EXPLORING THE INTERPLAY BETWEEN MEME COINS AND NATIVE NETWORKS

When you think about meme coins, you’re diving headfirst into the wacky, unpredictable, and utterly fascinating subsector of cryptocurrency that has taken the internet by storm. Unlike their more solemn cousins like Ethereum, meme coins are the unruly teenagers of the crypto market, full of surprises and, more often than not, driven by the kind of viral content you’d share with your friends via a text for a quick laugh. Global asset manager Franklin Templeton recently released a short research paper highlighting the interplay between these coins and their native network. So, let’s break it down.

The Wild World of Meme Coins

The research started with pointing out that meme coins are just a testament to the power of a good joke. They don’t boast the foundational technology or utility that underpins the giants of the crypto market. Instead, their value skyrockets like a meme shared across platforms, catching fire among netizens. Of course this makes them even more volatile than other cryptocurrencies. In the past few years, these coins have captivated a growing audience, offering an easy entry point for those new to the crypto industry. With minimal fees and the lure of quick, though risky, returns, meme coins have etched a niche of their own in the markets.

The poster child of meme coins, Dogecoin, howled its way into existence in 2013, inspired by a Shiba Inu meme that had everyone from your next-door neighbor to Elon Musk chuckling along. Musk’s public display of affection for Dogecoin sent its value on a rollercoaster ride, amassing a market cap that is around $12 billion. Since Dogecoin’s debut, the crypto market has become a breeding ground for similar coins, each vying for a viral moment too.

A striking example of meme coins’ symbiotic relationship with their native blockchain networks is the case of BONK, a coin that rides on the Solana network. Franklin Templeton pointed out that in the final quarter of 2023, BONK’s value skyrocketed, mirroring a significant uptick in Solana’s user activity. This surge was a clear indicator of how meme coins can influence and benefit from the ecosystems they inhabit.

Navigating the Risks

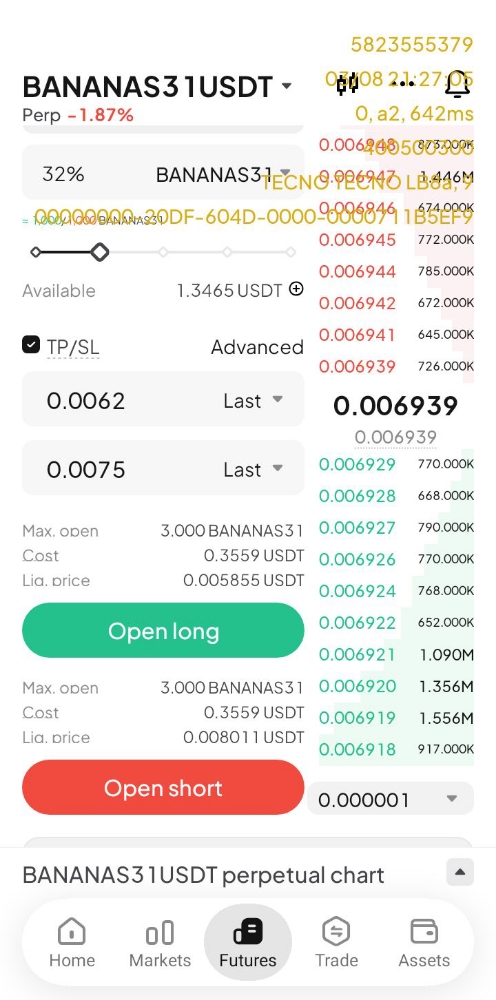

Investing in meme coins is akin to betting on the internet’s ever-changing tastes—a risky proposition that can yield high returns as quickly as it can plummet to losses. Blockchain technology, of course, carries its own set of risks. These range from the practical (like losing your cryptographic keys) to the more existential threats of technology that’s yet to be fully embraced or understood. Franklin Templeton also pointed out that meme coins are riddled with security vulnerabilities and regulatory grey areas that could either pave the way for innovation or serve as stumbling blocks.

