. These risks necessitate a well-thought-out strategy and a keen eye on market dynamics.

C. Risk Management Strategies: In my experience, successful investment in DeFi requires a blend of thorough research, diversification, and constant vigilance. It’s crucial to understand the mechanisms behind yield generation in DeFi and to stay updated on market trends and protocol developments.

D. The Importance of Due Diligence: As someone who advises on wealth management and financial planning, I cannot overstate the importance of due diligence. Before diving into any DeFi venture, scrutinize the protocol's security, the track record of its developers, and the sustainability of its yield generation mechanisms.

E. A Balanced Approach: My advice for navigating DeFi is to maintain a balanced approach. Align your investment strategies with your risk tolerance, and never invest more than you can afford to lose. The potential for high returns should be weighed against the possibility of significant losses.

F. Looking Ahead: As DeFi continues to evolve, I believe it will offer even more innovative and potentially profitable opportunities. However, the principles of careful investment and risk management will remain as relevant as ever.

Take Your First Step in the Digital Currency World

Are you ready to embark on your journey in the world of digital currency? Begin by creating an account on a trusted crypto exchange. Here are some recommended platforms where you can start:

👉 Click to register PRIMEXBT account 👈

👉 Click to register GATE account 👈

👉 Click to register HUOBI account 👈

👉 Click to register KUCOIN account 👈

👉 Click to register MEXC account 👈

👉 Click to register OKX account 👈

👉 Click to register BYBIT account 👈

Embrace the future of finance today by joining these platforms and exploring the opportunities in digital currencies like Ethereum.