Moreover, the speculative nature of trading in cryptocurrencies, amplified in the meme coin market, introduces significant risk. Investors might find themselves riding high one moment and facing total loss the next.

But it’s not just the technical and market risks that investors need to be wary of, says Franklin Templeton. The very ecosystem that supports meme coins and other cryptocurrencies is constantly changing, dependent on complex IT and communications systems that are vulnerable to threats. The security of these systems, despite best efforts to mitigate risks, remains a concern for investors and portfolio managers alike.

When you think about meme coins, you’re diving headfirst into the wacky, unpredictable, and utterly fascinating subsector of cryptocurrency that has taken the internet by storm. Unlike their more solemn cousins like Ethereum, meme coins are the unruly teenagers of the crypto market, full of surprises and, more often than not, driven by the kind of viral content you’d share with your friends via a text for a quick laugh. Global asset manager Franklin Templeton recently released a short research paper highlighting the interplay between these coins and their native network. So, let’s break it down.

The Wild World of Meme Coins

The research started with pointing out that meme coins are just a testament to the power of a good joke. They don’t boast the foundational technology or utility that underpins the giants of the crypto market. Instead, their value skyrockets like a meme shared across platforms, catching fire among netizens. Of course this makes them even more volatile than other cryptocurrencies. In the past few years, these coins have captivated a growing audience, offering an easy entry point for those new to the crypto industry. With minimal fees and the lure of quick, though risky, returns, meme coins have etched a niche of their own in the markets.

The poster child of meme coins, Dogecoin, howled its way into existence in 2013, inspired by a Shiba Inu meme that had everyone from your next-door neighbor to Elon Musk chuckling along. Musk’s public display of affection for Dogecoin sent its value on a rollercoaster ride, amassing a market cap that is around $12 billion. Since Dogecoin’s debut, the crypto market has become a breeding ground for similar coins, each vying for a viral moment too.

A striking example of meme coins’ symbiotic relationship with their native blockchain networks is the case of BONK, a coin that rides on the Solana network. Franklin Templeton pointed out that in the final quarter of 2023, BONK’s value skyrocketed, mirroring a significant uptick in Solana’s user activity. This surge was a clear indicator of how meme coins can influence and benefit from the ecosystems they inhabit.

Navigating the Risks

Investing in meme coins is akin to betting on the internet’s ever-changing tastes—a risky proposition that can yield high returns as quickly as it can plummet to losses. Blockchain technology, of course, carries its own set of risks. These range from the practical (like losing your cryptographic keys) to the more existential threats of technology that’s yet to be fully embraced or understood. Franklin Templeton also pointed out that meme coins are riddled with security vulnerabilities and regulatory grey areas that could either pave the way for innovation or serve as stumbling blocks.

Moreover, the speculative nature of trading in cryptocurrencies, amplified in the meme coin market, introduces significant risk. Investors might find themselves riding high one moment and facing total loss the next.

But it’s not just the technical and market risks that investors need to be wary of, says Franklin Templeton. The very ecosystem that supports meme coins and other cryptocurrencies is constantly changing, dependent on complex IT and communications systems that are vulnerable to threats. The security of these systems, despite best efforts to mitigate risks, remains a concern for investors and portfolio managers alike.

When you think about meme coins, you’re diving headfirst into the wacky, unpredictable, and utterly fascinating subsector of cryptocurrency that has taken the internet by storm. Unlike their more solemn cousins like Ethereum, meme coins are the unruly teenagers of the crypto market, full of surprises and, more often than not, driven by the kind of viral content you’d share with your friends via a text for a quick laugh. Global asset manager Franklin Templeton recently released a short research paper highlighting the interplay between these coins and their native network. So, let’s break it down.

The Wild World of Meme Coins

The research started with pointing out that meme coins are just a testament to the power of a good joke. They don’t boast the foundational technology or utility that underpins the giants of the crypto market. Instead, their value skyrockets like a meme shared across platforms, catching fire among netizens. Of course this makes them even more volatile than other cryptocurrencies. In the past few years, these coins have captivated a growing audience, offering an easy entry point for those new to the crypto industry. With minimal fees and the lure of quick, though risky, returns, meme coins have etched a niche of their own in the markets.

The poster child of meme coins, Dogecoin, howled its way into existence in 2013, inspired by a Shiba Inu meme that had everyone from your next-door neighbor to Elon Musk chuckling along. Musk’s public display of affection for Dogecoin sent its value on a rollercoaster ride, amassing a market cap that is around $12 billion. Since Dogecoin’s debut, the crypto market has become a breeding ground for similar coins, each vying for a viral moment too.

A striking example of meme coins’ symbiotic relationship with their native blockchain networks is the case of BONK, a coin that rides on the Solana network. Franklin Templeton pointed out that in the final quarter of 2023, BONK’s value skyrocketed, mirroring a significant uptick in Solana’s user activity. This surge was a clear indicator of how meme coins can influence and benefit from the ecosystems they inhabit.

Navigating the Risks

Investing in meme coins is akin to betting on the internet’s ever-changing tastes—a risky proposition that can yield high returns as quickly as it can plummet to losses. Blockchain technology, of course, carries its own set of risks. These range from the practical (like losing your cryptographic keys) to the more existential threats of technology that’s yet to be fully embraced or understood. Franklin Templeton also pointed out that meme coins are riddled with security vulnerabilities and regulatory grey areas that could either pave the way for innovation or serve as stumbling blocks.

Moreover, the speculative nature of trading in cryptocurrencies, amplified in the meme coin market, introduces significant risk. Investors might find themselves riding high one moment and facing total loss the next.

But it’s not just the technical and market risks that investors need to be wary of, says Franklin Templeton. The very ecosystem that supports meme coins and other cryptocurrencies is constantly changing, dependent on complex IT and communications systems that are vulnerable to threats. The security of these systems, despite best efforts to mitigate risks, remains a concern for investors and portfolio managers alike.

When you think about meme coins, you’re diving headfirst into the wacky, unpredictable, and utterly fascinating subsector of cryptocurrency that has taken the internet by storm. Unlike their more solemn cousins like Ethereum, meme coins are the unruly teenagers of the crypto market, full of surprises and, more often than not, driven by the kind of viral content you’d share with your friends via a text for a quick laugh. Global asset manager Franklin Templeton recently released a short research paper highlighting the interplay between these coins and their native network. So, let’s break it down.

The Wild World of Meme Coins

The research started with pointing out that meme coins are just a testament to the power of a good joke. They don’t boast the foundational technology or utility that underpins the giants of the crypto market. Instead, their value skyrockets like a meme shared across platforms, catching fire among netizens. Of course this makes them even more volatile than other cryptocurrencies. In the past few years, these coins have captivated a growing audience, offering an easy entry point for those new to the crypto industry. With minimal fees and the lure of quick, though risky, returns, meme coins have etched a niche of their own in the markets.

The poster child of meme coins, Dogecoin, howled its way into existence in 2013, inspired by a Shiba Inu meme that had everyone from your next-door neighbor to Elon Musk chuckling along. Musk’s public display of affection for Dogecoin sent its value on a rollercoaster ride, amassing a market cap that is around $12 billion. Since Dogecoin’s debut, the crypto market has become a breeding ground for similar coins, each vying for a viral moment too.

A striking example of meme coins’ symbiotic relationship with their native blockchain networks is the case of BONK, a coin that rides on the Solana network. Franklin Templeton pointed out that in the final quarter of 2023, BONK’s value skyrocketed, mirroring a significant uptick in Solana’s user activity. This surge was a clear indicator of how meme coins can influence and benefit from the ecosystems they inhabit.

Navigating the Risks

Investing in meme coins is akin to betting on the internet’s ever-changing tastes—a risky proposition that can yield high returns as quickly as it can plummet to losses. Blockchain technology, of course, carries its own set of risks. These range from the practical (like losing your cryptographic keys) to the more existential threats of technology that’s yet to be fully embraced or understood. Franklin Templeton also pointed out that meme coins are riddled with security vulnerabilities and regulatory grey areas that could either pave the way for innovation or serve as stumbling blocks.

Moreover, the speculative nature of trading in cryptocurrencies, amplified in the meme coin market, introduces significant risk. Investors might find themselves riding high one moment and facing total loss the next.

But it’s not just the technical and market risks that investors need to be wary of, says Franklin Templeton. The very ecosystem that supports meme coins and other cryptocurrencies is constantly changing, dependent on complex IT and communications systems that are vulnerable to threats. The security of these systems, despite best efforts to mitigate risks, remains a concern for investors and portfolio managers alike.

When you think about meme coins, you’re diving headfirst into the wacky, unpredictable, and utterly fascinating subsector of cryptocurrency that has taken the internet by storm. Unlike their more solemn cousins like Ethereum, meme coins are the unruly teenagers of the crypto market, full of surprises and, more often than not, driven by the kind of viral content you’d share with your friends via a text for a quick laugh. Global asset manager Franklin Templeton recently released a short research paper highlighting the interplay between these coins and their native network. So, let’s break it down.

The Wild World of Meme Coins

The research started with pointing out that meme coins are just a testament to the power of a good joke. They don’t boast the foundational technology or utility that underpins the giants of the crypto market. Instead, their value skyrockets like a meme shared across platforms, catching fire among netizens. Of course this makes them even more volatile than other cryptocurrencies. In the past few years, these coins have captivated a growing audience, offering an easy entry point for those new to the crypto industry. With minimal fees and the lure of quick, though risky, returns, meme coins have etched a niche of their own in the markets.

The poster child of meme coins, Dogecoin, howled its way into existence in 2013, inspired by a Shiba Inu meme that had everyone from your next-door neighbor to Elon Musk chuckling along. Musk’s public display of affection for Dogecoin sent its value on a rollercoaster ride, amassing a market cap that is around $12 billion. Since Dogecoin’s debut, the crypto market has become a breeding ground for similar coins, each vying for a viral moment too.

A striking example of meme coins’ symbiotic relationship with their native blockchain networks is the case of BONK, a coin that rides on the Solana network. Franklin Templeton pointed out that in the final quarter of 2023, BONK’s value skyrocketed, mirroring a significant uptick in Solana’s user activity. This surge was a clear indicator of how meme coins can influence and benefit from the ecosystems they inhabit.

Navigating the Risks

Investing in meme coins is akin to betting on the internet’s ever-changing tastes—a risky proposition that can yield high returns as quickly as it can plummet to losses. Blockchain technology, of course, carries its own set of risks. These range from the practical (like losing your cryptographic keys) to the more existential threats of technology that’s yet to be fully embraced or understood. Franklin Templeton also pointed out that meme coins are riddled with security vulnerabilities and regulatory grey areas that could either pave the way for innovation or serve as stumbling blocks.

Moreover, the speculative nature of trading in cryptocurrencies, amplified in the meme coin market, introduces significant risk. Investors might find themselves riding high one moment and facing total loss the next.

But it’s not just the technical and market risks that investors need to be wary of, says Franklin Templeton. The very ecosystem that supports meme coins and other cryptocurrencies is constantly changing, dependent on complex IT and communications systems that are vulnerable to threats. The security of these systems, despite best efforts to mitigate risks, remains a concern for investors and portfolio managers alike.

When you think about meme coins, you’re diving headfirst into the wacky, unpredictable, and utterly fascinating subsector of cryptocurrency that has taken the internet by storm. Unlike their more solemn cousins like Ethereum, meme coins are the unruly teenagers of the crypto market, full of surprises and, more often than not, driven by the kind of viral content you’d share with your friends via a text for a quick laugh. Global asset manager Franklin Templeton recently released a short research paper highlighting the interplay between these coins and their native network. So, let’s break it down.

The Wild World of Meme Coins

The research started with pointing out that meme coins are just a testament to the power of a good joke. They don’t boast the foundational technology or utility that underpins the giants of the crypto market. Instead, their value skyrockets like a meme shared across platforms, catching fire among netizens. Of course this makes them even more volatile than other cryptocurrencies. In the past few years, these coins have captivated a growing audience, offering an easy entry point for those new to the crypto industry. With minimal fees and the lure of quick, though risky, returns, meme coins have etched a niche of their own in the markets.

The poster child of meme coins, Dogecoin, howled its way into existence in 2013, inspired by a Shiba Inu meme that had everyone from your next-door neighbor to Elon Musk chuckling along. Musk’s public display of affection for Dogecoin sent its value on a rollercoaster ride, amassing a market cap that is around $12 billion. Since Dogecoin’s debut, the crypto market has become a breeding ground for similar coins, each vying for a viral moment too.

A striking example of meme coins’ symbiotic relationship with their native blockchain networks is the case of BONK, a coin that rides on the Solana network. Franklin Templeton pointed out that in the final quarter of 2023, BONK’s value skyrocketed, mirroring a significant uptick in Solana’s user activity. This surge was a clear indicator of how meme coins can influence and benefit from the ecosystems they inhabit.

Navigating the Risks

Investing in meme coins is akin to betting on the internet’s ever-changing tastes—a risky proposition that can yield high returns as quickly as it can plummet to losses. Blockchain technology, of course, carries its own set of risks. These range from the practical (like losing your cryptographic keys) to the more existential threats of technology that’s yet to be fully embraced or understood. Franklin Templeton also pointed out that meme coins are riddled with security vulnerabilities and regulatory grey areas that could either pave the way for innovation or serve as stumbling blocks.

Moreover, the speculative nature of trading in cryptocurrencies, amplified in the meme coin market, introduces significant risk. Investors might find themselves riding high one moment and facing total loss the next.

But it’s not just the technical and market risks that investors need to be wary of, says Franklin Templeton. The very ecosystem that supports meme coins and other cryptocurrencies is constantly changing, dependent on complex IT and communications systems that are vulnerable to threats. The security of these systems, despite best efforts to mitigate risks, remains a concern for investors and portfolio managers alike.

When you think about meme coins, you’re diving headfirst into the wacky, unpredictable, and utterly fascinating subsector of cryptocurrency that has taken the internet by storm. Unlike their more solemn cousins like Ethereum, meme coins are the unruly teenagers of the crypto market, full of surprises and, more often than not, driven by the kind of viral content you’d share with your friends via a text for a quick laugh. Global asset manager Franklin Templeton recently released a short research paper highlighting the interplay between these coins and their native network. So, let’s break it down.

The Wild World of Meme Coins

The research started with pointing out that meme coins are just a testament to the power of a good joke. They don’t boast the foundational technology or utility that underpins the giants of the crypto market. Instead, their value skyrockets like a meme shared across platforms, catching fire among netizens. Of course this makes them even more volatile than other cryptocurrencies. In the past few years, these coins have captivated a growing audience, offering an easy entry point for those new to the crypto industry. With minimal fees and the lure of quick, though risky, returns, meme coins have etched a niche of their own in the markets.

The poster child of meme coins, Dogecoin, howled its way into existence in 2013, inspired by a Shiba Inu meme that had everyone from your next-door neighbor to Elon Musk chuckling along. Musk’s public display of affection for Dogecoin sent its value on a rollercoaster ride, amassing a market cap that is around $12 billion. Since Dogecoin’s debut, the crypto market has become a breeding ground for similar coins, each vying for a viral moment too.

A striking example of meme coins’ symbiotic relationship with their native blockchain networks is the case of BONK, a coin that rides on the Solana network. Franklin Templeton pointed out that in the final quarter of 2023, BONK’s value skyrocketed, mirroring a significant uptick in Solana’s user activity. This surge was a clear indicator of how meme coins can influence and benefit from the ecosystems they inhabit.

Navigating the Risks

Investing in meme coins is akin to betting on the internet’s ever-changing tastes—a risky proposition that can yield high returns as quickly as it can plummet to losses. Blockchain technology, of course, carries its own set of risks. These range from the practical (like losing your cryptographic keys) to the more existential threats of technology that’s yet to be fully embraced or understood. Franklin Templeton also pointed out that meme coins are riddled with security vulnerabilities and regulatory grey areas that could either pave the way for innovation or serve as stumbling blocks.

Moreover, the speculative nature of trading in cryptocurrencies, amplified in the meme coin market, introduces significant risk. Investors might find themselves riding high one moment and facing total loss the next.

But it’s not just the technical and market risks that investors need to be wary of, says Franklin Templeton. The very ecosystem that supports meme coins and other cryptocurrencies is constantly changing, dependent on complex IT and communications systems that are vulnerable to threats. The security of these systems, despite best efforts to mitigate risks, remains a concern for investors and portfolio managers alike.

When you think about meme coins, you’re diving headfirst into the wacky, unpredictable, and utterly fascinating subsector of cryptocurrency that has taken the internet by storm. Unlike their more solemn cousins like Ethereum, meme coins are the unruly teenagers of the crypto market, full of surprises and, more often than not, driven by the kind of viral content you’d share with your friends via a text for a quick laugh. Global asset manager Franklin Templeton recently released a short research paper highlighting the interplay between these coins and their native network. So, let’s break it down.

The Wild World of Meme Coins

The research started with pointing out that meme coins are just a testament to the power of a good joke. They don’t boast the foundational technology or utility that underpins the giants of the crypto market. Instead, their value skyrockets like a meme shared across platforms, catching fire among netizens. Of course this makes them even more volatile than other cryptocurrencies. In the past few years, these coins have captivated a growing audience, offering an easy entry point for those new to the crypto industry. With minimal fees and the lure of quick, though risky, returns, meme coins have etched a niche of their own in the markets.

The poster child of meme coins, Dogecoin, howled its way into existence in 2013, inspired by a Shiba Inu meme that had everyone from your next-door neighbor to Elon Musk chuckling along. Musk’s public display of affection for Dogecoin sent its value on a rollercoaster ride, amassing a market cap that is around $12 billion. Since Dogecoin’s debut, the crypto market has become a breeding ground for similar coins, each vying for a viral moment too.

A striking example of meme coins’ symbiotic relationship with their native blockchain networks is the case of BONK, a coin that rides on the Solana network. Franklin Templeton pointed out that in the final quarter of 2023, BONK’s value skyrocketed, mirroring a significant uptick in Solana’s user activity. This surge was a clear indicator of how meme coins can influence and benefit from the ecosystems they inhabit.

Navigating the Risks

Investing in meme coins is akin to betting on the internet’s ever-changing tastes—a risky proposition that can yield high returns as quickly as it can plummet to losses. Blockchain technology, of course, carries its own set of risks. These range from the practical (like losing your cryptographic keys) to the more existential threats of technology that’s yet to be fully embraced or understood. Franklin Templeton also pointed out that meme coins are riddled with security vulnerabilities and regulatory grey areas that could either pave the way for innovation or serve as stumbling blocks.

Moreover, the speculative nature of trading in cryptocurrencies, amplified in the meme coin market, introduces significant risk. Investors might find themselves riding high one moment and facing total loss the next.

But it’s not just the technical and market risks that investors need to be wary of, says Franklin Templeton. The very ecosystem that supports meme coins and other cryptocurrencies is constantly changing, dependent on complex IT and communications systems that are vulnerable to threats. The security of these systems, despite best efforts to mitigate risks, remains a concern for investors and portfolio managers alike.